- Traders holding Bitcoin for 1-3 months recorded the highest level of inflows as Bitcoin approached $69,000

- Profit-taking by short-term holders could delay Bitcoin’s ATH, despite strong bullish trends

As a seasoned crypto investor with a decade of experience under my belt, I’ve seen my fair share of market highs and lows. The recent surge in Bitcoin price to $68,388 has caught my attention, and I can’t help but feel a mix of excitement and caution.

At the moment of writing, I find myself observing that Bitcoin (BTC) is currently trading at approximately $68,388, representing a 9% increase over just seven days. Notably, on October 18th, Bitcoin reached a two-month high surpassing $68,900, which has significantly boosted market sentiment towards potential future growth.

Multiple elements have contributed to Bitcoin reaching a new all-time high. Among these factors are the market anticipating the results of the U.S elections and significant investments flowing into exchange-traded funds (ETFs) that directly deal with Bitcoins.

On the other hand, it’s the actions of short-term investors that could determine how quickly Bitcoin will return to its all-time high prices. In other words, since Bitcoin recently hit a two-month peak, data from blockchain analysis suggests these short-term holders are cashing out.

Analyzing short-term holder behavior

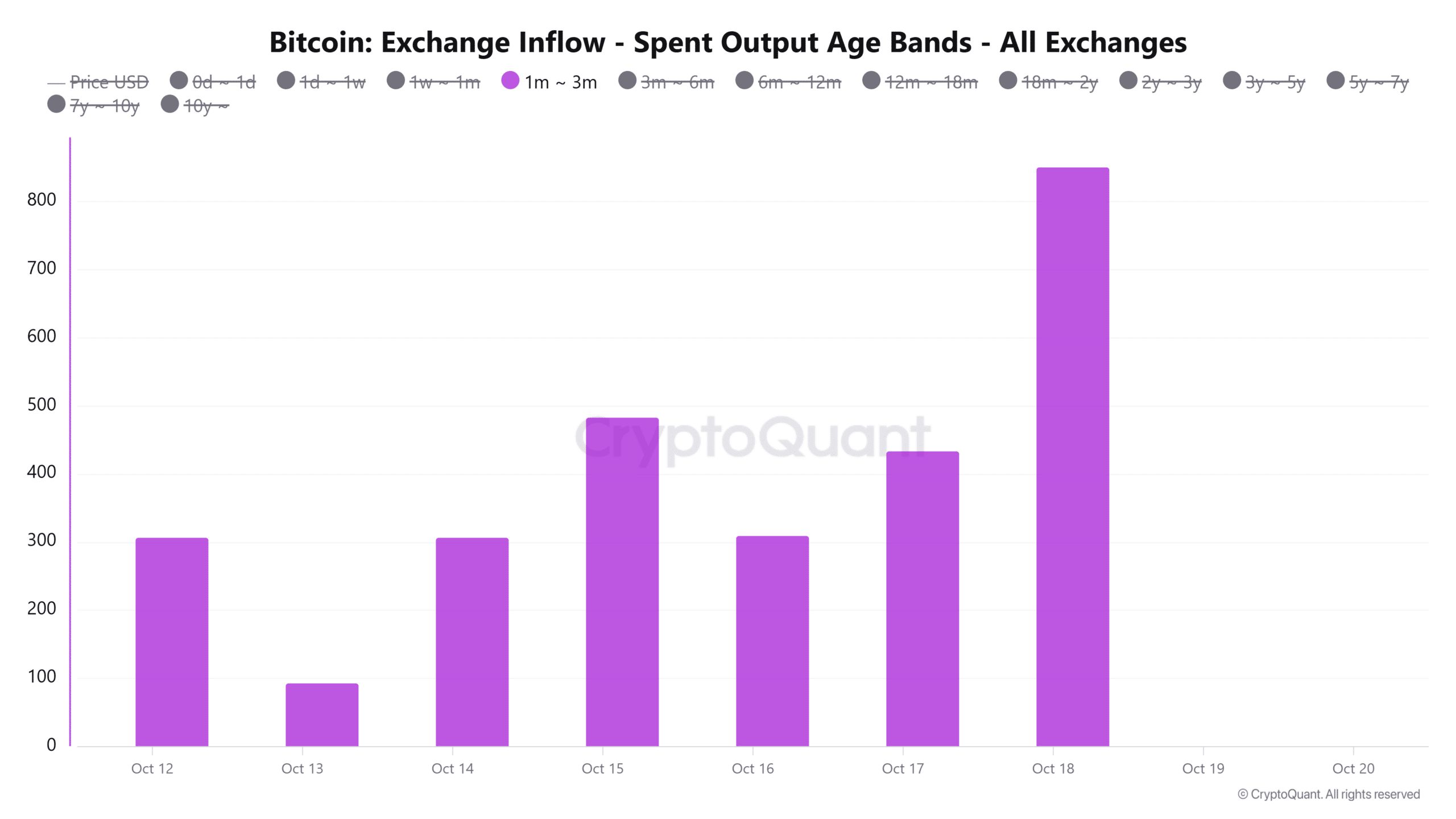

According to data from CryptoQuant, there was an uptick in Bitcoin inflows coming from traders who had held Bitcoin for approximately one to three months. The Spent Output Age Bands related to this group reached a weekly peak as Bitcoin neared $69,000 on the charts.

This upward trend could be interpreted as an indication of profit-seeking actions from short-term investors, who are trying to take advantage of the current market’s beneficial circumstances.

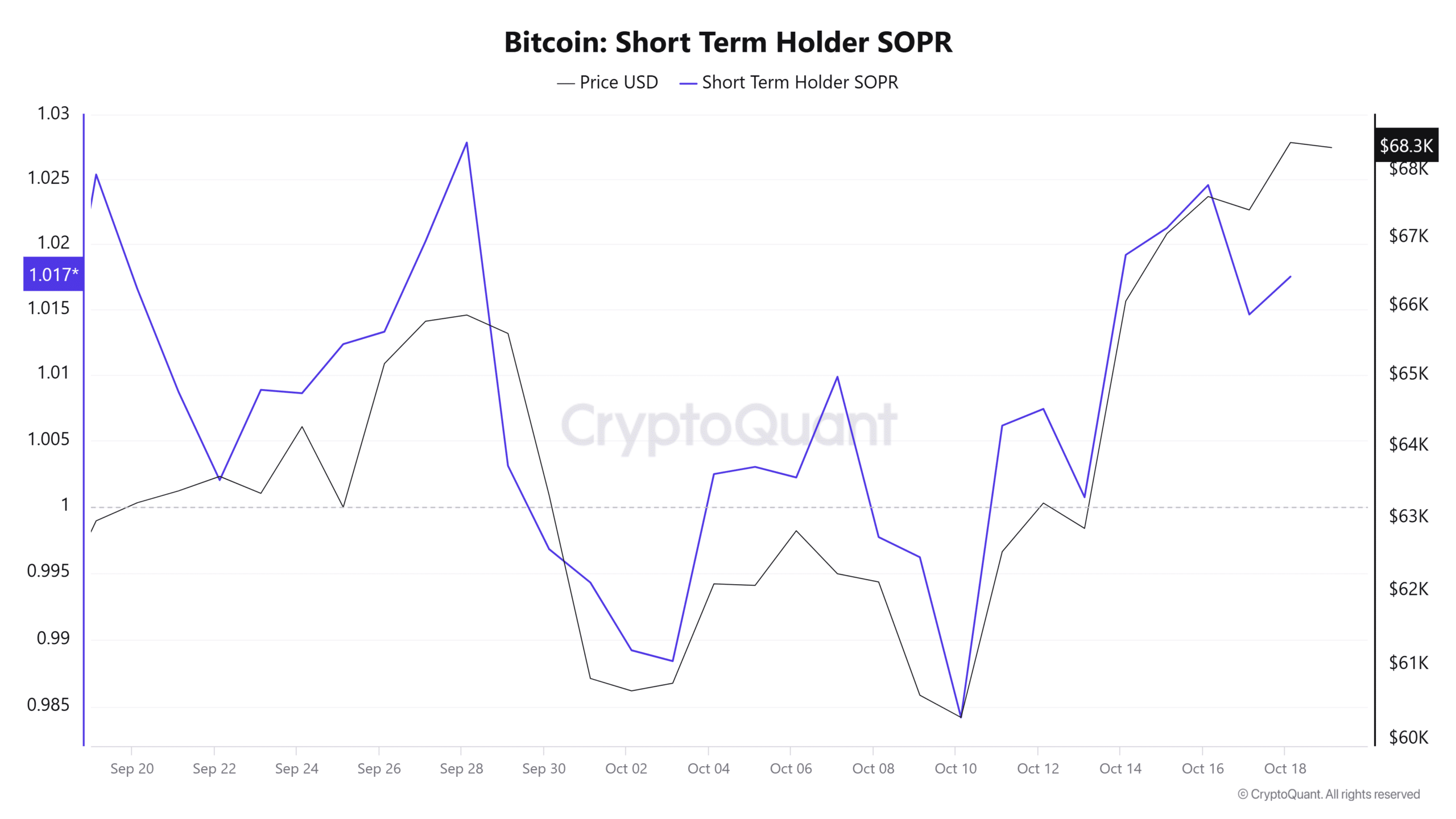

The short-term holder Spent Output Profit Ratio further highlighted that these traders have been selling BTC at a profit. Especially since the metric has been above 1 for over a week now.

When the Spent Output Profit Ratio (SOPR) exceeds 1, it often indicates a bullish market mood. However, this might also signal an increased probability of profit-taking. If Bitcoin’s upward trend exhibits any signs of faltering, those holding the cryptocurrency may be more inclined to sell, potentially triggering a price drop or reversal.

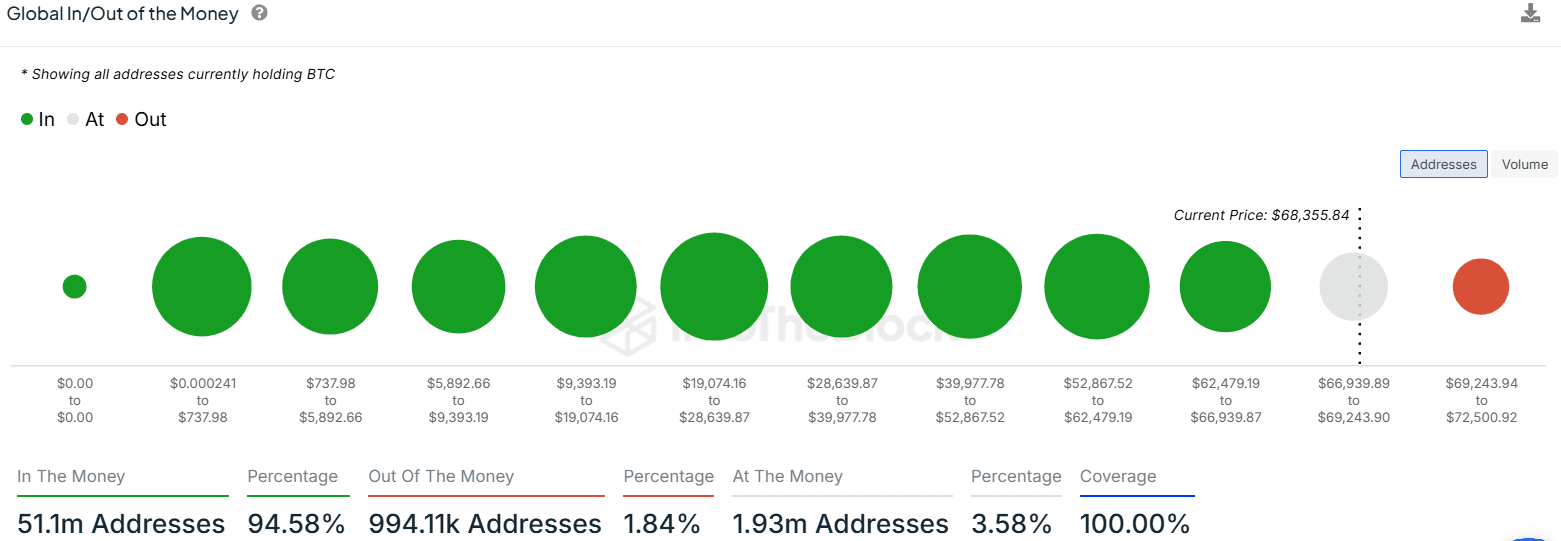

Additionally, apart from traders intending to sell quickly, it’s the group of approximately 1.9 million Bitcoin holders who purchased their coins between $66,900 and $69,200 that might postpone an All-Time High (ATH) for Bitcoin. As reported by IntoTheBlock, these investors, at the current moment, have broken even on their investment.

As Bitcoin nears the $69,000 mark, it may encounter selling pressure from investors who have made a profit, as they might decide to cash out their holdings.

Nevertheless, short-term holder behavior is unlikely to dampen market sentiment around Bitcoin. Especially since it is only 7% shy of its ATH now.

Technical indicators show bullish signs

At the moment, Bitcoin’s daily chart shows robust bullish trends. The Relative Strength Index (RSI), currently sitting at 68, signals a significant buying pressure. Moreover, the RSI has been creating higher peaks, implying that the upward trend could be growing more powerful.

The on-balance volume is rising and consistently surpassing the moving average, suggesting a growing influx of capital into Bitcoin. This trend supports the optimistic outlook since it implies an increase in buying activity, which might lead to price increases.

If the bullish trends persist and Bitcoin surpasses $69,000, it may encounter resistance around $75,250, marking a new all-time high (ATH). On the flip side, if selling pressure intensifies, the price could dip towards the 0.618 Fibonacci support level, approximately $65,130.

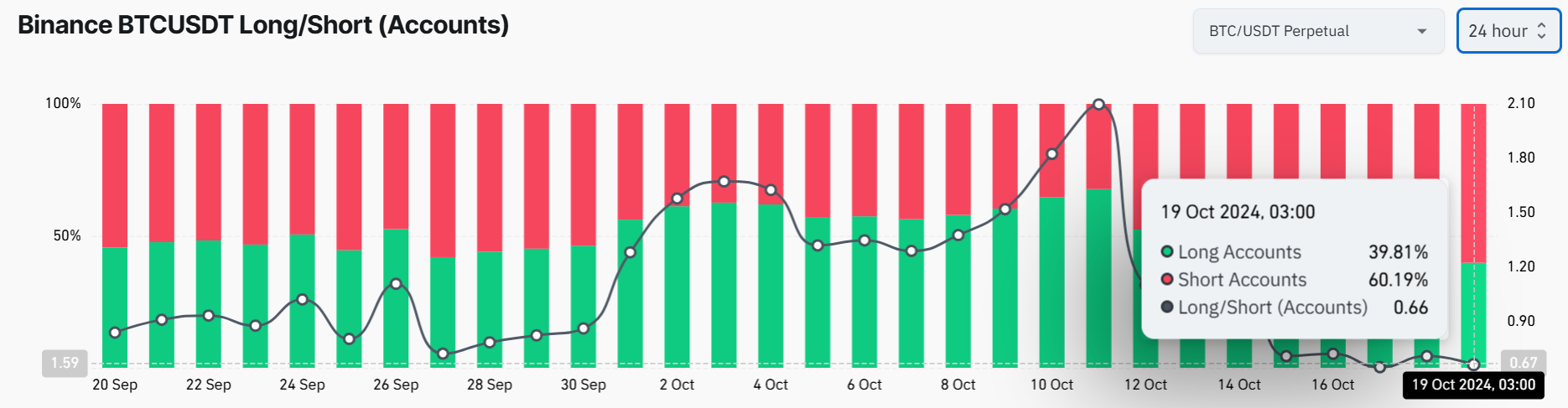

In fact, some traders are already anticipating such a drop. For example – Data from Coinglass revealed that 60% of open positions are short sellers betting on a failed uptrend.

Read More

- DYM PREDICTION. DYM cryptocurrency

- CYBER PREDICTION. CYBER cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- POPCAT PREDICTION. POPCAT cryptocurrency

- TURBO PREDICTION. TURBO cryptocurrency

- Top gainers and losers

- SKEY PREDICTION. SKEY cryptocurrency

- ETH CAD PREDICTION. ETH cryptocurrency

- BNB PREDICTION. BNB cryptocurrency

2024-10-20 00:07