- The accumulation\distribution indicator was relatively flat, showing limited buying interest.

- Uniswap faced a potential support breakdown, targeting $4.68.

As a seasoned crypto investor who’s been through multiple market cycles, I can say that Uniswap [UNI]’s current state is a familiar sight. The price action over the past week has been a stark reminder of the volatile nature of this asset class.

Over the last seven days, Uniswap’s token [UNI] has experienced notable selling force, as suggested by AMBCrypto, which predicts a possible 30% drop in its price.

Although there may be negative sentiments in the market, it’s worth noting that trading activity on Uniswap’s Celo implementation has actually risen. This discrepancy suggests a fascinating contrast between market feelings and the trajectory of adoption.

Uniswap’s value has persistently decreased, dipping to $6.6 on November 4th, which is its lowest point since October. This decline represents a significant 60% drop from its highest value this year.

In simpler terms, the approaching U.S. elections are causing more uncertainty, leading financial traders to search for lower price points as a means of achieving market stability.

Uniswap breaks bearish pennant

As a crypto investor, I’ve noticed a concerning trend with Uniswap. The technical analysis suggests that due to its recent break below a bearish pennant pattern visible on the daily chart, there might be further downside potential for this token in the near future.

Support for the price is expected to hold steady around $4.68, which corresponds to the estimated minimum price based on the pennant pattern, thus acting as a base for the current downtrend.

When the Stochastic RSI falls below 20, suggesting an oversold condition, it seems that a strong downward trend persists. This could mean that the price might keep dropping before potentially shifting direction, hinting at a possible change in momentum.

When the token’s price drops below both its 200-day and 50-day moving averages, it hints at the possibility of a “death cross” occurring.

On the 25th of July, this particular pattern emerged, indicating a prolonged downtrend, which was followed by a decrease of approximately 40%.

The recent break below critical moving averages reaffirms the bearish outlook.

Regardless of the reduction in prices, the usage of Uniswap on Celo has experienced significant expansion, as trading volumes have grown around 20 times more than they were in January 2024.

As a crypto investor, I’ve noticed an impressive surge in my weekly trades on Celo. What started as $10 million has grown nearly to $350 million, which speaks volumes about Uniswap’s growing influence within the decentralized finance (DeFi) sector.

On-chain metrics show steady growth

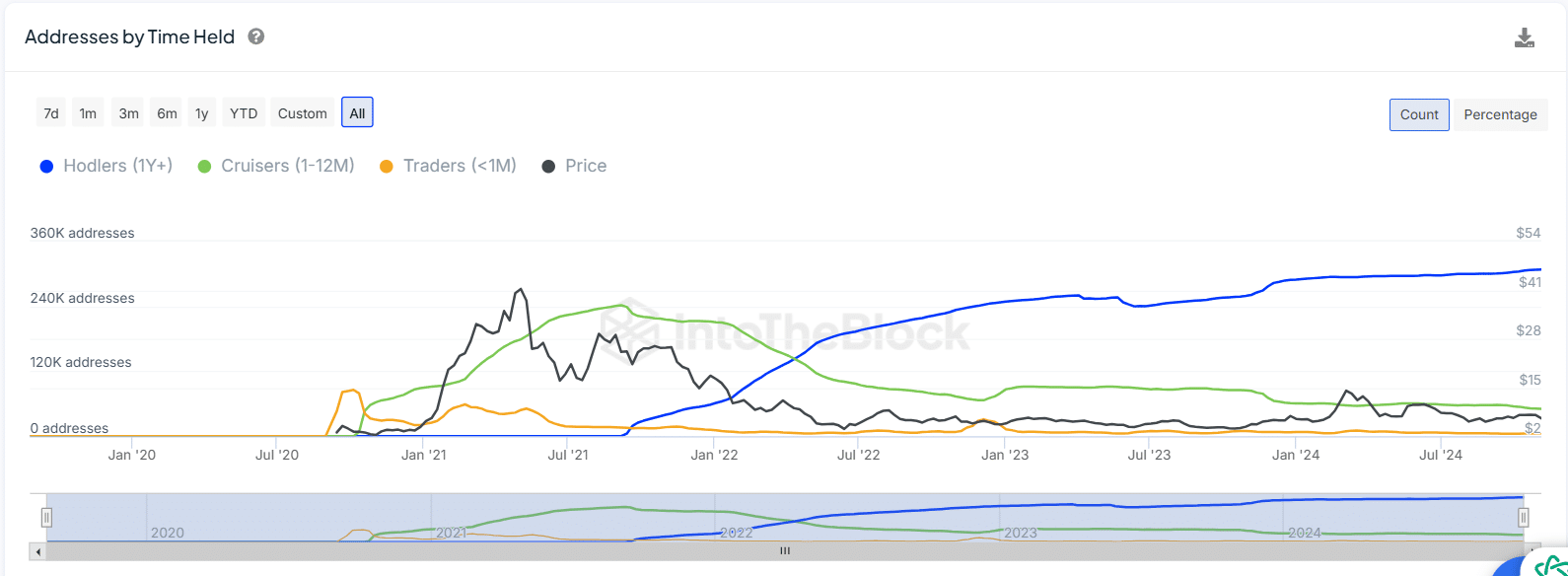

Address analysis revealed a steady increase in long-term holders, with over 360,000 addresses holding Uniswap for more than a year.

The increase in owners indicates a strong group of long-term investors, lending a sense of stability even amidst the present wave of selling.

Currently, the number of cryptocurrency users who hold their assets for a period ranging from one month to a year has remained fairly consistent at approximately 120,000 wallet addresses, following a peak in early 2021.

In simpler terms, it can be said that short-term investors, who usually keep their investments for less than a month, continue to represent a small portion of the market, suggesting that the level of speculative enthusiasm is decreasing as the market becomes more mature.

Divergence in UNI funding rates signals…

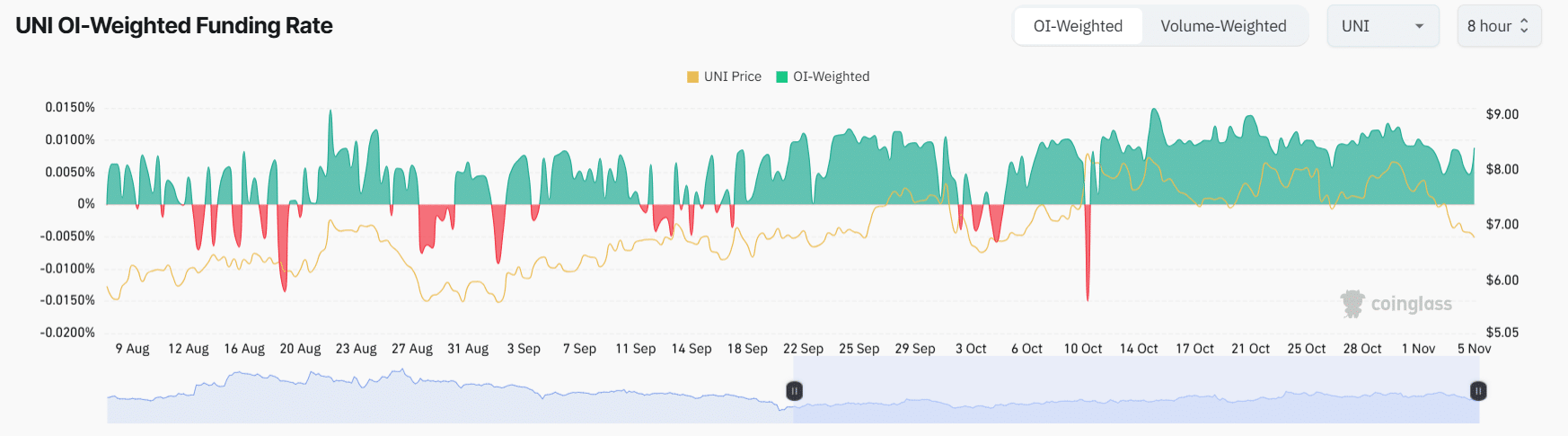

Green-colored funding rates signify periods where long positions held more weight, reflecting a generally optimistic or bullish market outlook.

Despite occasional brief drops below the zero line, indicating times of negative funding, these instances underscore bearish sentiment. Since late October, though, the funding rate has generally been favorable, yet the trend in UNI’s price has consistently fallen.

This indicated that while traders were eager to buy (go long), the overall feeling or attitude towards the market itself was still rather negative (remained weak).

Such a divergence between funding rates and price suggests caution among investors as the price continues its downtrend, with long positions potentially facing mounting pressure as the market corrects.

Read More

- DYM PREDICTION. DYM cryptocurrency

- CYBER PREDICTION. CYBER cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- POPCAT PREDICTION. POPCAT cryptocurrency

- Top gainers and losers

- SKEY PREDICTION. SKEY cryptocurrency

- TURBO PREDICTION. TURBO cryptocurrency

- BNB PREDICTION. BNB cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

2024-11-05 23:04