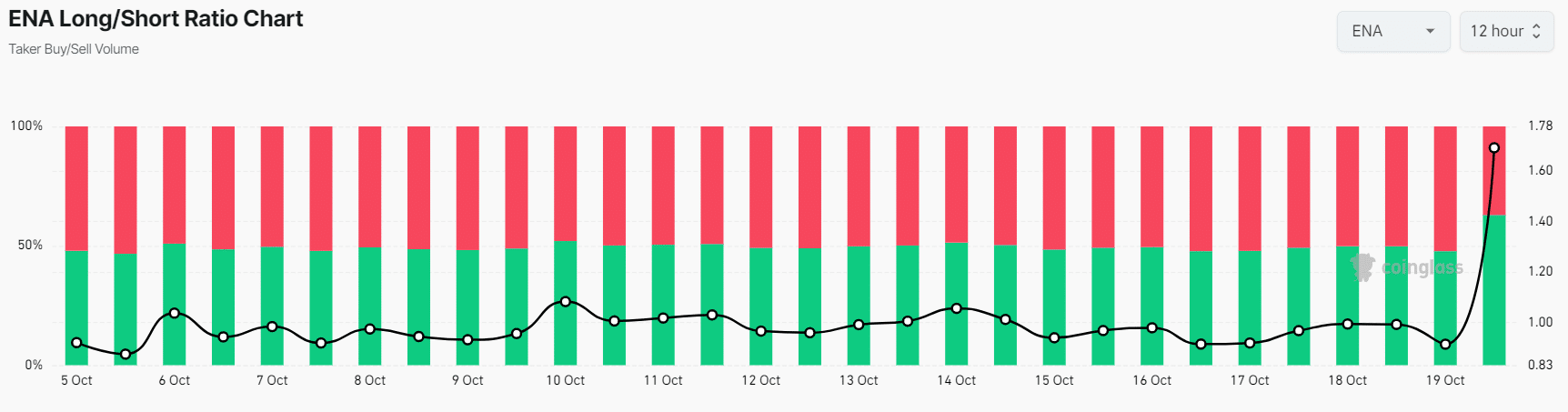

- ENA’s Long/Short Ratio in the past 12 hours stood at 1.69, indicating strong bullish sentiment.

- The major liquidation levels were near $0.395 and $0.409, with traders over-leveraged at these levels.

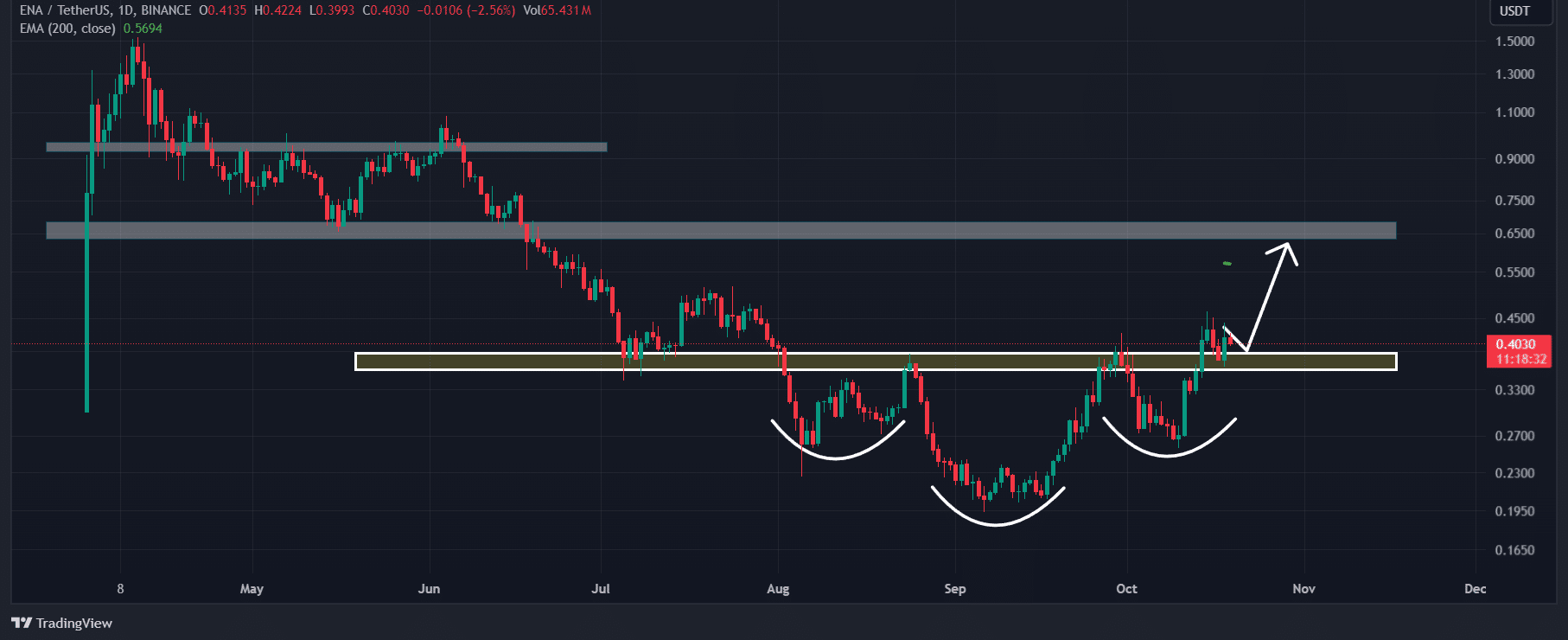

As a seasoned crypto investor with over a decade of experience in this dynamic market, I find myself intrigued by the recent performance of Ethena [ENA]. The bullish sentiment surrounding this asset is palpable, and its successful breakout from an inverted head-and-shoulder pattern is a positive sign for those holding ENA.

Most digital currencies, spread out over the crypto market, are either seeing significant price increases or adjustments in response to market conditions.

In the current situation, it seems that Ethena (ENA), which is associated with Telegram, is showing optimism. It has just tested a bullish trend in its price action, indicating it could be preparing for a significant upward surge within the next few days.

Ethena’s successful breakout

Based on AMBCrypto’s technical assessment, Ethena appears to have burst free from an upwardly sloping inverted head-and-shoulders chart formation at around $0.362, and it has subsequently confirmed this breakout by revisiting the level.

As a researcher observing the market dynamics, I’ve noticed that after the recent retest of the breakout level, Enigma (ENA) has started to trend upwards. This upward movement is certainly encouraging news for token holders.

Given the current trend in ENA’s price movement, it seems highly likely that its value could surge as much as 60%, potentially reaching around $0.65 in the near future.

Nevertheless, the asset’s latest results have sparked significant interest among investors and dealers, and it seems that ENA has also aroused comparable anticipation over the past seven days.

Many investors and traders interpret the emergence of an upside-down head and shoulders configuration, followed by a retest, as a positive signal, suggesting a successful continuation of the upward trend.

Bullish on-chain metrics

The optimistic view of ENA is backed up even more, as the Long/Short Ratio, according to Coinglass, was 1.69 during the previous 12 hours prior to the current moment, which is the highest it’s been since late September 2024.

This notable long/short value indicated strong bullish sentiment among traders.

Moreover, the Open Interest of ENA has stayed constant over the last 24 hours, implying that traders are on standby, anticipating the asset to surpass the $0.45 mark and end the day with a higher closing price.

At press time, 62.86% of top traders held long positions, while 37.14% held short positions.

Major liquidation levels

As a crypto investor, I’ve noticed that significant liquidation points were located around $0.395 on the downside and $0.409 on the upside, based on the data from Coinglass. It seems that traders have taken on a high level of leverage at these specific price levels.

If the current market feeling persists and the price ascends to approximately $0.409, it’s estimated that around $1.87 million in short positions will be closed out.

If the sentiment reverses and the price falls to around $0.395, it’s estimated that about $1.41 million in long positions will be closed or sold off.

Read Ethena’s [ENA] Price Prediction 2024–2025

The information about liquidation indicates that short-selling traders had been strategically positioned, anticipating a drop in price below the $0.395 threshold; however, given the prevailing optimistic outlook in the cryptocurrency sector, such a fall seems improbable.

Current price momentum

Currently, ENA is close to $0.402 following an approximately 0.55% increase in price within the last day. In the same timeframe, its trading activity has significantly risen by around 20%, suggesting increased investor engagement.

Read More

- DYM PREDICTION. DYM cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

- CYBER PREDICTION. CYBER cryptocurrency

- POPCAT PREDICTION. POPCAT cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- TURBO PREDICTION. TURBO cryptocurrency

- Top gainers and losers

- ETH CAD PREDICTION. ETH cryptocurrency

- MPL/USD

- GME PREDICTION. GME cryptocurrency

2024-10-20 10:16