- SUI could be gearing up for a breakout as weak hands exit the market.

- If this happens, a shift in rankings among the top 20 might follow.

As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen my fair share of market swings and trends. The recent performance of SUI [SUI] has certainly piqued my interest, especially considering its impressive surge past Litecoin [LTC] in market cap within the last 30 trading days. However, the recent pullback has left me a bit wary, as it landed SUI on the top losers chart.

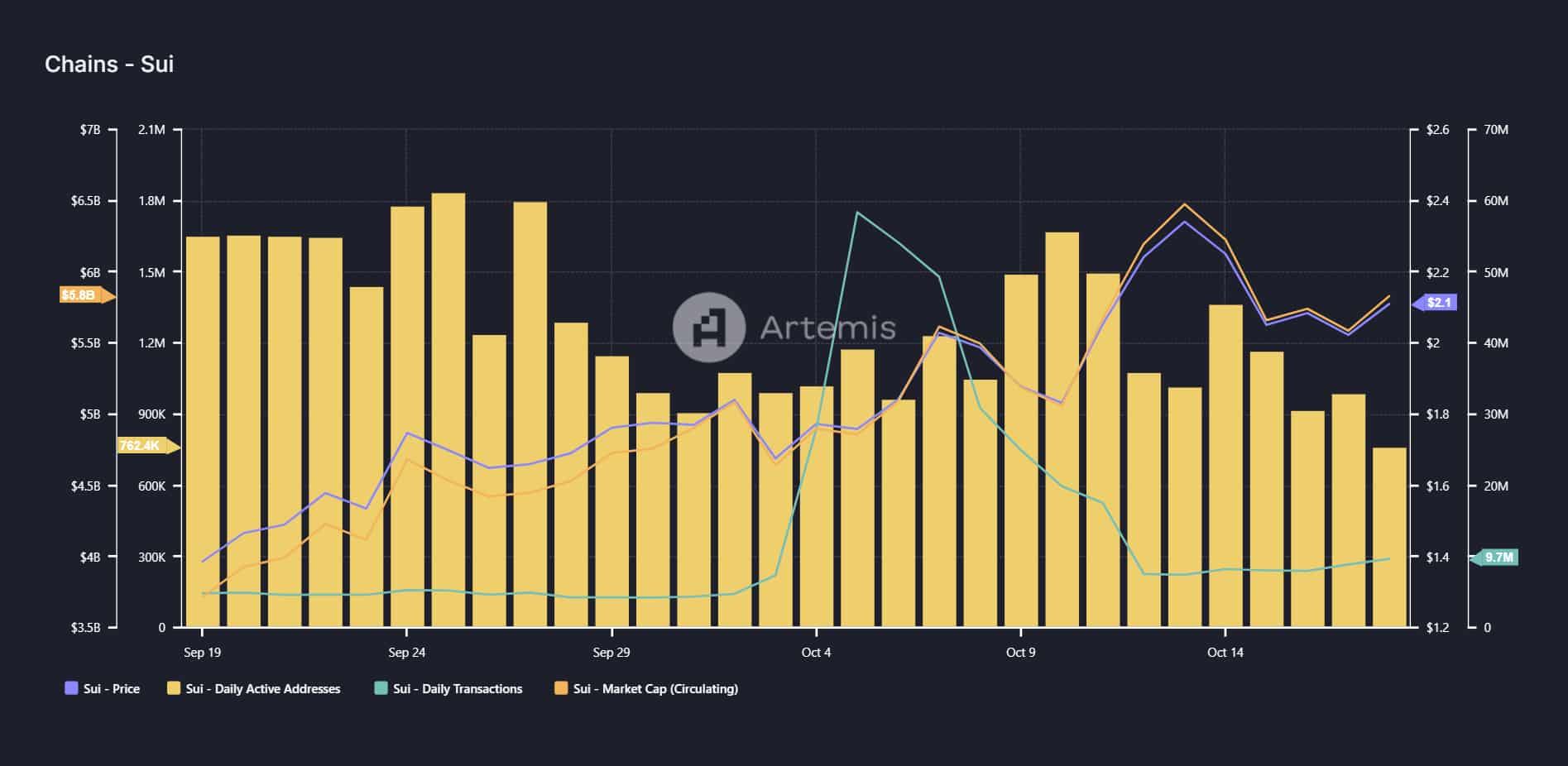

In the last 30 trading days, SUI has managed to exceed Litecoin (LTC) in terms of market capitalization, a notable achievement. The expansion of its user base appears to be the driving force behind this positive trajectory.

However, a recent weekly pullback of over 3% has landed SUI on the top losers chart.

The discrepancy led analysts from AMBCrypto to consider if the recent decline was intentionally designed to force out inexperienced investors, paving the way for a more robust advance potentially pushing SUI towards $2.40.

If it happens, a setback might potentially lead to NEAR losing its place among the top 17 cryptocurrencies by market capitalization; if not, Litecoin seems ready to regain that position.

SUI hits a transactional milestone

Over the past couple of months, I’ve noticed a significant growth trajectory for SUI, defying the general downward trend. Remarkably, even during the bearish phases, the bullish forces have successfully held off any significant declines, keeping the last support level steady at $0.53.

Currently priced at $2.06, SUI is demonstrating remarkable growth within a brief period. This rapid increase peaked notably, causing the Relative Strength Index (RSI) to exceed its limits.

However, despite this concern, the token has maintained its upward trajectory, experiencing only minor hiccups, strategically smoothed out by bullish support.

The speed of this system is supported by its architecture, which strives to overcome typical bottlenecks in traditional blockchains by facilitating quicker transactions without causing network overload.

Reaching 270,000 transactions per second (TPS), SUI has struck a chord with cryptocurrency users, demonstrating an impressive $6 billion worth of transactional activity.

This success propelled SUI to an ATH of $2.40 just a week ago.

Nevertheless, since the high price suggested a possible peak, numerous wallets started selling off their assets, causing a substantial decrease in daily transactions. This decline reached approximately $20 million, representing a reduction by half.

This pattern indicates that the increase in profits has led numerous investors to cash out, causing those with less commitment to sell off their holdings.

To have a recovery occur, it’s essential that new investors consider $2 as a possible dip in the local market bottom, hoping for a subsequent rally that may provide significant profits.

Should this trend continue, SuI may undergo a significant resurgence, possibly reaching a fresh all-time high. If so, its market capitalization could cause a shuffle in the rankings among the leading 20 cryptocurrencies.

Intense rivalry ahead

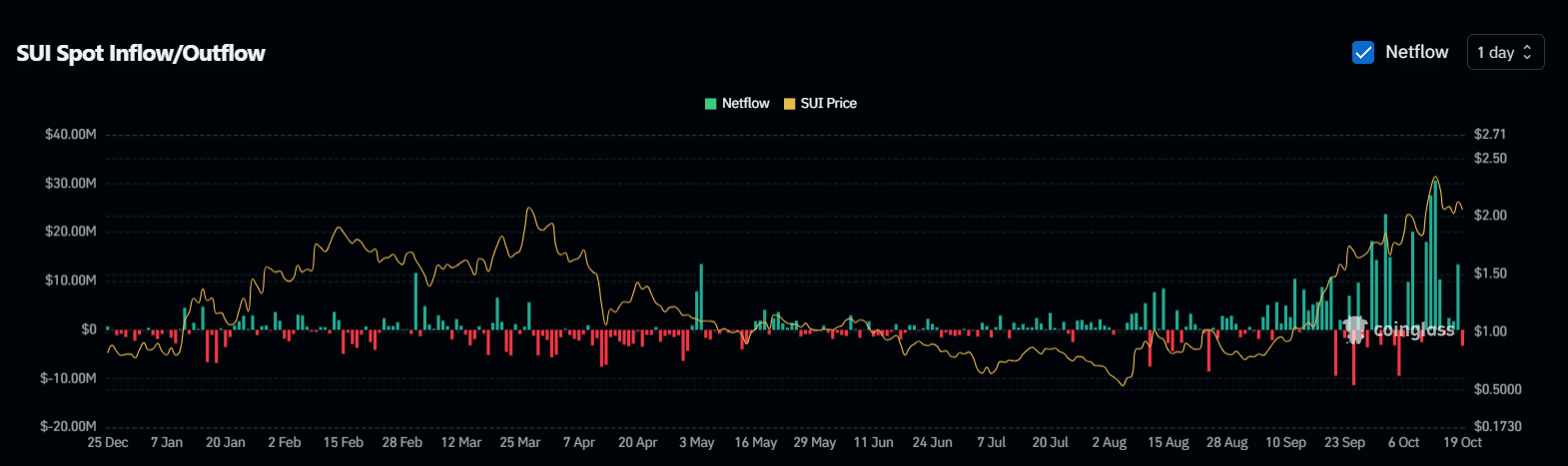

Over the last two months, I’ve noticed a significant increase in SUI, yet surprisingly, this rise didn’t seem to deter spot traders from unloading their positions. This action, in turn, led to a decrease in daily trading volume, which dropped to approximately $30 million.

Despite the price having become steady, this could indicate that investors are buying up more shares, a vital step towards recovery.

After a recent dip over the past week, the price of SUI has nearly reached $2.05. This presents an excellent opportunity for investors to consider buying in. It appears that some traders might be employing this very strategy, as suggested by the red candlestick.

Read Sui’s [SUI] Price Prediction 2024-25

If the current pattern continues, there’s a possibility that the value of SUI might experience a substantial decrease around the $2 mark. A recent Moving Average Convergence Divergence (MACD) crossover suggests a downward trend, indicating that the prices could drop unless active traders significantly increase their purchases.

Should the revived enthusiasm lead us near the $2 price point, a strong recovery might ensue. Yet, for SUI to exceed NEAR, the recovery needs to push SUI up towards approximately $2.40.

Read More

- DYM PREDICTION. DYM cryptocurrency

- CYBER PREDICTION. CYBER cryptocurrency

- ZK PREDICTION. ZK cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- POPCAT PREDICTION. POPCAT cryptocurrency

- TURBO PREDICTION. TURBO cryptocurrency

- Top gainers and losers

- SKEY PREDICTION. SKEY cryptocurrency

- ETH CAD PREDICTION. ETH cryptocurrency

- BNB PREDICTION. BNB cryptocurrency

2024-10-20 12:08