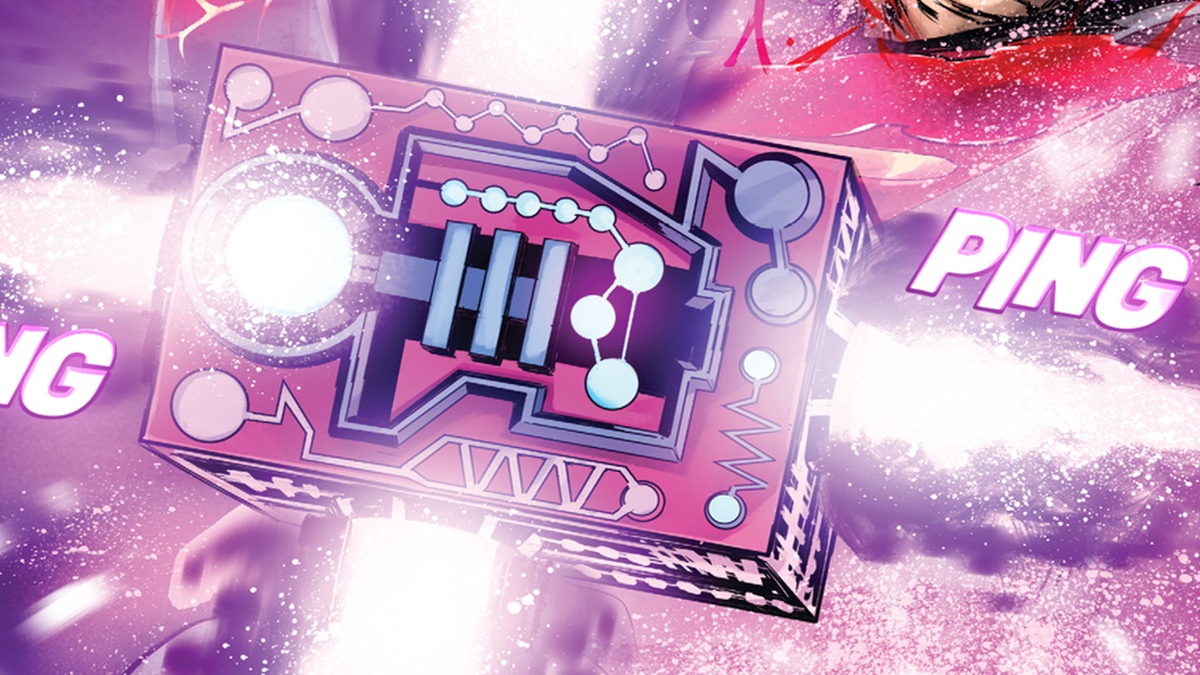

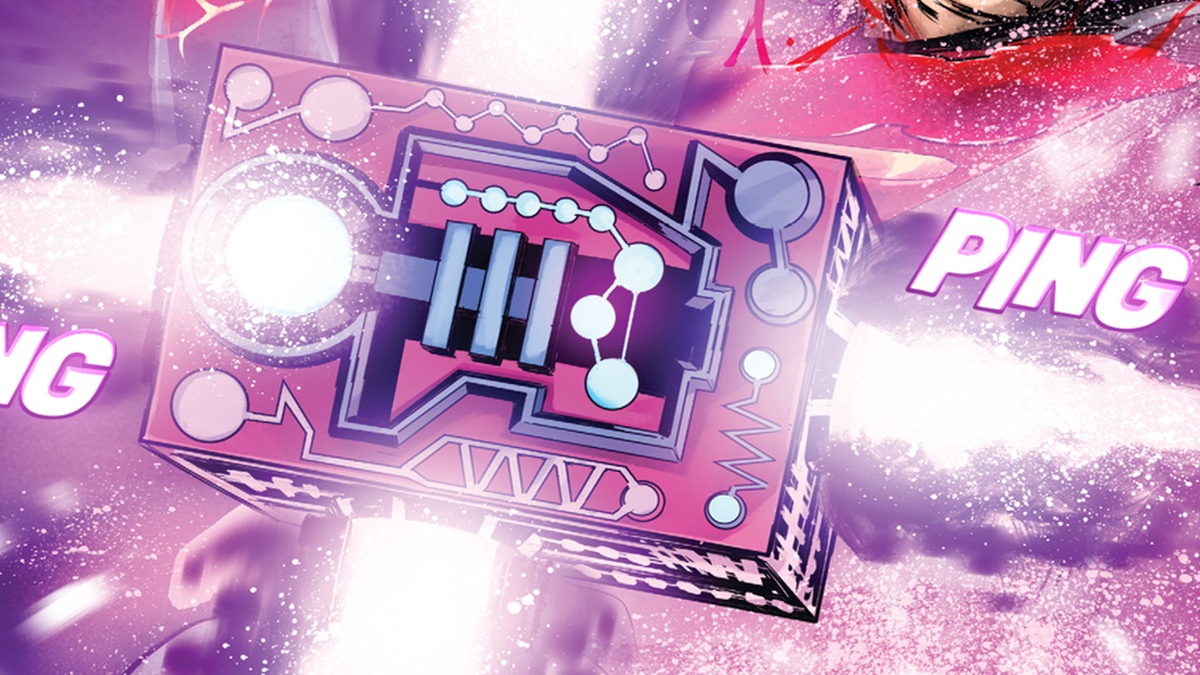

In the ninth issue of “Absolute Superman,” the story continues directly from where it ended in issue eight. The Omega Men have transported Superman to their base, aiming to remove the Kryptonite bullets embedded within him. Despite the Kryptonite draining his strength, Superman’s resilient body proves too tough for the Omega Men to extract the bullets easily. They attempt to dislodge one, but in the process, Superman inadvertently damages the room. The remaining two bullets are lodged near his ribs and lungs, making it impossible for the Omega Men to reach them. With no other choice, Superman must remove the bullets himself, using his X-ray vision as a guide. He manages to extract one bullet but is left too weak to pull out the remaining one. Recognizing that Superman is deteriorating, Primus unveils the Omega Men’s hidden weapon – the Father Box. The box emits a low ping, and removes the bullet from his chest. However, the Father Box doesn’t stop there; it also heals Superman, restoring his strength and saving his life.