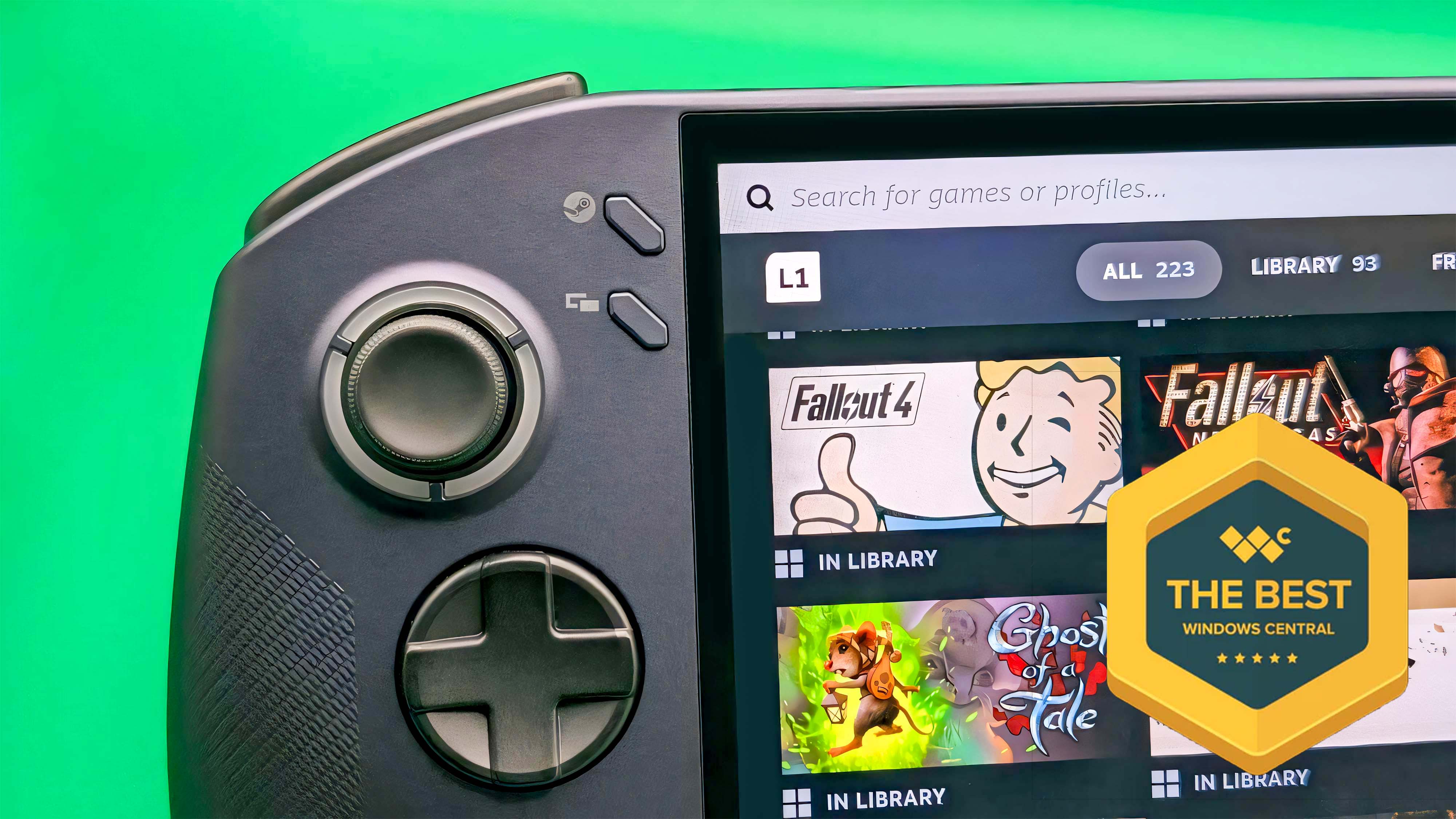

Gamers continue to make the switch to Windows 11 — and not just from Windows 10, either

In fact, it’s noticeable that many gamers are migrating towards Windows 11, as the data shows, not only compared to previous versions like Windows 10, but also in a broader context.