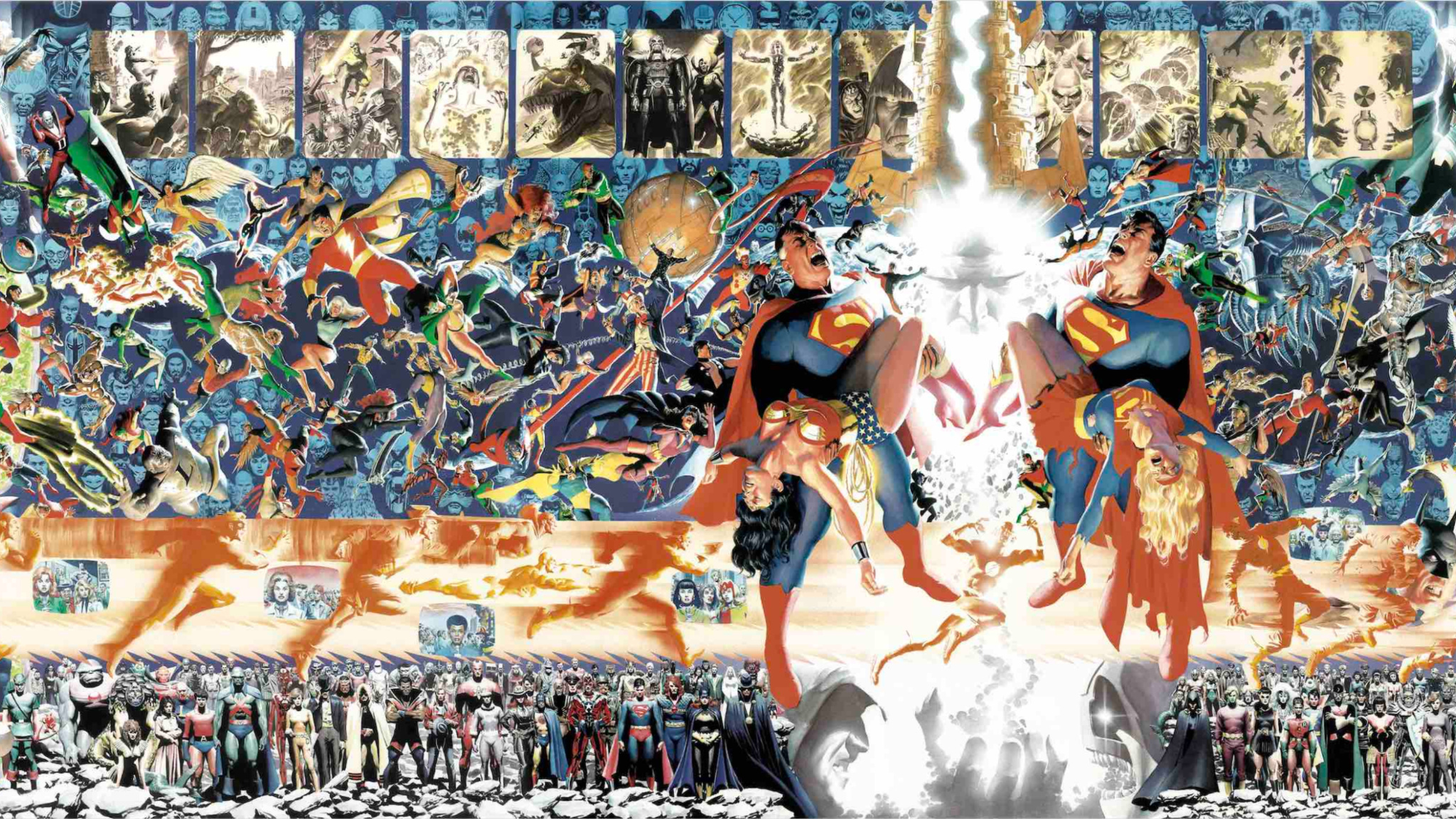

10 Best DC Stories of the 80s

During the extravagant ’80s, DC Comics stood out as the superior among the two major publishers. They produced comics that symbolize the ’80s and demonstrated that superhero stories could transcend mere morality tales. The top DC comics from this era are artistic masterpieces, reflecting the evolution of the superhero genre since its inception at the close of the Great Depression. These 10 DC comics of the ’80s were groundbreaking, shaping how the public interacts with superheroes.