What you need to know

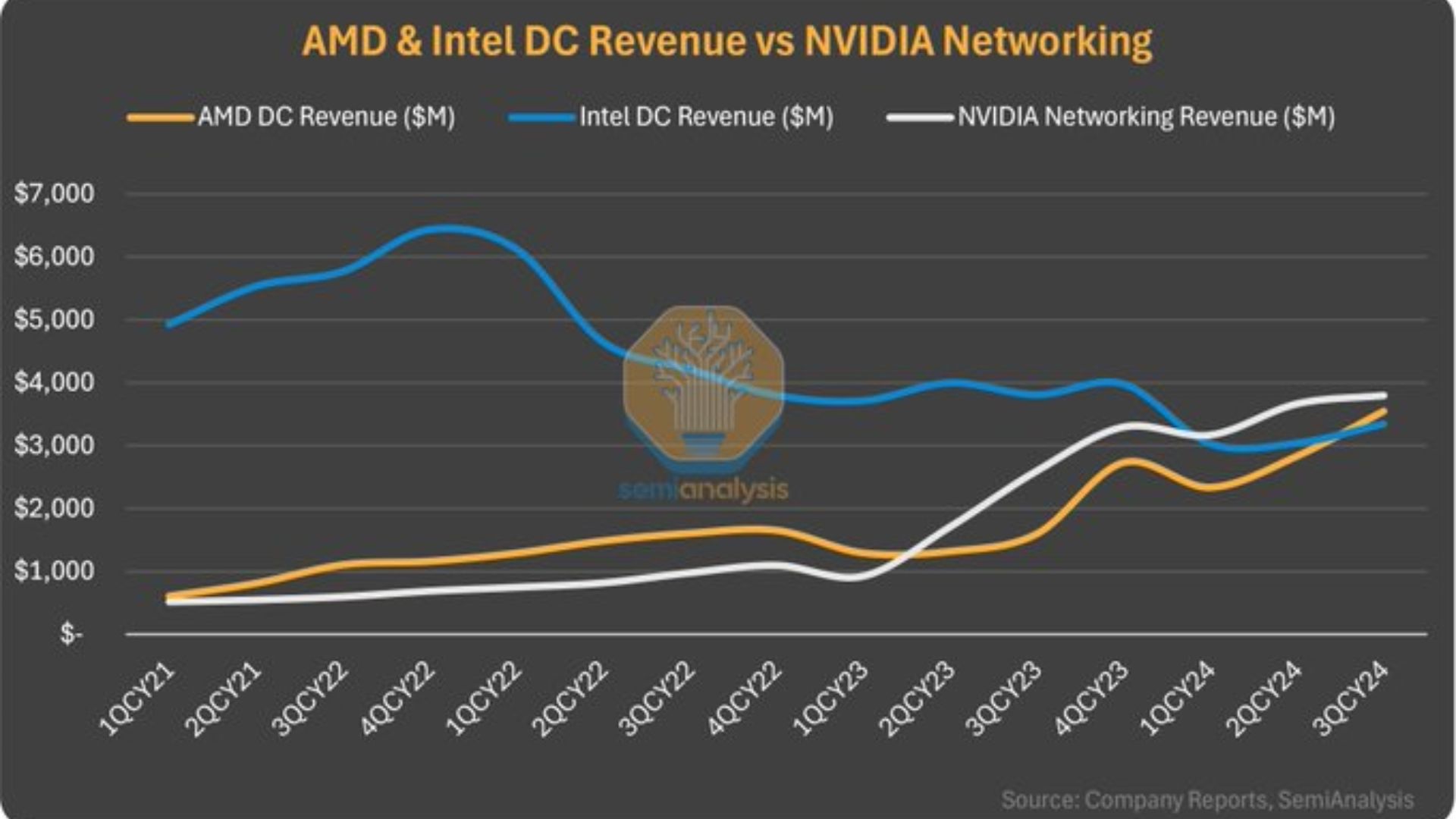

- A report by SemiAnalysis indicates AMD recently ended Intel’s long reign as the top chip brand for data center processors.

- More consumers are seemingly inclined toward AMD’s EPYC processors to power their sophisticated machines than Intel’s Xeon processors.

- AMD reported $3.549 billion in revenue from its data center business in Q3 2024, significantly higher than Intel’s $3.3 billion.

As a seasoned analyst with decades of experience in the tech industry, I’ve witnessed many shifts and trends over the years. However, the recent turn of events between AMD and Intel in the data center processor market is particularly noteworthy. AMD’s EPYC processors have been steadily gaining ground against Intel’s Xeon CPUs, a shift that was unthinkable just a few years ago.

It appears that Intel has been facing some difficulties recently. In an unexpected development, AMD has managed to dethrone Intel as the leading brand in data center processors, ending Intel’s long-standing dominance in this sector. For a considerable period, many corporations have been relying on Intel’s Xeon CPUs to run their servers, while AMD trailed significantly behind (according to Tom’s Hardware).

Lately, businesses are leaning towards using AMD’s EPYC processors for their complex systems. Yet, the majority of servers continue to operate with Intel’s Xeon processors. As per a report by SemiAnalysis, AMD outpaces Intel in terms of data center business sales.

In Q3 2024, AMD earned $3.549 billion from its data center business compared to Intel’s $3.3 billion. Although the difference isn’t huge, AMD remains ahead in this area. This trend might indicate a growing preference among consumers for AMD products, providing it with an edge over Intel. The increasing demand for AMD’s high-performance EPYC processors contributes to this advantage. Additionally, Intel’s heavy discounting on server chips may have negatively impacted its revenue and profit margins.

NVIDIA scales even greater heights with a strong demand for AI chips

In a nutshell, NVIDIA’s dominance in the artificial intelligence sector propelled it to become the world’s leading company by market value, surpassing giants like Apple and Microsoft, with an astounding valuation of over $3 trillion. Notably, last year, the robust demand for AI processors further cemented its status as the most profitable chip manufacturer globally.

Lately, NVIDIA has seen a significant increase in its market value, primarily because of the growing interest in AI chips. To provide some perspective, this surge increased the company’s total market capitalization by 9.3%, resulting in a valuation of approximately $3.26 trillion.

Noteworthy, Microsoft and OpenAI are collectively pouring a substantial $100 billion into an initiative dubbed Stargate. This data center aims to cater to both companies’ rapidly expanding needs in GPU resources, accelerating their Artificial Intelligence (AI) progress. The launch of this project is slated for 2028 and it seeks to diminish the overdependence on NVIDIA for AI chip production.

It’s worth noting that Microsoft and OpenAI have jointly committed $100 billion to a venture named Stargate. This data center aims to bolster both firms’ AI progress by catering to their significant need for GPUs. The launch of this project is tentatively scheduled for 2028, with the goal of decreasing the excessive dependence on NVIDIA for AI processors.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

2024-11-06 21:09