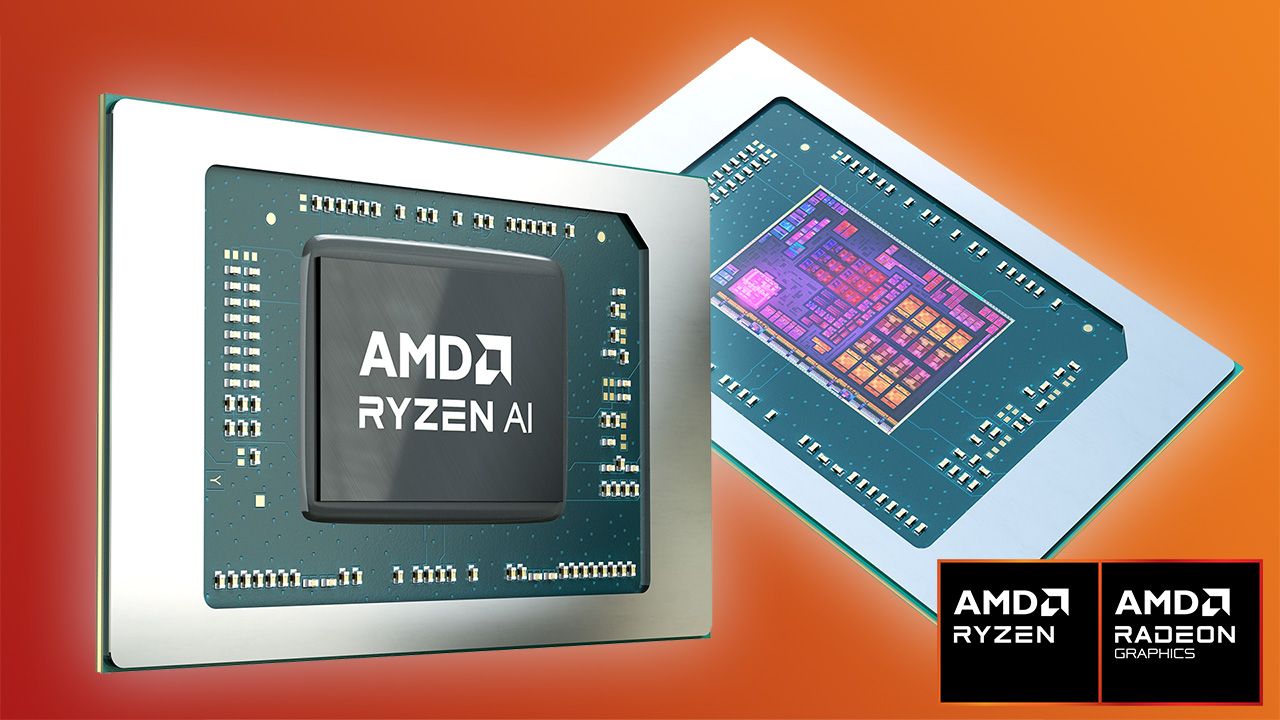

AMD’s budget Ryzen AI 5 330 processor will introduce a wave of ultra-affordable Copilot+ PCs with its mobile 50 TOPS NPU

Each of the six Ryzen AI 300 Series mobile processors comes equipped with an onboard Neural Processing Unit, specifically designed for local artificial intelligence processing. This NPU is capable of performing 50 Tera Operations per Second, surpassing the minimum 40 TOPS requirement for Copilot+ PC certification.