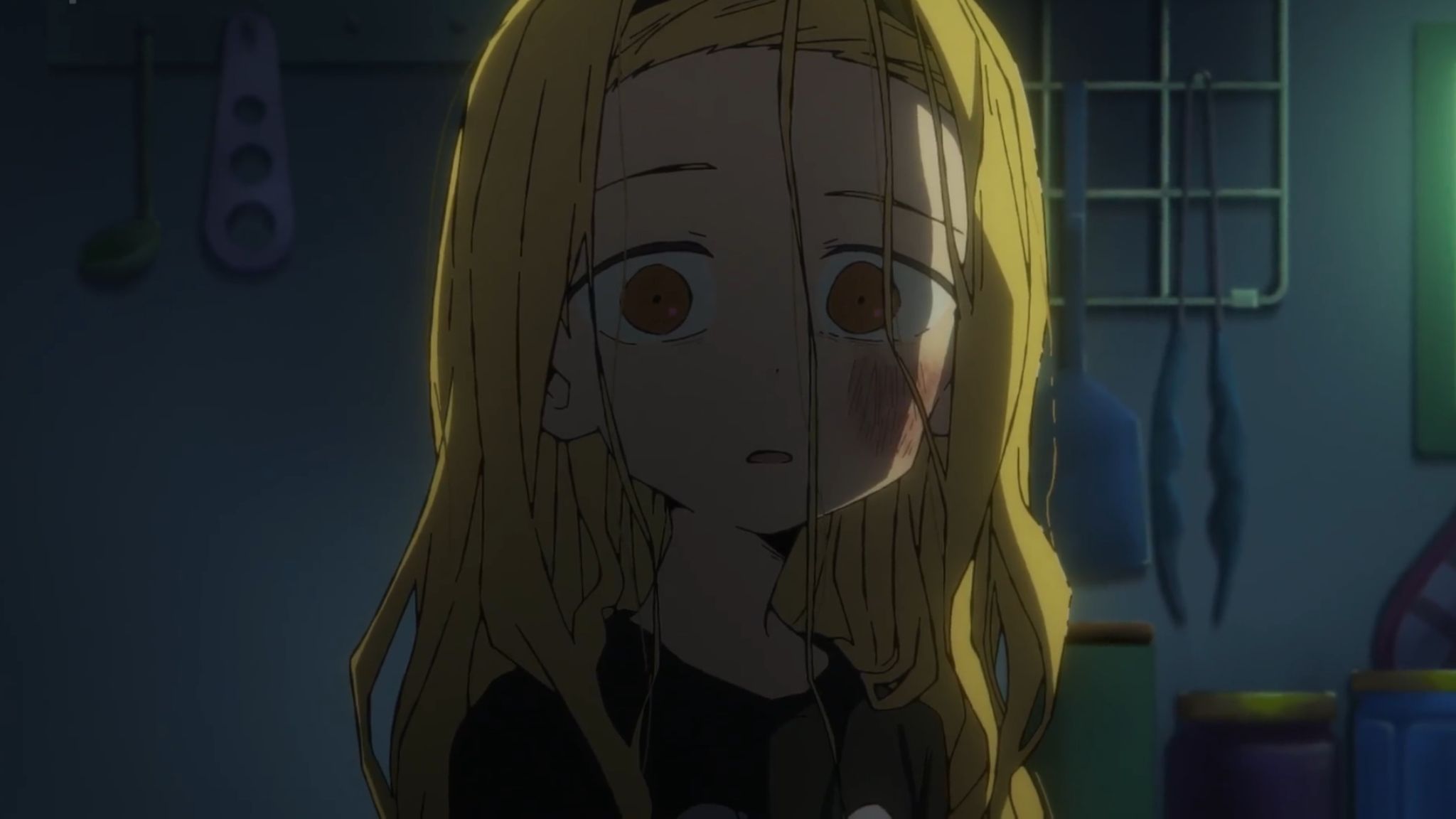

One of 2024’s Best Movies on Netflix for 72 Hours

The film to be released in 2024 is titled “Furiosa: A Mad Max Saga,” a sequel and prequel spin-off of the 2015 blockbuster and critically-adored Mad Max: Fury Road. This movie also marks the fifth installment in the Mad Max series, with a unique twist – Max Rockatansky, the franchise’s main character, is not the protagonist this time around. Instead, the lead role is given to Furiosa, a secondary character in previous films, and the narrative focuses on her backstory.