Lately, sports broadcasting has undergone significant transformations, resulting in an environment that combines hurdles and prospects. The dissolution of Disney’s Venu partnership and the antitrust lawsuit involving a Fubo subscriber have stirred up a storm in one of television’s remaining strongholds.

DirecTV’s MySports package is uniquely positioned to fill the resulting void.

Is $70 MySports on DirecTVStream the ultimate $83 YouTube TV killer?

— Altavistagoogle🇨🇦 (@Altavistagoogle) January 17, 2025

In light of these significant changes, sports enthusiasts who miss their regular team coverage and investors aiming for steadier media ventures are turning to DirectTV for potential solutions.

Directv aspires to regain a substantial portion of the market by leveraging its strong system foundation and forward-thinking approach, all while providing affordable options tailored for sports enthusiasts.

This article will examine the complexities surrounding recent changes in the industry and analyze why DirecTV’s Sports package is standing strong amidst the chaos. We’ll take a closer look at the demise of Disney’s Venu partnership, the aftermath from FuboTV’s antitrust court case, and how Directv is leveraging these events to provide a steady, dependable option for sports enthusiasts.

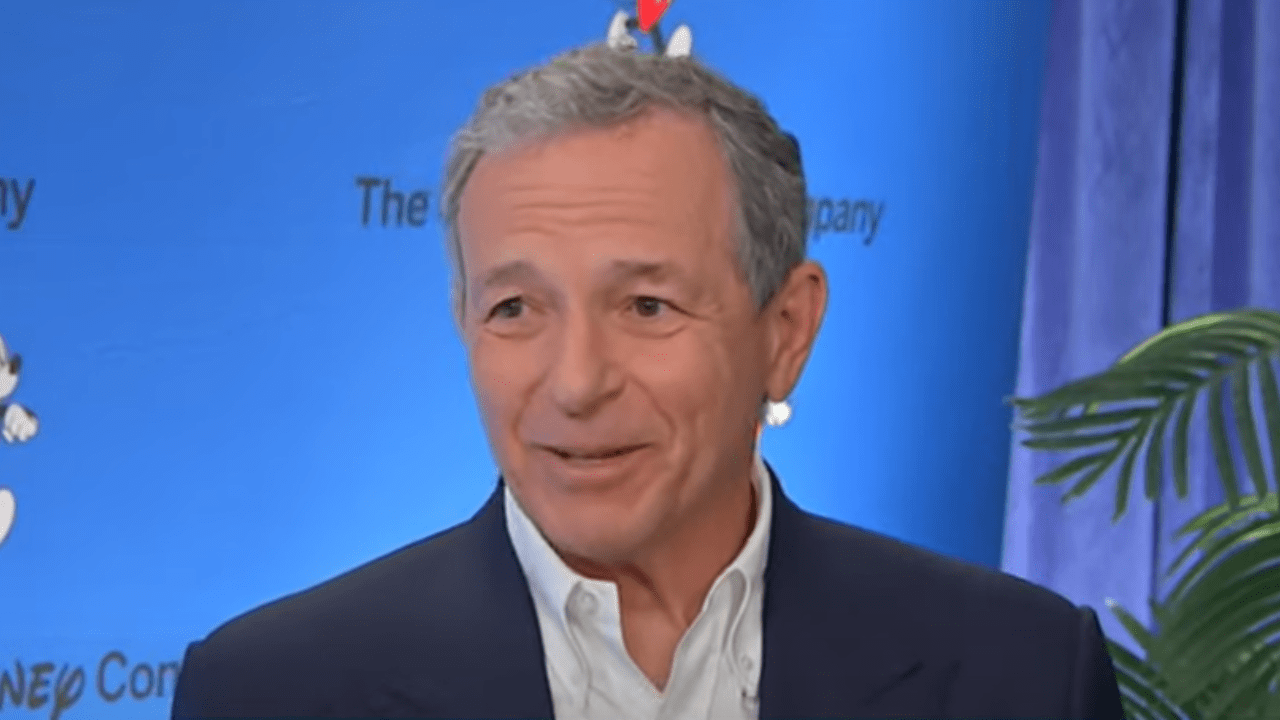

The Unraveling of Disney’s Venu Joint Venture

Right from the start, it was clear that Disney’s Venu joint venture might face antitrust issues. Announced with great enthusiasm, it seemed like a temporary measure to divert shareholder attention away from another underwhelming quarterly financial report. Given this context, its eventual failure appeared almost inevitable.

1) Sports broadcasting is a dynamic field that’s constantly evolving due to fluctuating market trends, disputes over broadcast rights, and legal hurdles. The collapse of Venu serves as a vivid illustration of its unpredictable nature. The alliance, quickly assembled in a bid to seem cutting-edge, was destined for failure from the outset. Disney and its associates lacked the unified strategy required to transform sports content distribution, and their ambitious promises fell apart under closer examination.

As a movie buff, I’d rephrase it like this: In the world of sports entertainment, things took an unexpected turn when the NBA rights deal that Warner Brothers had was seized by tech giants. This left Disney in a bit of a pickle, trying to stay relevant. Venu, a platform touted as a technological marvel offering immersive sports experiences, faced challenges that were as predictable as the next popcorn movie. Despite the initial buzz and financial backing, its lack of clear vision and strategic alignment ultimately led to its downfall.

As a devoted cinephile, I must admit that Venu’s downfall left an undeniable void within the sports broadcasting realm. It seemed as if a crucial piece was suddenly missing from the grand production. However, it appears that DirectTV has stepped up to fill this gap with impressive agility. Some might argue that their swift response could hint towards pre-prepared contingency plans, given the apparent flaws in Venu’s system.

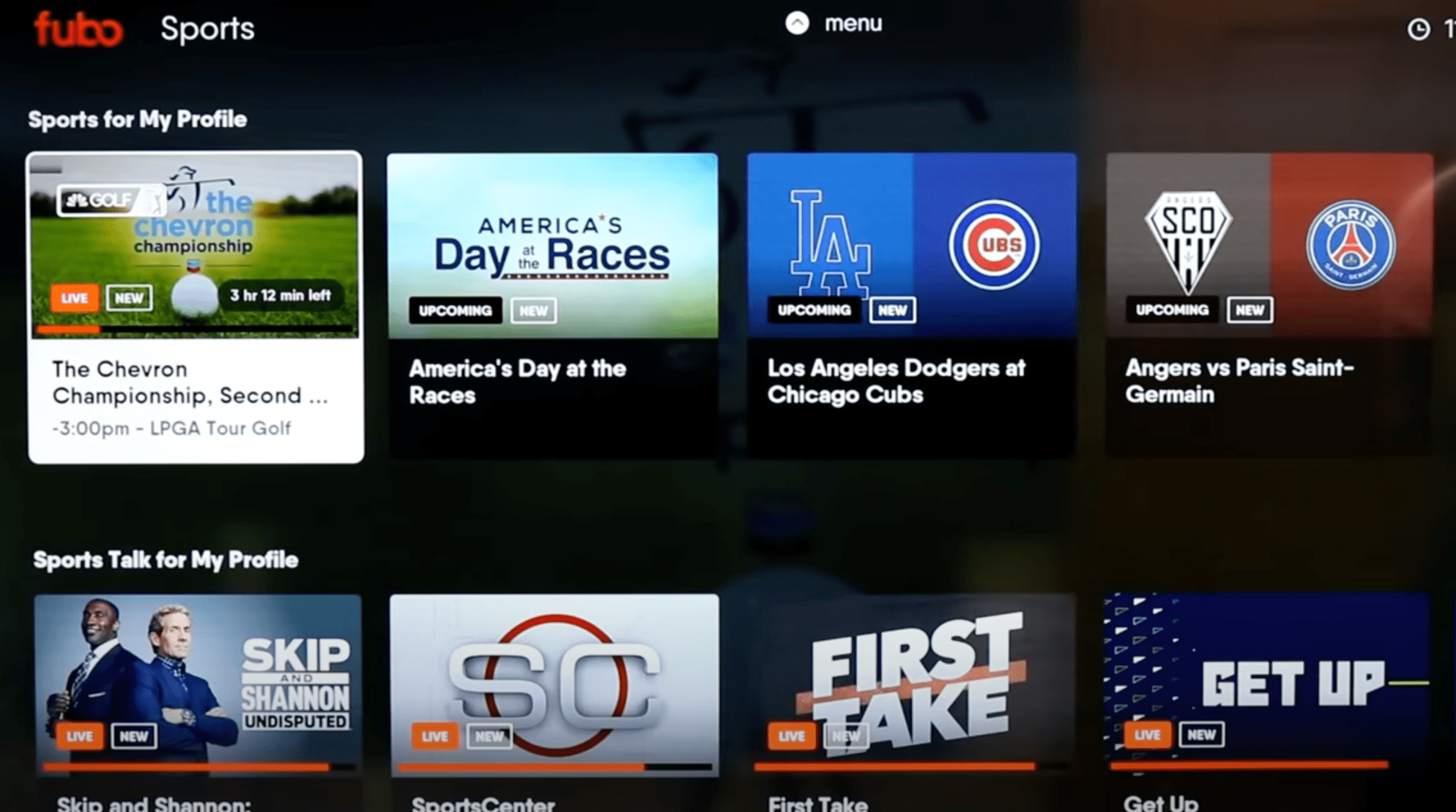

FuboTV’s Antitrust Lawsuit: A Ripple Effect of Desperation

As Venu fell, streaming service FuboTV encountered a significant hurdle: an antitrust lawsuit. A dissatisfied customer alleged that Fubo was involved in unfair business practices, adding to the intense competition in sports broadcasting. This legal action, coupled with other lawsuits from rivals, raised questions about Fubo’s future stability.

These challenges highlight a more significant concern: media companies are struggling to keep pace with how consumers behave, behavior that they unintentionally fostered. While technological progress is frequently criticized, it’s their own mistakes – such as disjointed services and overpricing – that have sparked frustration among consumers. The struggles of Venu and Fubo serve as warnings about the risks of ignoring consumer needs.

DirecTV’s MySports Package: A Strategic Response

In the midst of all the confusion, DirectTV rolled out their MySports package, providing a convenient and budget-friendly option for sports fans. Utilizing their vast distribution system and programming skills, DirectTV has established MySports as a dependable choice amidst the instability in the market.

The “skinny package” offers a broad selection of sports content, backed by advanced and user-friendly technology for smooth streaming experiences. This quick adaptation enabled DirecTV to profit from the void created by Venu’s downfall and FuboTV’s difficulties, further solidifying its standing as a trusted industry leader.

Conclusion: What’s Old is New Again

In the face of sports broadcasting industry upheavals, DirecTV’s MySports package has become a notable frontrunner. This is due to its blend of extensive sports content, robust technology, and strategic flexibility, providing sports enthusiasts with the stability they seek. Yet, in this cutthroat and fast-changing market, it’s crucial for DirecTV to stay alert to maintain its competitive advantage.

Although MySports is currently dominating, the volatile character of the industry guarantees that competitors will eventually emerge. Companies like Disney or other media titans could potentially reclaim the sports broadcasting throne. For now, DirecTV’s strategy offers optimism for fans seeking a reliable platform to watch their preferred games.

Read More

2025-01-18 21:55