This article offers an analysis of opinions about The Walt Disney Company, but please remember that it’s not intended for use as financial guidance.

Over the last ten years, Disney’s stock performance has painted a generally unfavorable picture for long-term investors when considering factors like inflation and overall market trends. Contrary to the numerous articles criticizing Tesla after an incident involving customers being scared away in just one quarter, there’s not much negativity about Disney even with a decade of decline! Despite the tendency of mainstream media to selectively present stories that fit their agenda, it’s quite remarkable that they’ve managed to remain largely positive despite losing money for such a long time. To illustrate this, let’s look at Disney’s stock performance: on April 7, 2015, the stock closed at $97.06 per share, but by April 7, 2025, it had dropped to $82.68 per share, representing a decrease of about 14.8%. However, this decline doesn’t take into account the impact of inflation over the same period, which significantly worsens the situation.

Investment values are greatly affected by inflation. From 2015 to 2025, the average annual inflation rate in the U.S. was around 2.97%. This adds up to an overall inflation of nearly 33.68% over that ten-year span. When considering Disney’s stock price from 2015 ($97.06), it would be equivalent to about $129.73 in 2025, after accounting for inflation. This means that Disney’s stock decreased by approximately 36.3% when adjusted for inflation, suggesting a considerable decrease in the actual buying power for investors over this period.

To put it simply, while the specific stock you’re discussing might be experiencing one set of trends, the broader market, symbolized by the S&P 500 Index, has displayed a completely different pattern. For instance, on April 7, 2015, the S&P 500 closed at 2,080.62. Fast forward to April 7, 2025, and the index had soared to 5,611.85. This equates to a nominal increase of around 169.7%. However, when adjusted for the inflation rate of about 33.68% over that ten-year period, the real growth of the S&P 500 amounts to roughly 102%, effectively doubling the purchasing power of an investment in the index.

These statistics emphasize the necessity of taking into account both actual returns and inflation when assessing long-term financial commitments. For instance, Disney’s share price dropped in terms of raw value as well as experienced a considerable decrease in real worth after accounting for inflation. On the other hand, the S&P 500 demonstrated impressive real growth, demonstrating the possible advantages of diversified investments across broad market segments.

Disney stock has cratered over the weekend, dipping below $80 for the first time since…. 2014…..

I’m eagerly looking forward to the potential resurgence of Disney over the coming decade, which I hope will be nothing short of spectacular. They have boundless capabilities when they wholeheartedly commit and believe in their creative talents 🌟🌟🌟

— Wallin Ballin (@wallin_ballin) April 7, 2025

Over the past ten years, numerous elements have played a role in Disney’s stock performance. The company encountered hurdles such as adjustments in consumer tastes, upheavals within the entertainment sector, and broader economic circumstances, like trade conflicts and tariff policies. For example, during early 2025, the intensifying trade disputes under the Trump administration led to market fluctuations, affecting companies with extensive international operations, including Disney.

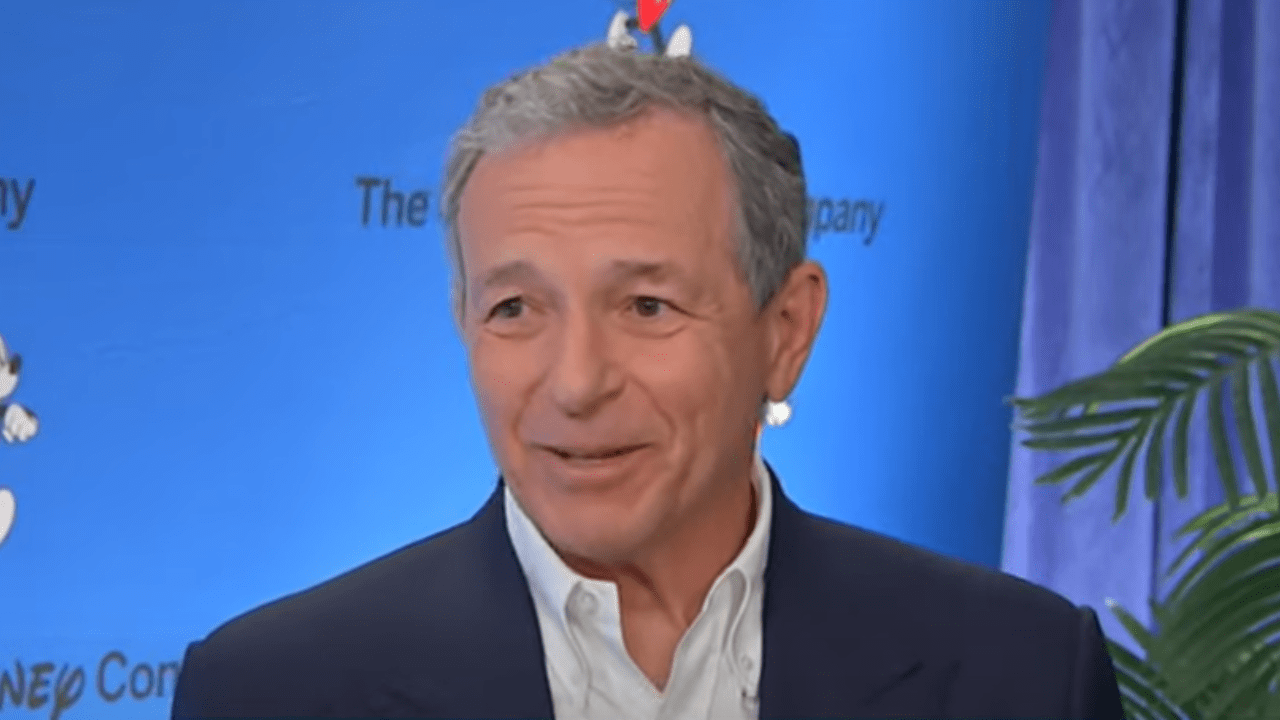

However, when we exclude the fluctuations due to tariffs, it appears that Disney didn’t make significant progress except for a specific period from 2020 to 2022, which coincided with Bob Chapek serving as CEO instead of Bob Iger.

To put it simply, after a ten-year period, considering inflation, Disney’s investment value decreased significantly, while an equal investment in the S&P 500 saw substantial growth. This contrast underscores the importance of diversification and the role macroeconomic conditions play in influencing individual stocks’ performance. As for Disney, with a new CEO on the horizon, Bob Iger has a tight window to turn things around if he wants to secure his legacy.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2025-04-07 19:56