The extraordinary Universal Studio’s Epic Universe theme park surpasses anything Disney currently offers significantly. However, speculations about Disney potentially countering this in the next five years might be nullified due to new Chinese tariffs. This potential setback could deal a severe blow to Bob Iger’s legacy.

The rising tariffs between the U.S. and China create substantial hurdles for companies such as The Walt Disney Company, particularly in terms of building and managing their domestic theme parks. The potential creation or expansion of theme park properties domestically might heavily rely on Chinese imports, which could potentially double in cost for an extended period. Despite Disney’s passive approach towards their main competitor overtaking them in Orlando without immediate action, the Magic Kingdom now confronts a potential scenario where they may not be able to react at all due to increased costs. Meanwhile, Universal Studios has strategically opened its Epic Universe theme park at an opportune moment, thereby avoiding these financial pressures.

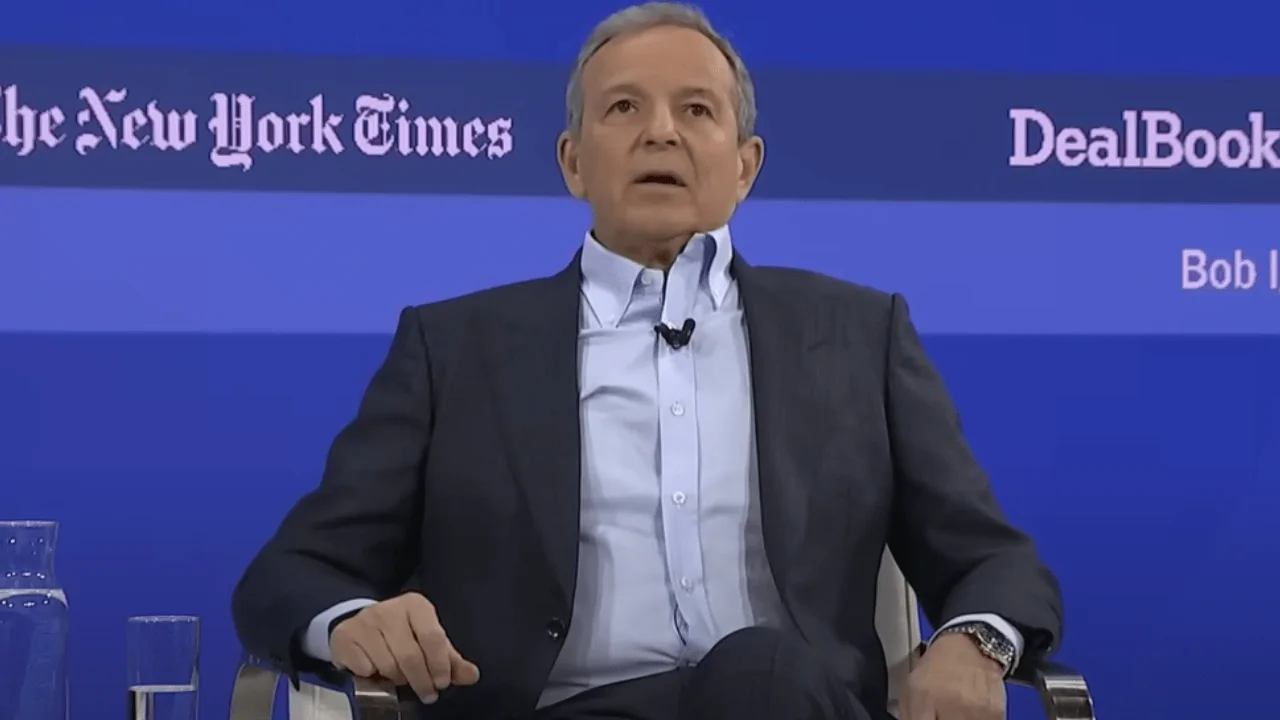

According to reports, Disney’s CEO, Bob Iger, unexpectedly addressed the ABC News team, expressing concerns over potential effects of Trump’s tariffs on their operations.

— New York Post (@nypost) April 4, 2025

Disney’s primary domestic theme parks, such as Walt Disney World and Disneyland, depend significantly on imported materials and intricate robots, a large portion of which are made in China. A rise in tariffs to 104% on Chinese goods by the U.S. government, effective April 9, 2025, has significantly increased the cost of these imports. In response, China implemented a 84% tariff on American goods starting April 10, 2025, escalating the trade dispute even further.

Disney CEO Bob Iger has voiced worries about how proposed tariffs could affect the company’s $60 billion growth initiatives for its theme parks and cruise lines. He hinted that rising costs might force a reduction or postponement of these projects, while also cautioning that increased expenses could result in higher prices for consumers. This increase could impact various aspects, including ticket prices, merchandise, and food costs within the parks.

The increased costs of materials due to tariffs are causing strain in the construction industry. This means that companies constructing factories in the U.S. are preparing for higher expenses, with some projects being postponed or abandoned. This trend indicates that Disney’s planned expansions may encounter similar financial obstacles, possibly leading to delays or increased debt. Maintaining current technology could also prove challenging for Disney, as they are having difficulties sourcing components for broken animatronics in domestic parks. One possible solution is for Disney to purchase parts for their Chinese parks from Chinese companies and then transfer them to domestic Disney parks as an internal sale. However, it’s unclear whether the U.S. government would allow such a practice. If allowed, it could alleviate existing supply issues, but new parks or expansions couldn’t use this method for procurement.

Contrarily, Universal Studios stands ready to reap advantages from the timing of its upcoming theme park, Epic Universe, set to debut on May 22, 2025. The construction of Epic Universe was largely finished before the introduction of new tariffs, thus shielding Universal from significant increases in material and equipment costs. This tactical edge empowers Universal to present affordable pricing and sustain strong profit margins, giving it a competitive edge in the market.

Had an Epic Day today

— Jay D3PO 🏴☠️ (@Drunk3po) April 6, 2025

As a film enthusiast, I’m keenly aware that the ongoing U.S.-China trade war could significantly impact the broader theme park industry. The potential rise in costs for construction materials and imported goods might force ticket price hikes, decrease spending, and potentially lower attendance rates. To counteract these challenges, theme park operators may need to reevaluate their supply chains, find new suppliers, or even explore domestic manufacturing – all of which could introduce additional expenses and logistical hurdles.

However, the application of tariffs could actually boost the financial health of domestic theme parks that have been sparingly investing in imported capital expenditure projects. In a tariff-laden environment, it becomes more affordable for families to spend domestically, making our local theme parks like Universal Studios an attractive choice! Indeed, I believe Universal Studios couldn’t have timed this better!

Additionally, unpredictable global trade regulations could discourage businesses from investing in extensive ventures, as they may hesitate to allocate significant assets under fluctuating economic circumstances. The current climate emphasizes the necessity for strategic foresight and flexibility among companies with industries deeply connected to international supply networks.

The rising tariffs between the U.S. and China pose substantial hurdles for The Walt Disney Company, possibly delaying its growth initiatives and boosting operational expenses. As Iger has hinted, the completion of cruise ships might be postponed. Now, analysts may start pondering if Disney World’s expansion projects are also under threat. At the same time, Epic is set to erode Disney’s market share steadily.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2025-04-09 18:58