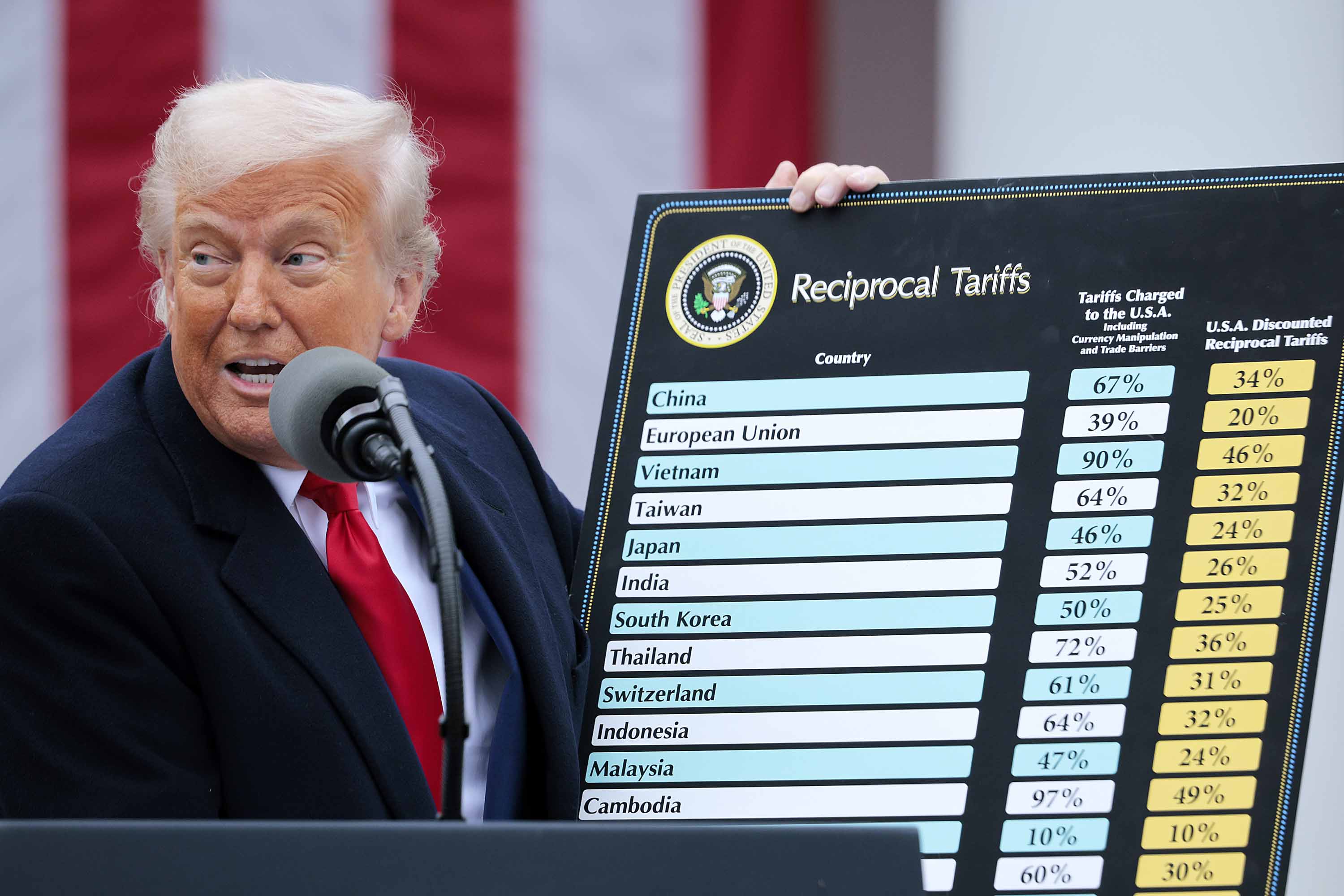

In the year 2025, tariffs became a significant focus as the Trump administration unexpectedly increased import taxes across approximately 70 nations. The objectives behind this action were threefold: fostering domestic manufacturing within the U.S., renegotiating trade deals that prioritize American interests, and generating income to compensate for tax reductions.

The technology sector has taken a significant blow, with consumer electronics such as personal computers, laptops, graphics processing units (GPUs), and gaming consoles being particularly affected. A large proportion of these items are made in China, where steep tariffs have caused either price increases or product shortages. Firms like Razer have temporarily halted shipments of new devices to the U.S., while the prices for products such as the Legion Go S and MSI Claw have risen. This underscores the difficulties that businesses and consumers are facing due to these tariffs.

For example, if the US implemented a 125% tariff on Chinese goods starting April 9th, 2025, a business importing a $1,000 laptop from China would have to pay an additional $1,250 in taxes, making the total cost of the laptop $2,250.

Instead of a laptop costing $1,000, it now retails at $2,250!

Given the tumultuous dynamics within the Trump administration, the news cycle is swiftly changing, which means this “trade war” could span days, weeks, months, or even years.

In this space, you’ll find the most recent updates regarding those tariffs and their impact on PCs, gaming, laptops, as well as notable companies such as Microsoft, HP, Dell, and others.

China slaps 84% retaliatory tariffs on US

In response to U.S. President Donald Trump’s tough tariff approach, China has retaliated by raising taxes significantly on goods imported from America, thereby intensifying the trade conflict, according to the Associated Press.

Starting April 10, tariffs on U.S. goods entering China will jump from 34% to 84%.

In response to the U.S.’s increase in tariffs on Chinese goods beyond 100% starting last night, China has stated they won’t be coerced into fulfilling American demands and are counteracting strongly. Some within the Trump administration argue that since China exports almost five times more to the U.S. than vice versa, any retaliatory tariffs would affect China more severely.

It’s speculated that if China’s economy experiences a significant decline, it could undermine Chinese President Xi Jinping’s power and potentially spark domestic upheaval.

Trump raises the stakes: Increases tariff on China to 125%

Shortly after China implemented a 84% tariff hike against the U.S., President Trump responded by raising his own tariffs to 125%.

After China increased their taxes on American goods to 84%, President Trump retaliated with a 125% tax increase on Chinese goods.

Trump asserts that the modifications take effect straightaway, owing to China’s perceived disregard for global market respect. It’s unclear if China will retaliate with further tariff hikes or engage in dialogue with the U.S. to forge a fresh agreement; both parties seem unwilling to yield at this point.

90-day pause: Everyone except China gets a break for talks

Beyond increasing the high tariff rate on China to 125%, effective straight away, President Trump also declared a temporary halt in applying tariffs for 90 days, reducing them to only 10% for any nations that have expressed interest in revising their trade deals with the United States.

Trump claims that over 75 countries are eager to engage in discussions about suspending or reconsidering the tariff hikes, as they foresee significant damage these increases could cause to numerous economies.

In positive market reaction, the S&P 500 Index has risen by more than 7%, the NASDAQ Composite has climbed by 10%, and the Dow Jones Industrial Average is almost 7% higher.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2025-04-09 22:09