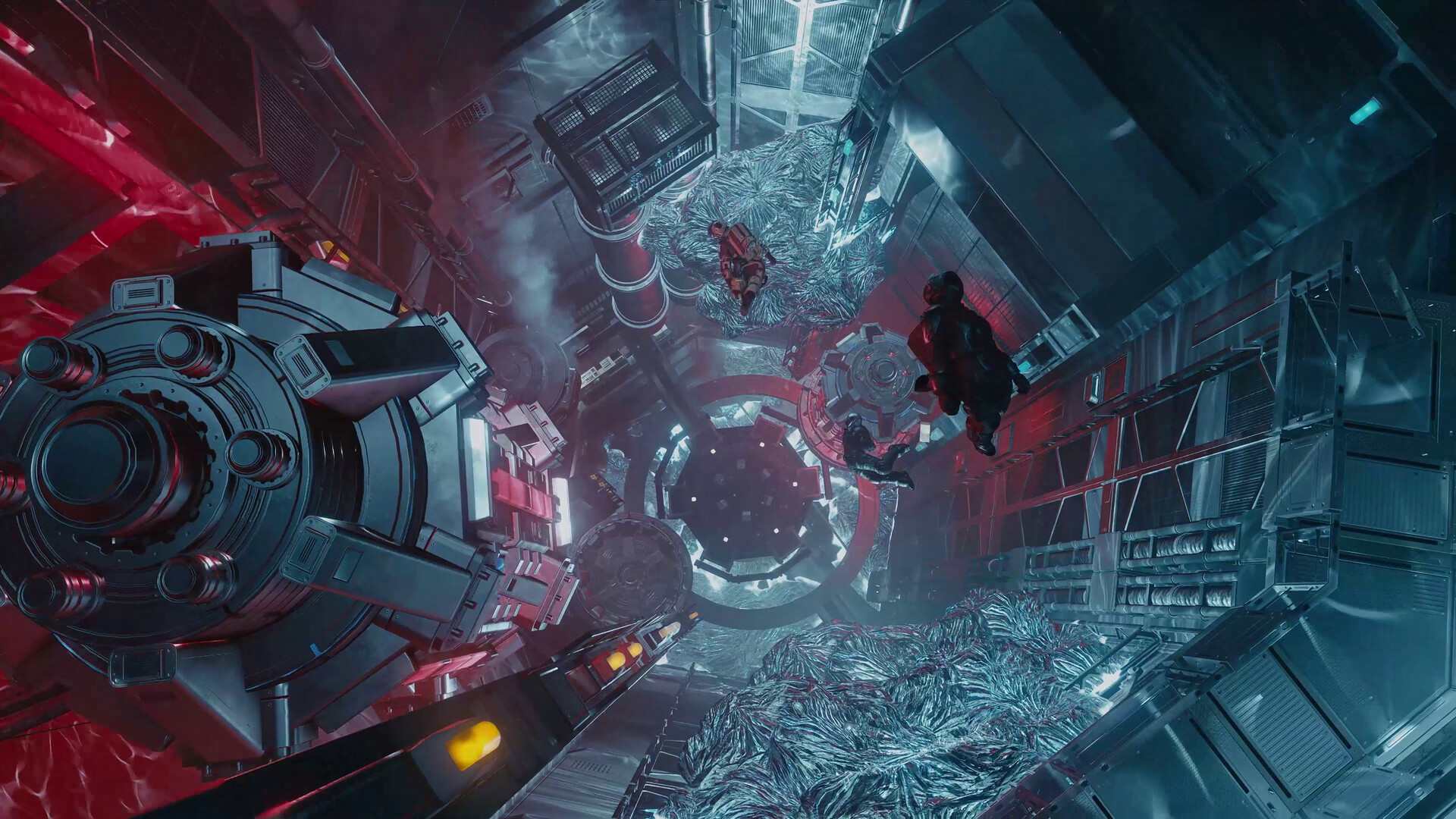

Starfield Receives Small Steam Beta Update, Bethesda Will Detail “Exciting Things” in Coming Months

After the May Update, features such as Creation Bundles, 2 GB Creations, and Low-Resolution graphics for PC were introduced. However, there’s been no news regarding the next expansion or significant updates. Previously, Bethesda expressed enthusiasm about numerous exciting plans, a sentiment they reaffirmed with this update announcement.