Top gainers and losers

Most profitable crypto: Kori (KORI), Hyperlane (HYPER), Viction (VIC), Graphite Protocol (GP), Omni Network (OMNI), REVOX (REX), Sologenic (SOLO), Mog Coin (MOG), League of Kingdoms (LOKA), MESSIER (M87).

Most profitable crypto: Kori (KORI), Hyperlane (HYPER), Viction (VIC), Graphite Protocol (GP), Omni Network (OMNI), REVOX (REX), Sologenic (SOLO), Mog Coin (MOG), League of Kingdoms (LOKA), MESSIER (M87).

Cryptocurrencies that are trading close to all time high values Fasttoken (FTN/USDT) Fasttoken rate has changed by 0.40% in the last 7 days. The difference for the last day was -0.23%. Cryptocurrency Fasttoken ranks the 63 place in the rating by capitalization. The price of FTN/USD has declined by 0.41% from the peak value on … Read more

Initially, I find myself attempting flight like Superman, yet I’m unsure how to assist others when airborne or without laser eyes. Then, Brosnahan enlightens me that heroism isn’t bound by superpowers alone. Corenswet chimes in, suggesting that external underpants might be the secret (according to him).

In the latest trailer for “The Fantastic Four: First Steps,” there’s a moment featuring a towering structure in Paris emitting a powerful energy blast toward the cosmos. A keen-eyed Reddit user has noticed this scene looks like Marvel Comics’ Ultimate Nullifier, a potent artifact used by the Ultimate Fantastic Four team on Earth-1610 to transfer residual energy from another reality’s Big Bang into the Gah Lak Tus swarm, weakening it. If the Fantastic Four in “First Steps” attempt something similar – drawing energy from another universe to combat Galactus (Ralph Ineson) – there’s a chance they might trigger an incursion event.

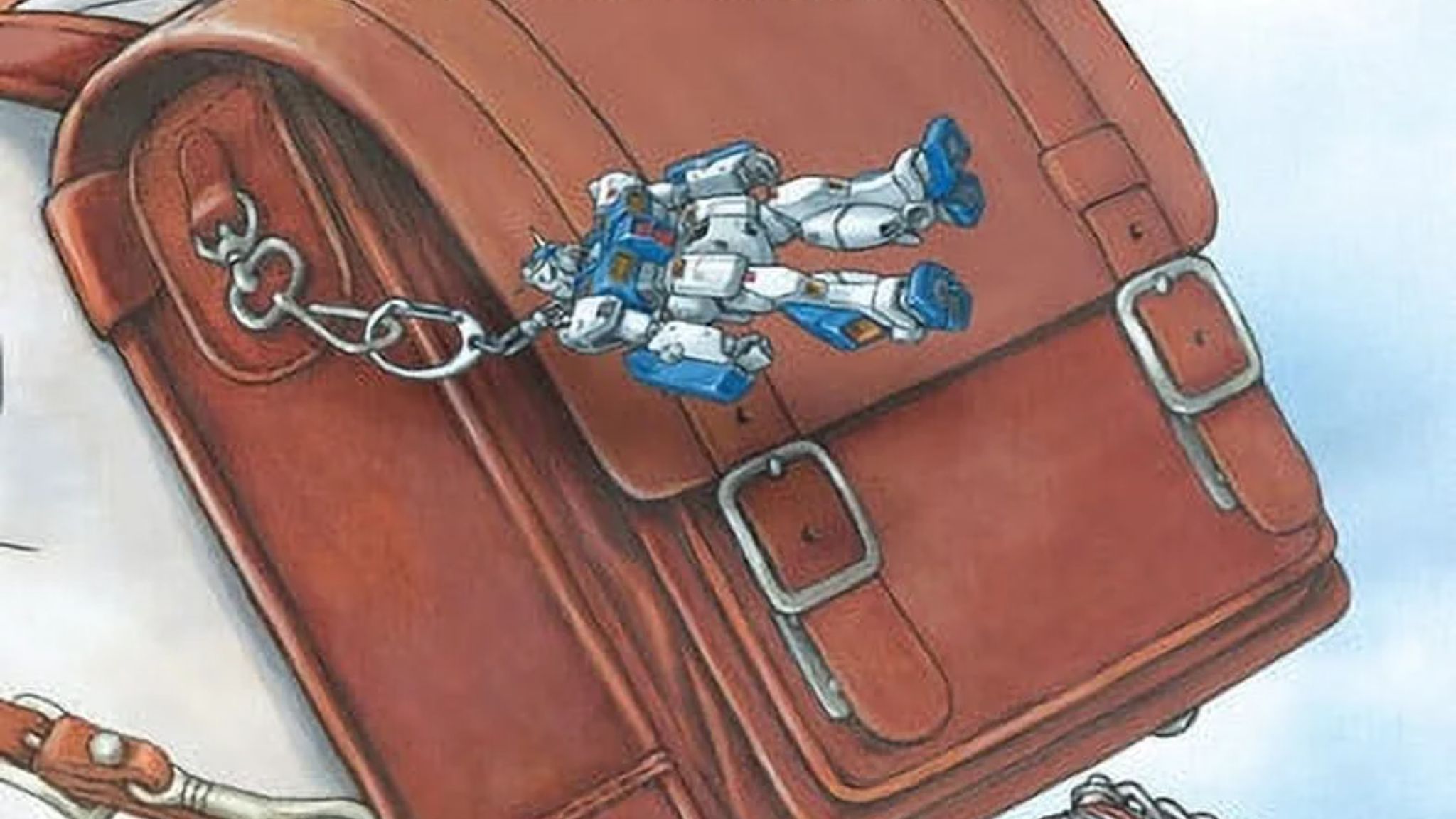

Last December, it was disclosed that the author’s liver cancer had recurred, leading him to undergo a third surgery in January. He recently shared on platform X (previously known as Twitter) that additional cancer cells were discovered in his liver. Tamakoshi is now preparing for another round of chemotherapy. Despite this, a new chapter for the “War in the Pocket” manga was published in the Gundam Ace magazine on June 26, signaling the series’ comeback for a three-chapter serialization. Tamakoshi has assured his fans on X that he is still writing manuscripts for “War in the Pocket” and another manga, “The AV Actress with One Year Left to Live,” while undergoing chemotherapy. A note within Gundam Ace indicates that he has already prepared three chapters for release.

On SmackDown, The Street Profits entered with a sense of self-assuredness, having successfully navigated through some tough competition from the Tag Team division lately. Tonight, they were set to square off against Dexter Lumis and Joe Gacy from The Wyatt Sicks in a replay of their match held in Saudi Arabia earlier. However, that previous encounter was cut short due to interference from the rest of the division.

The actress from “Outer Banks” spoke out on social media comments regarding her looks, mentioning that although she’s conscious of the chatter online, it often doesn’t have a significant impact on her self-perception.

Five years following their public split, the host of Dancing With the Stars was seen enjoying a day out on the lake with her ex-husband Brooks Laich and his expectant fiancee Katrín Tanja Davídsdóttir.

The latest news, as reported by Fightful Select, reveals that ex-IWGP Heavyweight Champion Hirooki Goto has joined the cast of the Street Fighter movie. His role will be portraying the iconic Street Fighter character, E. Honda. Although it’s not definitive, his new acting gig might have influenced his recent loss of the IWGP Heavyweight Championship to Zack Sabre Jr., potentially being a significant contributing factor.

According to a trustworthy yet not always accurate source, Nash Weedle – an insider at Nintendo – has leaked a fresh report. Keep in mind that while this individual has shown reliability in the past, they are not infallible. So, approach the information with caution.