Elden Ring Nightreign ‘Duo Expeditions’ update launches July 30

The fantasy action role-playing game Elden Ring Nightreign is currently accessible on PlayStation 5, Xbox Series, PlayStation 4, Xbox One, and personal computers using Steam.

The fantasy action role-playing game Elden Ring Nightreign is currently accessible on PlayStation 5, Xbox Series, PlayStation 4, Xbox One, and personal computers using Steam.

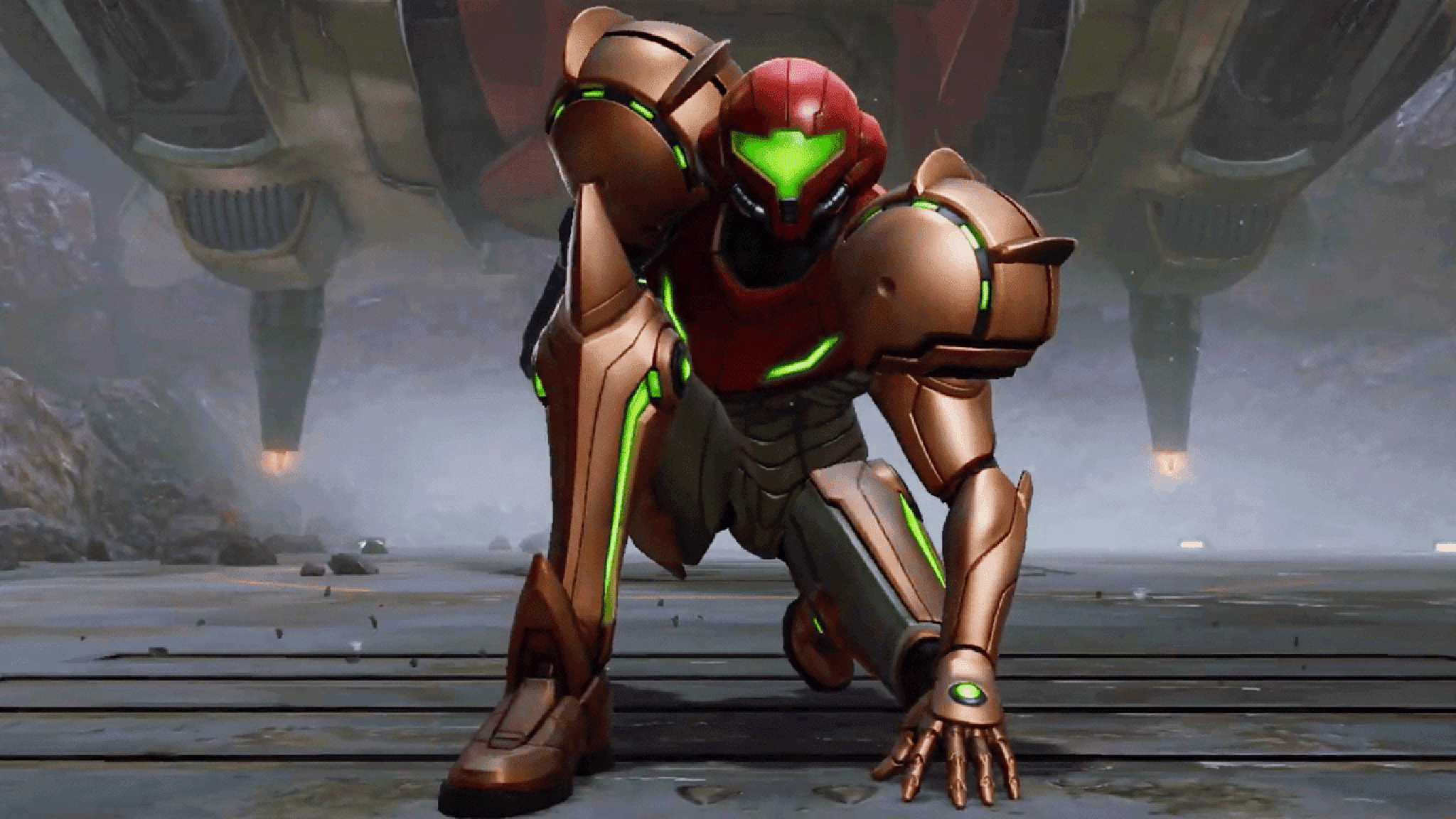

On July 25th, several sources reported that the Korean classification board has rated the upcoming Nintendo Switch 2 version of “Metroid Prime 4”. Usually, games need to reach a certain level of completion before they can receive a content rating. The appearance of these ratings often indicates that a release date announcement is close at hand. Therefore, knowing that “Metroid Prime 4” now has a rating may alleviate concerns among fans following the news about development delays.

Throughout his career, Galactus stands out as the primary antagonist for the Fantastic Four, yet his presence extends beyond this role into numerous significant plotlines throughout the years. These tales underscore why Galactus is among the most captivating figures within the Marvel Universe.

Bandai announced that the sequel will be screening in North American movie theaters this winter season. During the panel, Kensho Ono – who portrays Hathaway Noa – made an appearance to address the fans. The majority of the cast and crew are reprising their roles for the upcoming film, with Shukou Murase returning as director. The Hathaway Flash novels were penned by Yoshiyuki Tomino, the mastermind behind Gundam, and were published from 1989 to 1990. The novel serves as a continuation of the Char’s Counterattack movie, which concluded the long-running narrative between the franchise’s primary characters.

As a die-hard movie buff, it’s clear that “The Fantastic Four: First Steps” left its mark this year, outshining Marvel’s other two blockbusters on the Thursday box office charts. In comparison, “Captain America: Brave New World” earned $12 million domestically from its February preview screenings, and “Thunderbolts” managed to rake in $11.5 million in May.

Lionsgate is set to launch “The Long Walk” in September, which will feature a panel discussion at this year’s San Diego Comic-Con in Hall H. Producer Roy Lee, who worked on both “The Long Walk” and “Strange Darling,” is teaming up with Mollner and Lionsgate once more for the upcoming project.

Approximately a year back, the city-building game set in a frozen landscape was launched for PC platforms. This game has garnered positive reviews from both critics and players, earning an 85 score on Metacritic.

The fictional nation has long been the residence of the Black Panther, a role that was last fulfilled by King T’Challa (the late Chadwick Boseman) and his sister Shuri (Letitia Wright). They are set to return in next year’s Avengers: Doomsday.

As a devoted fan, I must say that this esports bracket isn’t just about competition; it’s a grand celebration of the game’s thriving community. It’s a perfect blend of intense rivalry and captivating commentary that keeps me hooked. Hercules and his crew manage to infuse high-stakes excitement with a touch of the unpredictable, concocting a unique mix of strategies, vehicles, and unexpected tactics on the battlefield. It’s not just a game – it’s an exhilarating roller coaster ride!

Frostpunk 2 first launched for PC via Steam, Epic Games Store, and GOG on September 20, 2024.