In simple terms, the world’s largest asset manager, BlackRock, has been a major supporter of initiatives promoting Diversity, Equity, and Inclusion (DEI). Previously, the company linked corporate financing and internal hiring to DEI targets, favoring companies that shared these values. But in a surprising move, BlackRock has declared it will no longer set specific workforce representation goals related to DEI. Instead, they are integrating their DEI department into a broader “Talent and Culture” unit.

Though this victory marks a significant step in combating corporate social engineering, the issue persists: is BlackRock genuinely renouncing Diversity, Equity, and Inclusion (DEI), or are they merely giving it a fresh label instead?

The End of DEI Quotas?

As per a memo distributed by Larry Fink, CEO of BlackRock, and other top executives, the company’s previous Diversity, Equity, and Inclusion (DEI) goals set to expire in 2023 will not be extended further. This move deviates from their past commitments aimed at increasing the representation of specific demographic groups within the firm. Moreover, hiring managers are no longer obligated to consider a diverse group of candidates for open positions, a practice that has faced criticism due to potential prioritization of identity over qualifications and merit.

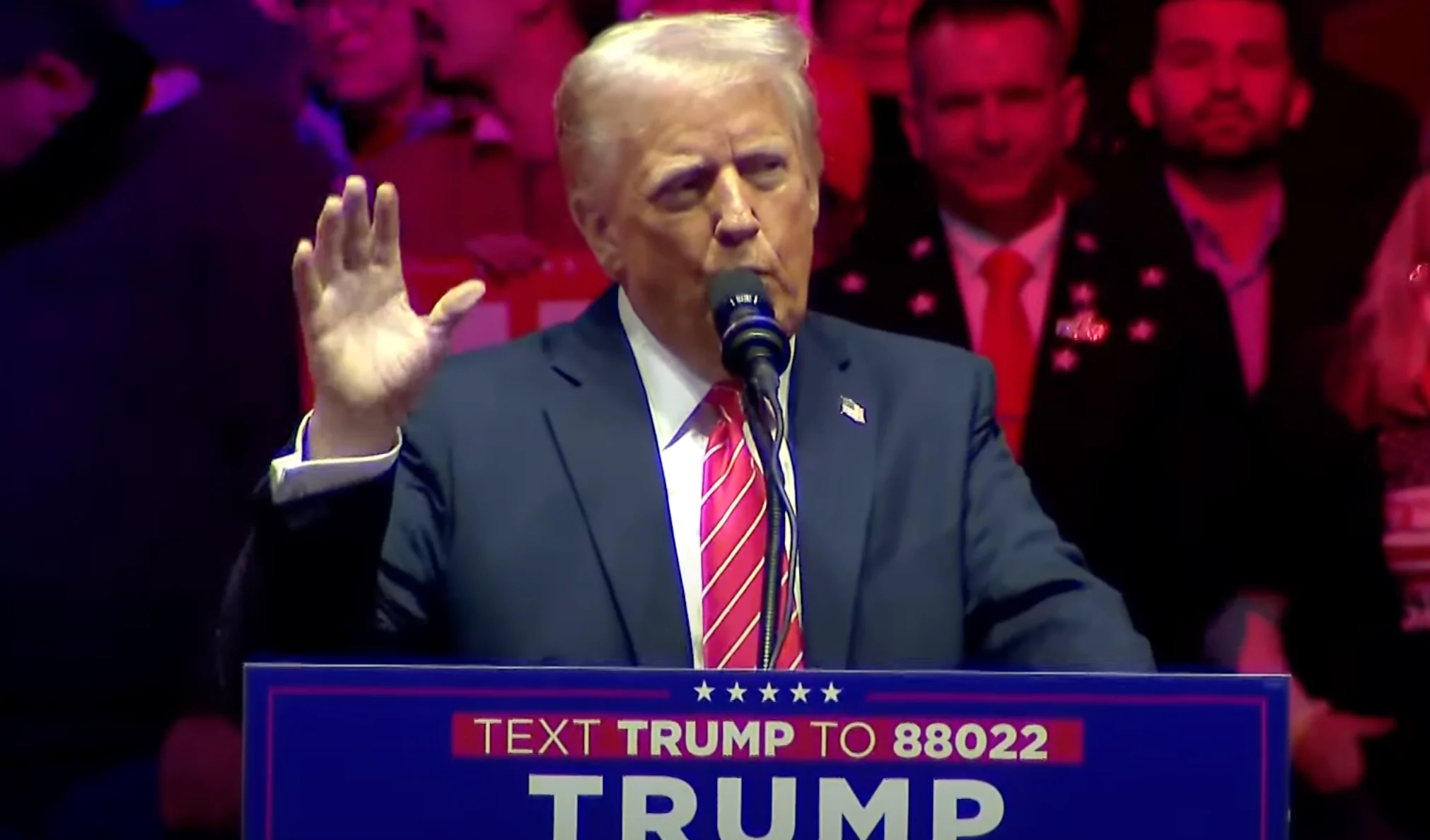

This transition takes place as part of significant modifications in the regulatory environment. After his inauguration, President Donald Trump issued a sequence of executive orders aimed at DEI programs in both public and private realms. Although parts of these orders have been contested in court, corporations such as BlackRock are proactively revising their policies to adapt.

For a long time, BlackRock has enforced its diversity, equity, and inclusion (DEI) principles by imposing financial consequences on companies that failed to meet these standards. Using its significant influence in the financial sector, it has pushed for ideological conformity. Companies often needed to focus on diversity targets to receive more favorable investment conditions under BlackRock’s Environmental, Social, and Governance (ESG) guidelines. In one instance, the terms of a credit facility offered by BlackRock were explicitly linked to achieving racial and gender diversity benchmarks.

With this new policy shift, the firm’s ability to force compliance may be fading.

A Real Change or Just a Facelift?

Although BlackRock appears to be scaling back its aggressive Diversity, Equity, and Inclusion (DEI) strategy, it’s crucial to maintain a degree of skepticism. The company hasn’t abandoned its diversity initiatives altogether; instead, it has rebranded them. Previously labeled as the DEI division, these efforts are now incorporated into a revamped “Talent and Culture” department. Important figures like Michelle Gadsden-Williams, who held a key role in DEI, continue to hold leadership positions within this new team.

Beyond this, it’s worth noting that BlackRock’s internal talent reports continue to focus on demographic considerations in their hiring and leadership processes. Although the company has taken down specific diversity statistics from its online platform, historical data indicates that their recruitment strategies have been significantly influenced by Diversity, Equity, and Inclusion (DEI) goals. Considering these points, it’s plausible to speculate that BlackRock might be covertly persisting with its past methods under a different label, similar to what companies like Disney appear to have done, in the face of public criticism.

The Broader War on Ideological Hiring

Reversing BlackRock’s diversity, equity, and inclusion (DEI) pledges marks a substantial step towards reestablishing workforces based on merit over identity. For quite some time, large corporations have opted for hiring candidates based more on their identities than their qualifications, with BlackRock being a prominent figure in this trend. However, with increasing scrutiny from regulators and politicians, the situation seems to be shifting.

Is it more likely that this change represents an honest transformation, or is it merely a tactical move designed to dodge criticism? Will BlackRock genuinely embrace meritocracy in the future, or will they continue with their existing practices under new labels?

The battle against “conscious” investment strategies isn’t entirely won yet, but BlackRock’s recent action indicates that the efforts are effective. It’s crucial for investors and the public to stay alert, as companies might only be changing their labels without actually altering the questionable practices hidden within.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2025-03-06 21:08