Top gainers and losers

Most profitable crypto: Graphite Protocol (GP), ONFA (OFT), Viction (VIC), Banana For Scale (BANANAS31), REVOX (REX), TAGGER (TAG), Build On BNB (BOB), Parcl (PRCL), Sologenic (SOLO), Treasure (MAGIC).

Most profitable crypto: Graphite Protocol (GP), ONFA (OFT), Viction (VIC), Banana For Scale (BANANAS31), REVOX (REX), TAGGER (TAG), Build On BNB (BOB), Parcl (PRCL), Sologenic (SOLO), Treasure (MAGIC).

Cryptocurrencies that are trading close to all time high values TAGGER (TAG/USDT) TAGGER rate has changed by 59.70% in the last 7 days. The difference for the last day was 31.20%. Cryptocurrency TAGGER ranks the 661 place in the rating by capitalization. The price of TAG/USD has declined by 1.43% from the peak value on … Read more

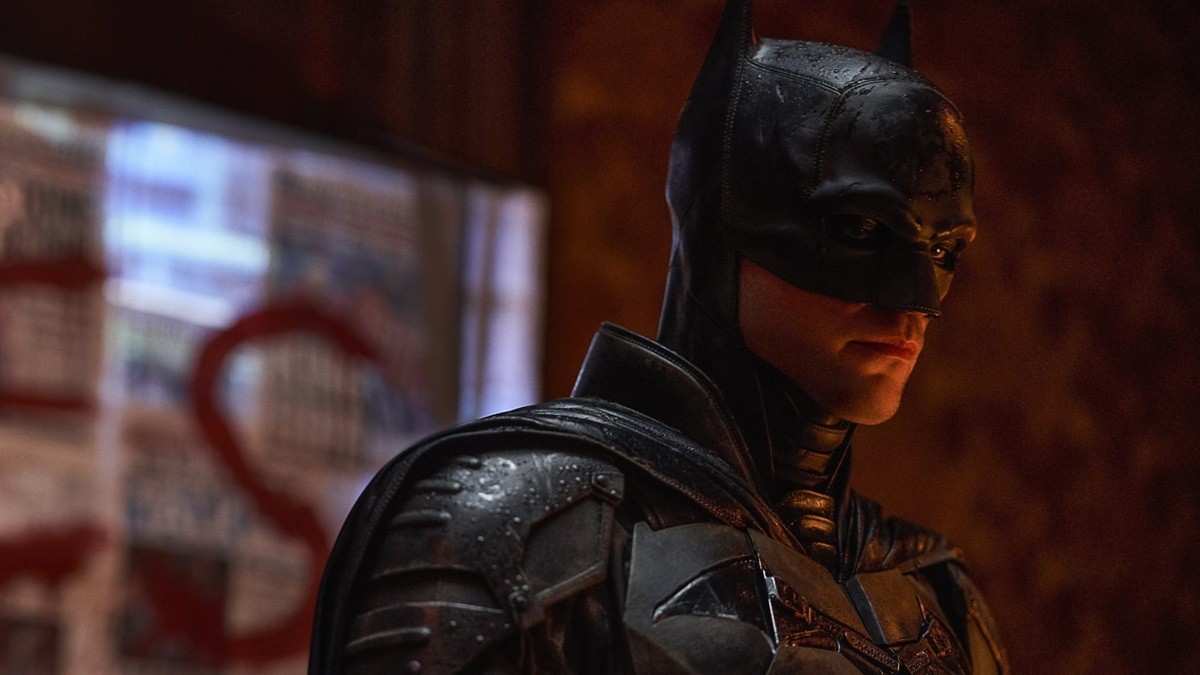

As a cinephile, I’ve got some exciting news! HBO Max is streaming some top-tier films according to FlixPatrol, like Sinners and A Minecraft Movie, with Batman Ninja vs. Yakuza League following closely. This isn’t just any Batman movie; it’s the second installment in the Batman Ninja series, a spin-off that started with the original Batman Ninja back in 2018. The first film saw our Dark Knight transported to Feudal Japan due to some time displacement shenanigans, and this sequel finds him and his allies trying to navigate their way back to the present. However, they soon discover that things have undergone a significant transformation since their departure.

No, Robert Pattinson’s Batman is not in Superman.

Previously seen on “The Real Housewives of Atlanta,” this reality star’s pursuit of physical perfection was furthered in the debut episode of TopMob’s latest show, “Botched Presents: A Look Back at Plastic Surgery.

Initially, comic books served as the primary source for all things related to superheroes, while movies, shows, and cartoons were occasional treats. However, over time, the situation has reversed due to the surge of superhero films. This leads us to ponder: have these movies diminished the charm of comic books? The truth is, it’s not that straightforward.

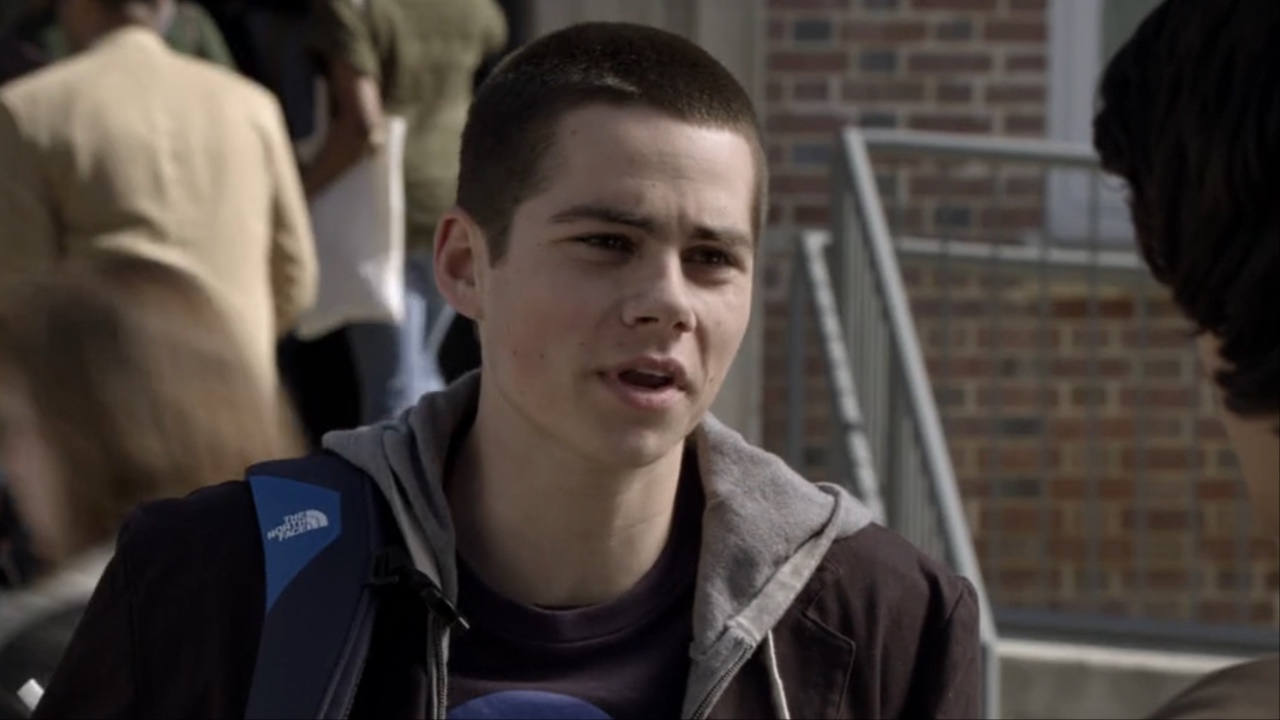

In a career that spans many years and includes significant roles like leading the Maze Runner series and starring in Taylor Swift’s “All Too Well” short film, Stiles had his first major credit in O’Brien’s project before these accomplishments. Despite not appearing in the Teen Wolf movie, he reminisced about Stiles to EW, sharing that there’s a specific aspect of this character he has carried forward into every role since then. He stated:

Marvel Studios has now put out a total of 36 movies in theaters, and these films form five connected story arcs that started with the release of Iron Man in 2008. The fifth phase is currently unfolding, and it’s slated to conclude on Disney+ with the movie Ironheart. This upcoming film has sparked a variety of responses online after early screenings were shown.

On July 8, a heartwarming photograph was shared by Milo Ventimiglia’s wife, Jarah Mariano, showing the This Is Us alum spending quality time with their 5-month-old daughter, Ke’ala Ventimiglia. In the picture, Milo is seen holding his baby girl while pointing to a leaf on a tree, capturing Ke’ala’s attention and curiosity.

On July 9, it was revealed that the brother of Nicola Peltz Beckham, aged 39, and the daughter of the late Quincy Jones, aged 32, are now engaged.)