Michael C. Hall Reveals Shocking Secrets Behind Dexter’s Unstoppable Return!

Over the past five years, the captivating drama has experienced a revival, mirroring the resilience of its lead character when confronted with impending doom.

Over the past five years, the captivating drama has experienced a revival, mirroring the resilience of its lead character when confronted with impending doom.

20th Century Studios is working on a fresh film adaptation of the humorous TV show where objects inside a museum mysteriously spring to life. The production company, 21 Laps Entertainment, has recruited Tripper Clancy, the writer behind the movie “Stuber”, to pen the screenplay for this project.

31 years after the passing of the ‘Sweatin’ to the Oldies’ instructor in his residence in Beverly Hills, a day following his 76th birthday, his long-time housekeeper, who lived with him for over three decades, is now sharing insights into their unusual relationship dynamics.

Currently, Nintendo’s application provides daily news tailored to your preferences. You can personalize the main screen and calendar with your preferred Nintendo theme such as Animal Crossing, Mario, or Zelda. The app will soon introduce additional features to ensure enthusiasts are always informed about the latest updates from Nintendo.

More recently, Chris Condon’s ongoing series has seen a resurgence of political themes in the Green Arrow stories. Drawing inspiration from Oliver Queen’s past, Condon has delicately woven back Oliver’s mistrust towards those in power and his connection with Star City’s police force. Once more, Oliver recognizes that no one else is protecting the city’s downtrodden areas, prompting him to stand up for the oppressed. The latest story arc concluded with Oliver using his own fortune to assist the Freshwater community, positioning himself as a people’s billionaire by performing heroic deeds both in and out of costume. Given the relevance and character-fitting nature of this development for Green Arrow, it is puzzling why DC Comics isn’t capitalizing more on this iconic hero. The reasons are multifarious.

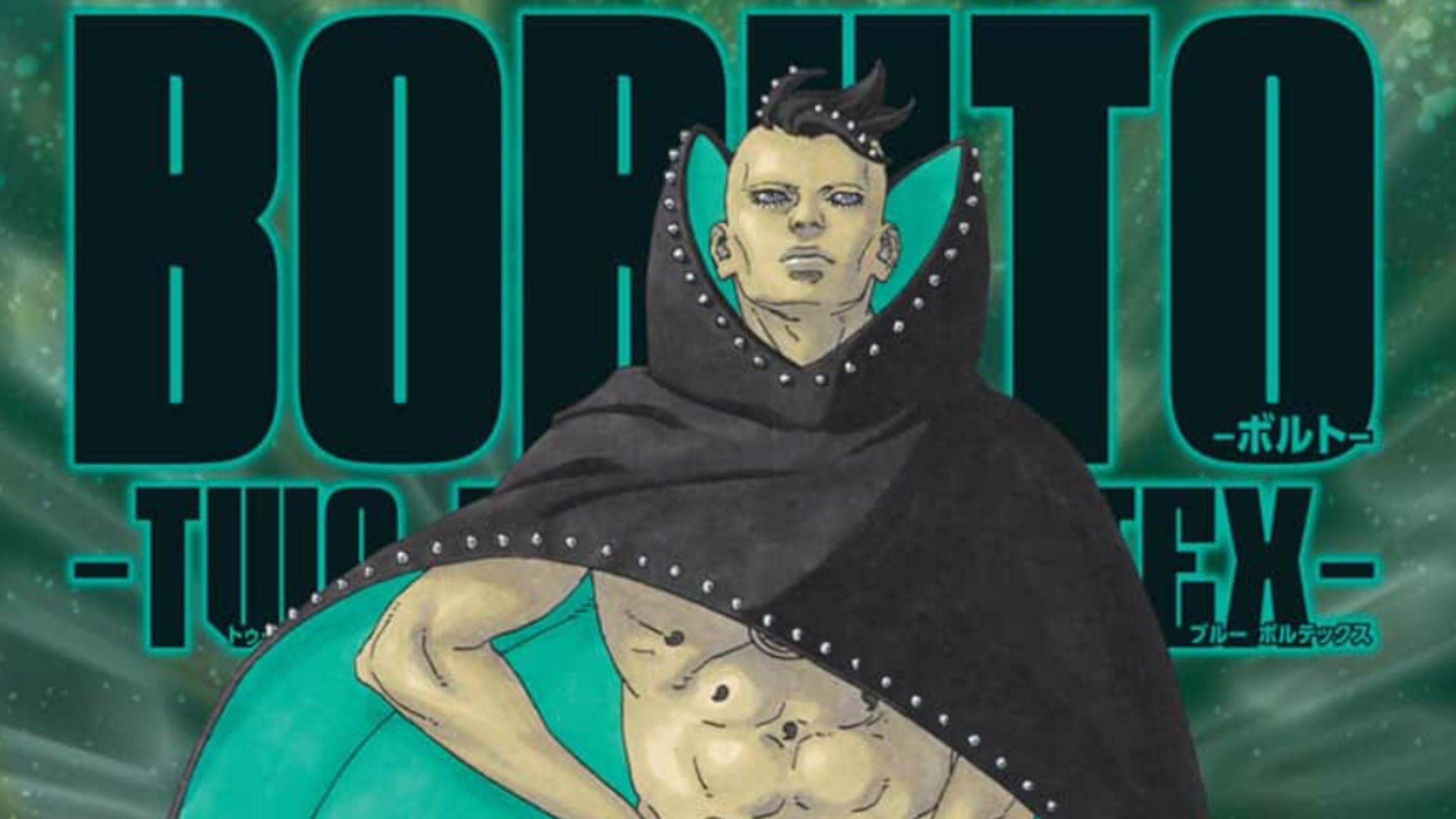

One week and two days prior to the official release, a sneak preview of Chapter 23 in the series Boruto: Two Blue Vortex has been disclosed. In this early look, we witness Kawaki attacking Jura violently; his arm is destroyed by Kawaki’s staff, followed by a stab in the chest. This unprecedented turn of events for Jura, who has previously demonstrated an ability to hold his own against formidable characters such as Code, Boruto, and Himawari, raises curiosity about how he will respond to this opponent who clearly surpasses him in power. The upcoming chapters promise to reveal the course of their battle and Jura’s strategies for defense and retaliation.

Prepare, Science SARU enthusiasts! The captivating series “Dandadan” is set to debut on Toonami, airing on July 26th at 12:30 AM Eastern time. This series, filled with supernatural and extraterrestrial exploits featuring Momo and Okarun, will be positioned between popular shonen shows like “Dragon Ball Daima” and “Bleach: Thousand-Year Blood War”. As new episodes will be released weekly, it seems that only season one will air initially. However, with the second season currently streaming on Crunchyroll and Netflix, now is an excellent time to catch up if you haven’t yet. If you want to keep up with this anime sensation, Cartoon Network could be your go-to platform.

A popular discussion on the PlayStation Plus Reddit forum centers around identifying the most underrated game available through the service for both PS4 and PS5 users. While numerous games are suggested, two titles have attracted significant attention, with one receiving a remarkable 400 votes! In comparison, other games mentioned receive no more than a few dozen votes. Consequently, it’s clear that Killer Frequency, the game with 400 votes up, is an exceptional find among the PlayStation Plus free games, according to this online community.

For the first time ever, during the Developer Direct for Sea of Thieves, it was announced that the most significant aspect of the upcoming update will be the integration of Custom Servers. This feature is set to debut in early 2026 as part of a new subscription plan and offers additional perks. With this addition, players can create their own tailored servers complete with various settings, commands, and cinematic camera options. This empowers players to populate their customized “Safer Seas” servers with friends and engage in activities at their leisure, all while earning rewards.

In such a way, Rachel Brosnahan (playing Superman), confessed during a pre-production breakfast with costar David Corenswet (portraying Clark Kent), that when they first sat down, she was taken aback by the enormous amount of food laid out for her character.