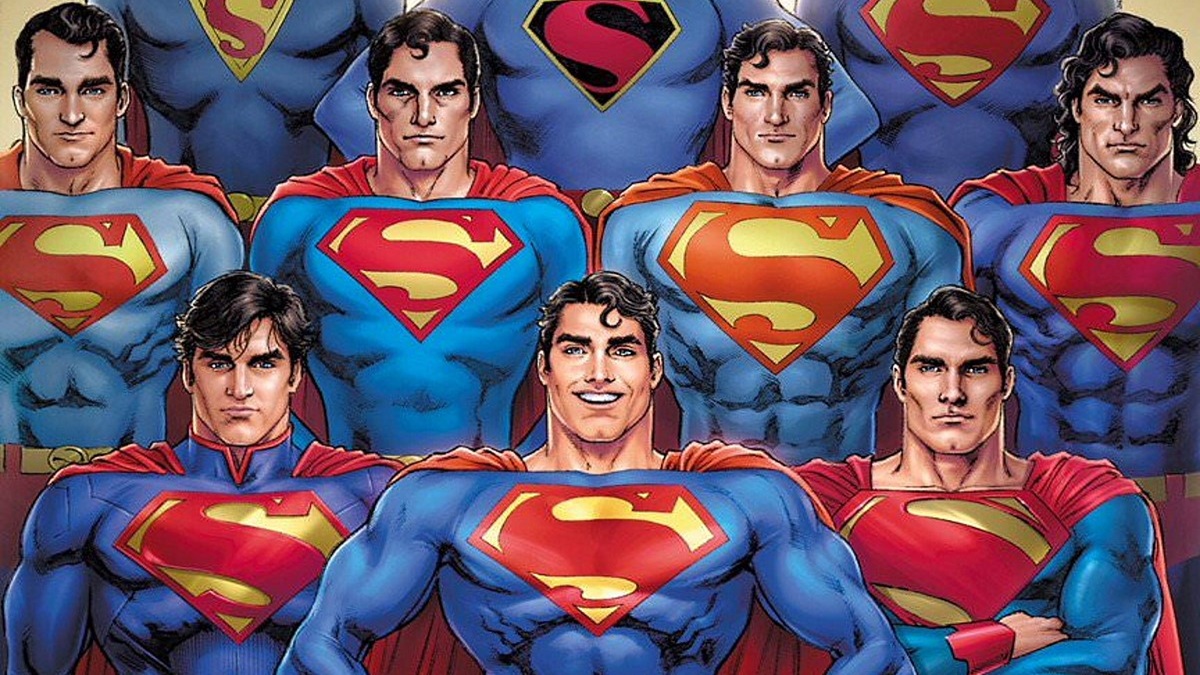

The Best Superman Costumes in Comics, Ranked

This new take on Superman’s suit is quite unusual yet surprisingly effective. Instead of the traditional design, it presents a striking departure yet retains an uncanny familiarity that makes it work flawlessly. Gone are Clark’s cape, shorts, and long sleeves, replaced by this streamlined redesign featuring gloves and a striking black shield emblem on the chest. The unusual military-inspired design, blended with remnants of the classic look for the Man of Steel, imparts an aura of authority and power that resonates with anyone who lays eyes on it. This suit harks back to iconic and cherished designs like the one from “Kingdom Come,” while still maintaining a contemporary and practical feel. In my opinion, it ranks among the best Superman suits available today.