The idea that China might block American movies is making headlines, but the financial ramifications for Hollywood wouldn’t be as severe today as they once were.

Over time, China’s impact on Hollywood’s financial success has gradually decreased, a fact that was once a significant concern for studios but is now merely a passing news item. The data supports this trend; China no longer holds the influence it once did.

Trump Resets the Global Playing Field

This week, President Trump unveiled a revised tariff system, altering America’s approach towards international trade. Starting now, the majority of imports will be subject to a uniform 10% charge, serving as an initial step within a 90-day period for renegotiating trade deals.

Despite this, China experienced significant impacts – a 125% import tax was imposed on all goods coming into the U.S., starting from April 9.

Beijing has responded by imposing tariffs on U.S. goods, and state-affiliated media have suggested potential retaliation in the form of cultural limitations – such as taking American films out of Chinese cinemas.

A decade back, a decision like this could’ve caused ripples throughout the sector. By 2025, though, a more cautious apprehension rather than fear seems appropriate—and a popular graph provides insights as to why.

Alan Ng’s Box Office Breakdown Tells the Real Story

Alan Ng, who serves as the Editor-in-Chief at Film Threat, has put together an insightful graphic using statistical data to illustrate the China-Hollywood partnership in a clear and revealing manner.

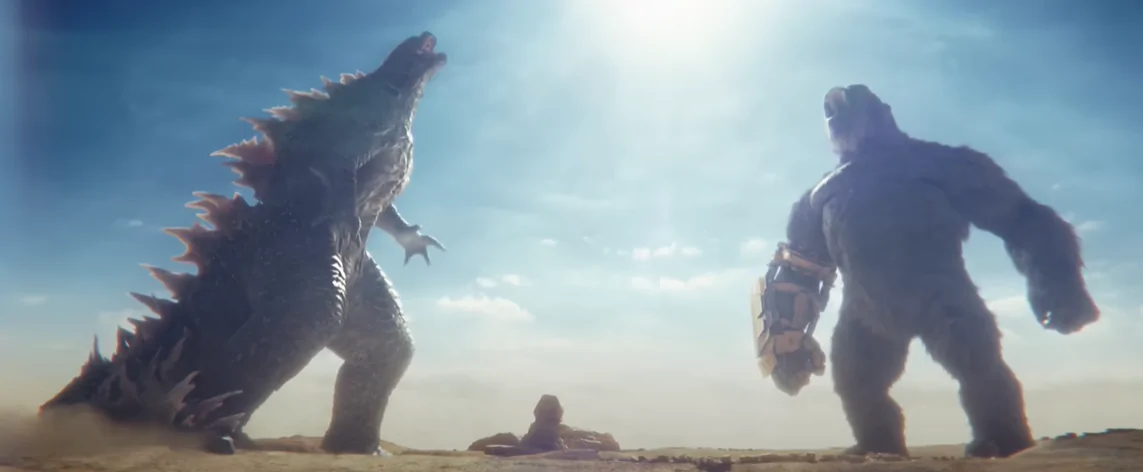

It appears I made some errors with the China box office figures. Here’s a revised version of the chart. Godzilla has surpassed all other American films in terms of performance. Only Avatar and Jurassic Park are expected to secure victories at the Chinese box office this year.

— Alan Ng @ Film Threat (@mypalal) April 10, 2025

Last year’s top 10 American films, such as Deadpool and Wolverine, the sequels of Moana, Dune, and Inside Out, were followed in terms of their Chinese box office earnings. These figures were then contrasted with each movie’s overall global revenue.

His findings were definitive:

- Combined global box office: $8.86 billion

- Combined China earnings: $429 million (just 5% of total)

- Studio take-home after China’s revenue split: $107.3 million total

Across the entire collection of ten movies, the total revenue amounts to $107 million. This money is divided among Disney, Universal, Warner Bros., and Paramount. If a China-Hollywood ban were enforced, these studios could potentially lose this amount collectively from future movie sales in China.

Several films earned so little in China, they barely register:

- Wicked: $2.1 million

- Sonic 3: $6 million

- Moana 2: $15 million

- Mufasa: $16 million

In contrast to most films, only the movie “Godzilla vs. Kong” managed to make a significant impact, earning $134 million in Chinese cinemas. However, this contribution represented only 23% of its overall global earnings, and it’s important to note that such success is more of an exception rather than the norm.

Hollywood Still Bows to Beijing—Even as the Numbers Fade

In contrast to the diminishing importance of Chinese markets for American film studios, Hollywood continues its efforts to cater to Chinese audiences.

During the 2010s and up until the mid-2020s, American production companies frequently adjusted their content, revised advertising, and deleted politically controversial aspects, not for financial gain, but due to apprehension about being banned from the Chinese market.

To be honest, that conduct persists. Surprisingly enough, it’s still prevalent despite the fact that Chinese viewers are turning more towards domestic movies instead of imports.

Disney remains the clearest example:

- In 2020, Mulan was filmed in Xinjiang, and the credits openly thanked Chinese regional authorities, including those linked to global controversy.

- Black Panther’s promotional art masked Chadwick Boseman entirely in the Chinese market despite the same poster showing his face everywhere esle.

- Star Wars minimized John Boyega’s character on Chinese posters, reducing one of the film’s leads to the background.

The direction has not changed; in fact, only this previous year, production studios have been modifying trailers, trimming sequences, and inserting dialogues specifically to comply with China’s censorship regulations. However, it’s worth noting that the majority of these films garnered less than 5% of their overall earnings from China.

Black Panther isn’t going to do well in China.

— Ian Miles Cheong (@stillgray) January 30, 2018

In my perspective, Hollywood continues to seek validation from a nation that no longer guarantees blockbuster revenues, which suggests a more profound predicament: the overarching influence of fear over strategic decision-making.

Despite data indicating decreasing benefits, the industry’s stance remains unaltered. It persists in sacrificing creative choices for a market that has minimal impact on a global scale.

A Ban Now Would Be Symbolic, Not Substantial

If China decides to prohibit American movies, it’s more about sending a message than affecting the financial aspect significantly. Essentially, it signifies a cultural rift, not a significant economic setback for the U.S. movie industry. The U.S. media may exaggerate this as a substantial problem that harms the American film industry, but the facts don’t back up such an assertion.

In simple terms, if a ban were imposed on Chinese markets for Hollywood movies, it would only affect a minor portion of the revenue coming from an industry that’s already facing difficulties. The current box office data indicates that most films earn less than 6% of their global income in China, with many falling below the 1% mark.

Alan Ng’s Work Clarifies the Shift

Ng’s diagram now offers the most lucid overview of the evolving situation. It challenges the conventional notion of China serving as a financial backbone for Hollywood, effectively breaking down this long-held narrative.

The findings of his research reveal not only that the financial impact is smaller than previously believed, but also that many assumptions within the industry are now obsolete. For quite some time, executives have considered access to China as an indispensable requirement. However, today it’s more of a valuable opportunity—and one whose worth is rapidly diminishing. Contrary to popular belief in the media, a ban on Hollywood in China will not bring about the collapse of the film industry.

Ng’s input underscores for both studios and viewers that figures can’t deceive. The current data, however, seems to lead us to a single inference.

Losing China isn’t a crisis—it’s a rounding error.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

2025-04-10 19:57