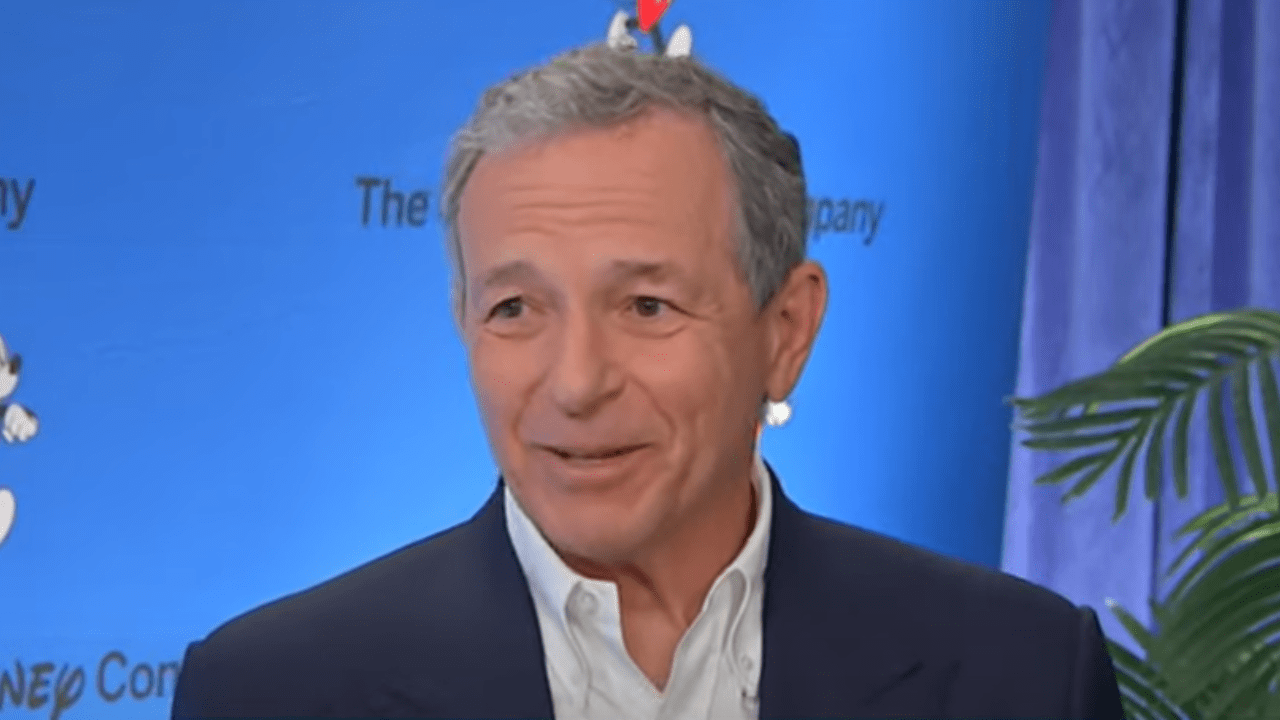

The CEO of Walt Disney Company, Bob Iger, has voiced concerns about the potential impacts of recently enacted tariffs from President Trump’s administration during an unexpected meeting at ABC News. In a straightforward and unguarded manner, he warned about the possible repercussions of what is being referred to as “Liberation Day” tariffs – a broad policy that imposes a 10% uniform tariff on all imports, with heavier taxes especially on significant trading partners.

Starting from April 5, 2025, the U.S. imposed a 10% tax on imported goods. On April 9, 2025, a second wave of higher “reciprocal” tariffs will take effect, with an additional 34% on Chinese imports (making it 44% in total). President Trump has warned that if China does not withdraw its countermeasures, he might impose an extra 50%, bringing the total to a potentially shocking 94%.

Robert Iger expressed a significant worry about potential implications for Disney and the American economy, stating that swiftly moving overseas manufacturing back to the U.S. was impractical due to the specialized labor required. Citing Apple’s Foxconn factories in China as an example, he suggested it would be highly challenging to replicate those conditions domestically in the near future.

During the meeting, it was reported to CNN’s Oliver Darcy by those present that Iger seemed to be encouraging ABC News to clarify certain matters for the public, pointing out that most people in America struggle to grasp the concept of tariffs. He cautioned about potential repercussions affecting Disney’s numerous divisions, emphasizing Disney Cruise Line as a sector particularly at risk due to its heavy use of imported steel for shipbuilding. Iger went so far as to propose that increasing expenses might compel the company to reduce future investment plans.

Although Iger’s worries might be valid, his remarks also spark some doubts. For instance, Disney Cruise Line (DCL), the sector he specifically pointed out, might not be as exposed to risks as it seems. Given that most Disney ships are constructed in Europe and registered in the Bahamas, they are exempt from U.S. import tariffs. Consequently, DCL could potentially attract more investment due to its global flexibility and supply chain network.

On the flip side, Disney’s domestic theme parks, such as Walt Disney World and Disneyland, face greater exposure compared to their counterparts. Construction of these theme parks heavily depends on imported ride systems and raw materials, a significant portion of which originate from European manufacturers. With the implementation of new tariffs, these costs are expected to surge significantly, potentially adding strain to projects that are already under review.

It’s important to mention that Disney has reduced its investment plans in recent times, leading to the postponement or cancellation of several projects such as the Play Pavilion, Reflections resort, an upgrade for Spaceship Earth, and the expansion of Cherry Tree Lane in EPCOT. Some of these were delayed due to the global health crisis, while others have been quietly abandoned without any official announcement. It appears that Disney often uses external crises, like the current tariff situation, as a reason to make cuts.

Essentially, a significant portion of Disney’s grand $60 billion, 10-year investment plan hasn’t been realized yet. Projects like Villains Land, Cars Land, and Monstropolis are still in their early stages of development. Given the increase in the cost of imported components, Disney might choose to secretly postpone or reduce the scale of these projects, all while citing economic instability as the reason. This strategy would enable them to save money without giving the impression that the company is reneging on its public commitments.

It’s worth mentioning that the expansions in both the Magic Kingdom and Disney’s Hollywood Studios have been controversial undertakings that have sparked significant disagreement within the Disney fan community. These projects may involve the demolition of cherished attractions such as MuppetVision 3D and the Rivers of America, which might explain why some people suspect that tariffs could be giving Disney a convenient way out to avoid implementing unpopular changes without openly acknowledging any wrongdoing.

This strategy isn’t entirely novel; during the worldwide health crisis of 2020, Disney opted to trim details and scale from various ongoing projects like EPCOT’s World Celebration. In some instances, they chose to halt construction indefinitely on certain venues, essentially preserving them as is to reduce operational costs, akin to mothballing these spaces.

As a movie critic, I’m keeping a keen eye on the current situation unfolding with Disney and the imposed tariffs. Bob Iger’s recent statements suggest that there’s growing unease within the company. The real conundrum lies in determining whether these tariffs are merely temporary setbacks or cleverly disguised pretexts for decisions Disney was already gearing up to take.

It’s clear that everyone – fans, investors, and analysts – will be keeping a close eye on Disney’s actions. If they choose to delay or reduce their domestic plans due to tariffs, the focus might shift from external economic challenges to an internal strategic pullback. The upcoming months will reveal the truth.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-04-08 23:59