Electronic Arts (EA) is grappling with a significant financial predicament following an unprecedented plunge in its stock value by almost 20%. This decline was triggered after the company openly acknowledged that their games, “Dragon Age: The Veilguard” and “EA Sports FC 25”, have not been successful. This double failure has sent ripples of concern across the gaming industry, prompting investors to respond immediately and negatively to EA’s revised revenue expectations for the current fiscal year.

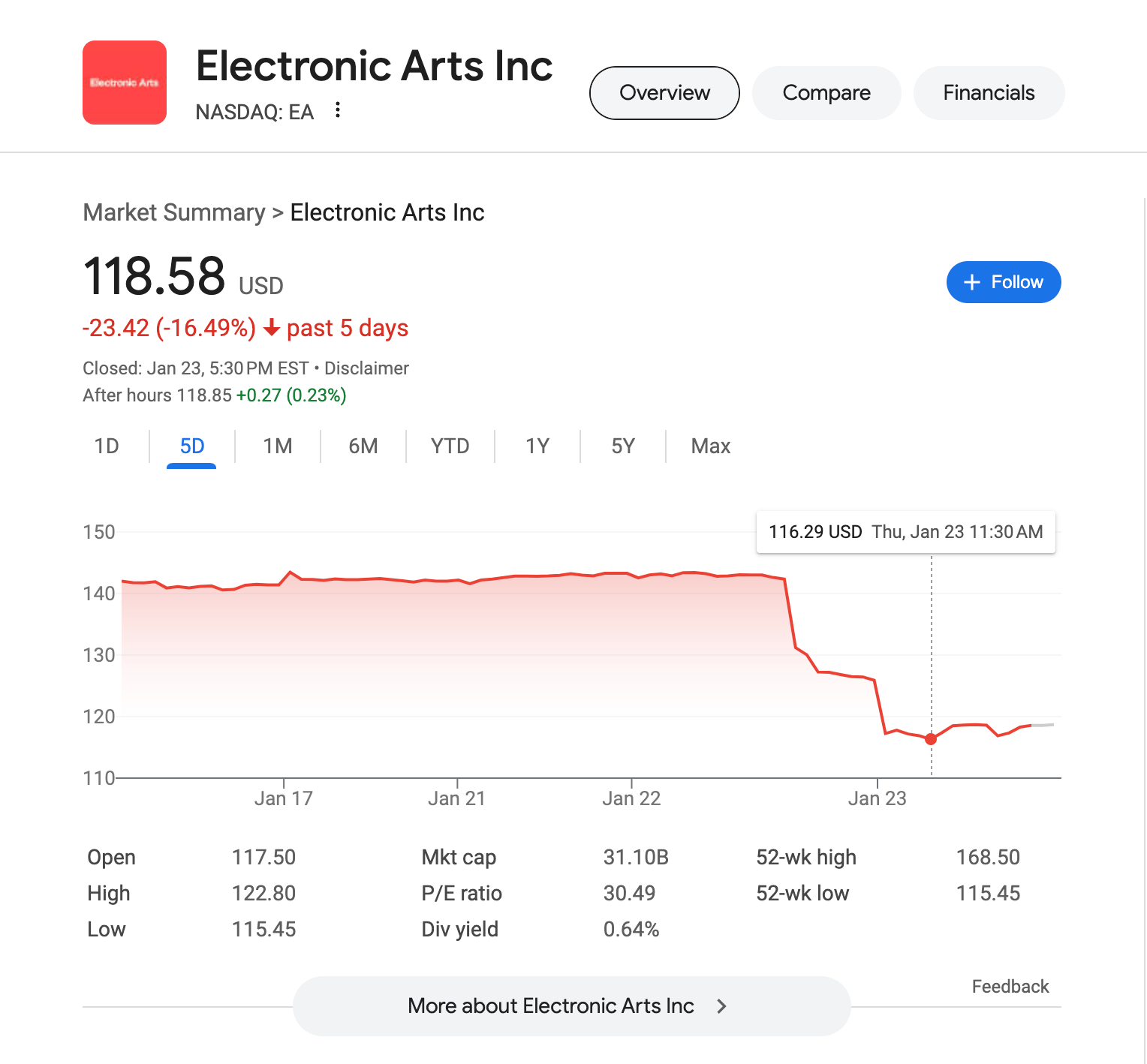

Since this past week, EA’s stock has experienced a significant drop. On January 22nd alone, it fell from $142.35 to $125.90. Today, the descent persisted, reaching an intraday low of $116.29 but subsequently recovering slightly to its current price of $118.58. These figures represent a substantial setback for a company that was once considered a bedrock of stability within the gaming sector.

The situation facing EA today could have been prevented, according to many, due to what they perceive as poor management within BioWare and an overemphasis on diversity, equity, and inclusion initiatives across the company, which some argue are contributing factors to its difficulties.

The highly anticipated role-playing game title “Dragon Age: Veilguard” didn’t live up to the hype, falling significantly short of projected sales figures. Initially predicted to sell 3 million copies upon release and an impressive 10 million in total during its lifespan, the game had managed to captivate just 1.5 million players by December 31, 2024.

The issues don’t stop at that point. The rebranded follow-up of EA Sports’ FIFA franchise, known as EA Sports FC 25, has also struggled. A significant drop in sales during the holiday season further complicated the company’s financial difficulties, leading to a reduction in its projected annual revenue by hundreds of millions of dollars.

The current state at BioWare is quite concerning. Known for creating classics such as Dragon Age: Origins, Jade Empire, and Mass Effect, the studio now seems to be a mere shadow of its past glory. Rumors from Smash JT and Grummz hint that BioWare’s Edmonton office could potentially face closure. It is alleged that EA is planning to close the studio as part of wider cost-reduction strategies.

In a notable change, The Veilguard embraced advanced ideas, which was met with disapproval by many loyal fans. Critics contend that the game focused more on delivering political messages instead of immersive gameplay and captivating narratives, leading to a final product that fell flat for its intended audience.

The significant drop in EA’s stock suggests a rising unease about EA’s management and future plans. Despite CEO Andrew Wilson trying to allay investor fears by hinting at potential growth in 2026, his words seem insufficient amidst the challenges EA is facing now.

It seems that Electronic Arts (EA) is facing a decline in player goodwill due to its increased focus on live-service models, rebranding, and identity politics. This shift has not only distanced parts of their original fanbase but also fallen short of providing the financial success that investors anticipate.

Currently, Electronic Arts (EA) finds itself in a challenging situation as it grapples with the aftermath of two major setbacks – ‘Dragon Age: The Veilguard’ and ‘EA Sports FC 25’. The revised financial expectations for the fiscal year now range between $7 billion and $7.15 billion, marking a significant decrease from the initial forecast of $7.5 billion to $7.8 billion.

Under increased scrutiny from both investors and supporters, there’s a lingering curiosity: Will EA adjust its approach or persist with the strategies that contributed to its downfall?

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- The Battle Royale That Started It All Has Never Been More Profitable

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

2025-01-24 01:55