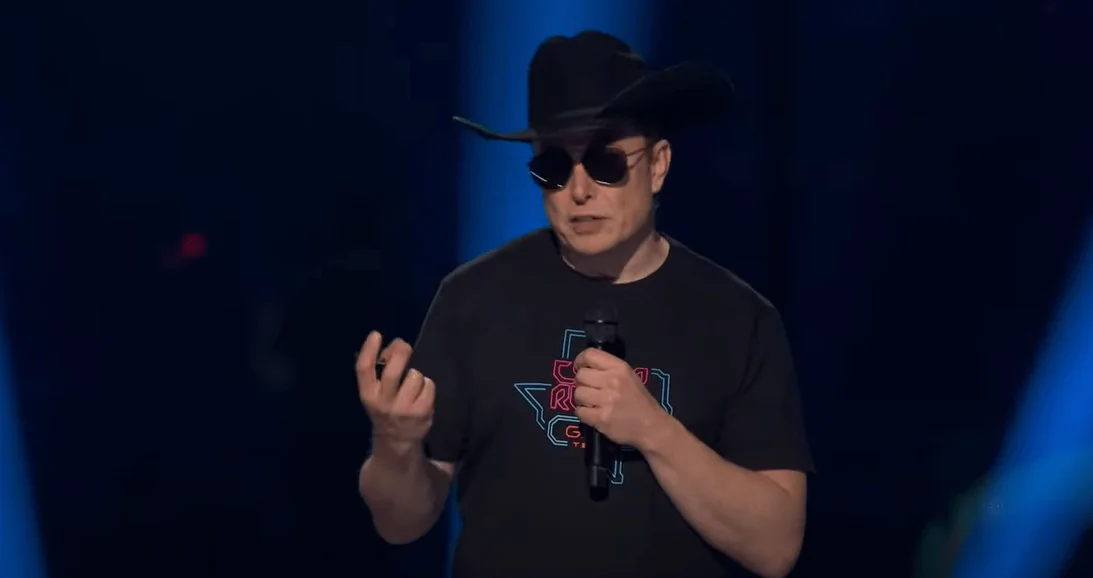

In an unusual move that appears politically driven, the SEC, under the control of the Biden Administration, has filed a lawsuit against Elon Musk, alleging that he did not promptly disclose his 2022 Twitter stock purchases, which is considered a violation.

Just days prior to President-elect Donald Trump’s inauguration, this action stirs up considerable doubt regarding the reasons for the lawsuit and a growing trend of government scrutiny towards Elon Musk.

The Suit Itself, Examined:

According to Variety and other sources, the SEC’s accusation claims that Elon Musk failed to make the required “beneficial ownership” declarations when he owned more than 5% of Twitter shares by March 24, 2022. Instead, he only filed these disclosures on April 4.

According to the SEC, the delay in disclosing information allowed Elon Musk to buy shares at prices that were potentially lower than their actual market value, which could have resulted in other shareholders losing approximately $150 million, as stated by the SEC. However, this simplified account fails to consider the intricacies involved in such a large-scale purchase and possible errors or oversights in the high-profile transaction that were not fully explored.

Alex Spiro, attorney for Elon Musk, described the lawsuit as baseless and insincere, implying it’s the SEC under the outgoing Biden administration’s last-ditch effort to harm Musk’s reputation before a potential Trump presidency. Spiro emphasizes that if the allegations are valid, they stem from an administrative oversight, with minimal penalties even if substantiated. The timing and release of this information suggest the petty nature of the legal action itself.

Transparent Timing and Political Motivation

The timing of this lawsuit seems deliberately strategic rather than accidental, suggesting a recurring pattern. This pattern appears to have targeted President Trump’s efforts to reclaim the presidency through questionable legal tactics, often referred to as “lawfare.” With Elon Musk now playing a significant role in Trump’s inner circle, having been appointed co-head of the Department of Government Efficiency, this lawsuit should be perceived through a political prism. This lens seems deliberately aimed at undermining Elon’s business endeavors.

Instead of searching elsewhere, consider the simmering tension between California, a state known for its beautiful coastline, and Elon Musk’s SpaceX operations. This tension has been made clear by the California Coastal Commission, whose leaders have openly expressed their disapproval in public statements such as:

Commission Chair Caryl Hart: “We’re confronting a company led by someone who has forcefully inserted himself into the presidential campaign.

Commissioner Gretchen Newsom: “Elon Musk is traveling across the nation, spreading untrue political statements and criticizing the Federal Emergency Management Agency, all while asserting that he wants to aid hurricane victims by offering them free Starlink internet access.

Commissioner Mike Wilson: “The firm we’re discussing is under the ownership of the wealthiest individual globally, possessing potential dominance over a worldwide communication network. Notably, this powerful figure recently mentioned threats of political reprisal.

These statements have been brought up in a legal action that Elon Musk initiated on October 15th, regarding what he perceives as excessive actions by the California Coastal Commission.

Could it be that the SEC’s actions are comparable to a response or an effort to undermine Elon Musk’s reputation, perhaps before he takes on a position where he might investigate government inefficiencies, even those within the SEC? It seems plausible that you’re hinting at this possibility.

The History of Harassment Laid Bare

Ever since the 2018 lawsuit over my “funding secured” tweet about Tesla, my interactions with the SEC have been marked by tension. After that incident, it seems like I’ve found myself under their scrutiny frequently, with numerous investigations and requests for testimony, especially concerning my Twitter (now X) acquisition.

In a pattern that’s been observed recently, Elon Musk, known for his criticism of excessive regulation, seems to be more frequently targeted in lawsuits related to SEO compared to other business leaders facing similar or even graver allegations. This frequent discussion about two-tier justice raises eyebrows, as the perceived selective enforcement by the SEC hints at potential weaponization (similar to other federal agencies) against individuals who question the established order or openly support figures like Trump who are seen as anti-establishment.

The Broader Context of Overreaching Investigations

Over the last several years, I’ve observed a significant change in the way government bodies interact with Musk.

- Continued Probes: The SEC tried to force Musk’s testimony in his 2023 Twitter acquisition, showing nagging interest in his specific thoughts and actions.

- Political Repercussions: Musk’s public endorsement of Trump and his role in the new administration has certainly driven establishment scrutiny, resulting in increased regulatory actions against him.

- Increased Cultural and Media Influence: Elon’s shift of compromised Twitter into X, handlining free speech, has made him a target of those trying to maintain control over narrative and thought.

Last Ditch Lawfare

The SEC’s lawsuit against Elon Musk for what appears to be a minor, frequently disregarded offense raises questions about politically motivated legal warfare. I can’t help but wonder when Bill Gates or George Soros were last examined so thoroughly.

As a passionate filmgoer, I must say Elon’s harsh criticism of the SEC and his relentless pursuit of government accountability has undeniably stirred up some discomfort within the administrative realm. With his expanded role and the powerful mandate he now holds, he’s become a potential disruptor to those who thrive under the existing system. Could it be that they fear a taste of their own medicine, given how they’ve treated him in the past?

This legal action underlines the potential misuse of regulatory bodies for partisan conflicts instead of their intended purpose of impartial oversight. As we transition into another term of President Trump’s administration, it’s crucial to consider whether these tactics of harassment, lawfare, and political retribution will escalate further or if fresh leadership will rise above a decade marked by immature feuds.

Could the proposals in the DOGE campaign, along with other related initiatives, potentially lead to a more equitable regulatory approach and eliminate unnecessary regulations? Might they ultimately bring the administrative system under control? That’s what many are wondering. For now, some see the SEC’s latest move as a politically motivated attack.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-01-17 01:55