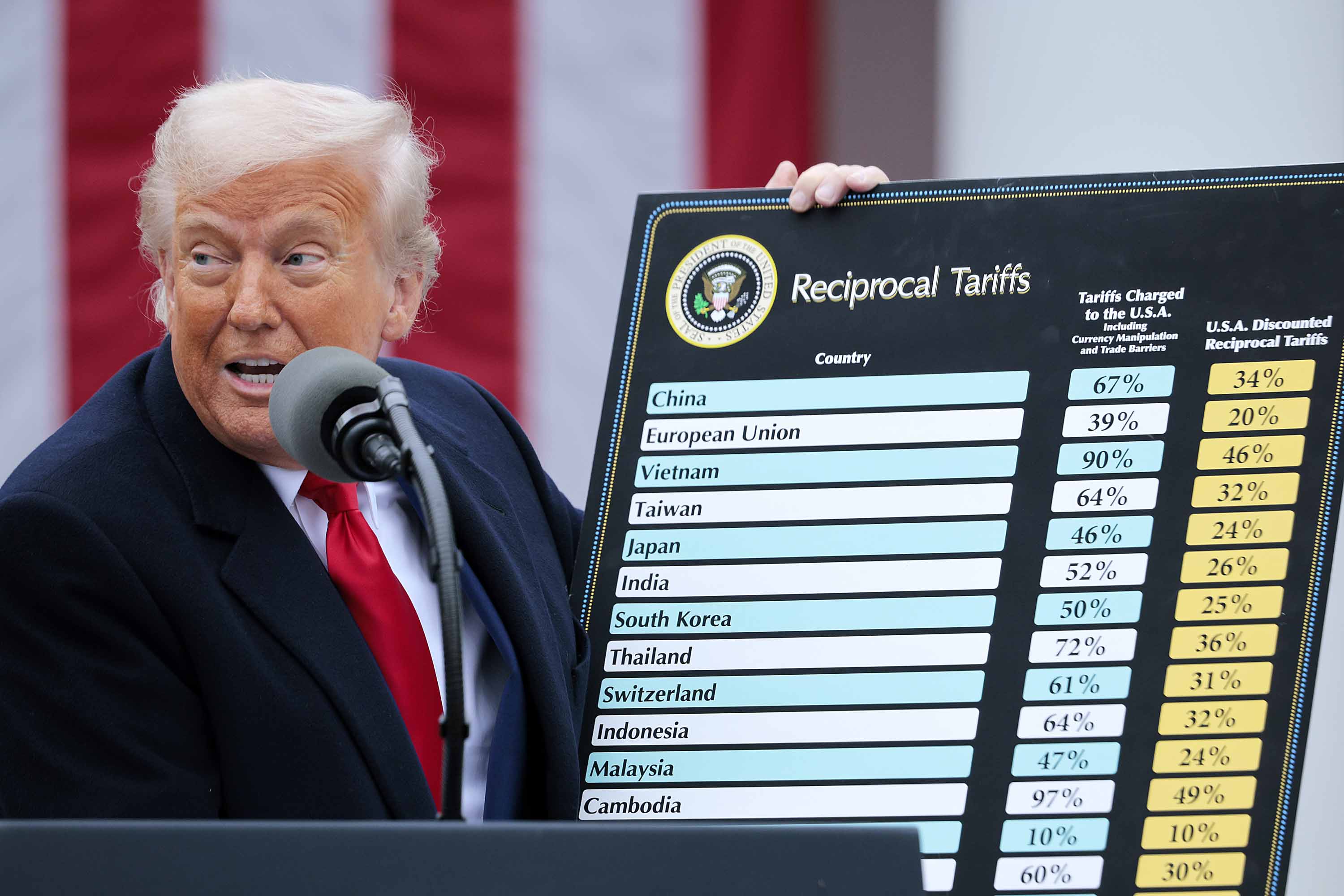

To put it another way, as many might have anticipated based on his election pledges, U.S. President Trump implemented tariffs on numerous countries worldwide. However, most of these tariffs have since been reduced to a rate of 10%.

The primary issue at hand is that a tariff on Chinese goods stands firm at an extraordinary 145%, while China imposes retaliatory tariffs of 125% on American imports. Additionally, there have been reports of China and other countries liquidating U.S. government bonds, leading to instability in the bond market within the United States, and speculation about a potential ban on American entertainment exports such as movies.

What’s the significance here? Given that the U.S. purchased a staggering $439.9 billion worth of goods from China in 2024, imposing a 145% tariff on these imports could trigger both immediate and long-term effects.

Although the Trump administration has temporarily exempted various electronic items from its trade war with China, investors remain uneasy as these products might face renewed tariffs at a later date. Notably, devices such as Xbox consoles, Surface laptops, Apple iPhones, and numerous others are either partially or fully produced in China. Analysts predict that if current tariffs persist, the cost of an iPhone could potentially skyrocket to around $3000.

This trade war, however, could potentially overlook a variety of factors such as its impact on worldwide prices, logistics, the strength of the US currency, and overall economic stability.

The idea is that increasing the cost of importing goods from China could encourage domestic manufacturing by prompting companies to establish factories within the United States. Yet, it’s important to recognize that starting a new operation would involve substantial expenses such as staff training, site construction, logistics, and more, over both the short and long term.

Regardless of producing goods within the U.S. to sidestep tariffs or bearing the cost of tariffs on imported goods from China, businesses inevitably transfer these extra expenses to the consumers. This pattern became evident during the pandemic, as trade was significantly affected by lockdown situations.

An uneven playing field?

It’s clear that when it comes to trading with the West, China seems to have an unfair advantage. For instance, companies like Xbox and Ubisoft from the West must surrender their intellectual property (IP) to Chinese firms just to make any profit in the market. Games such as World of Warcraft, produced by American companies, are published by Chinese firms like NetEast within China, ultimately reaping a large portion of the profits. This leaves little for U.S. companies after these deals, which might explain why partnerships between Blizzard and NetEase have faced challenges in the past.

In China, NetEase is both releasing Overwatch 2 and competing against it with their own game, Marvel Rivals, which they have licensed from U.S.-based Disney. The unique aspect here is that if a Chinese company takes intellectual property from a Western company, there’s often no legal action they can take in return, unlike the other way around. This is a common challenge faced by companies dealing with China, as some experts suggest that it leaves them little choice but to enter into potentially unfair agreements or risk losing their copyright without any legal remedy available.

From another perspective, companies like Microsoft, Apple, and others can produce their products such as Xbox consoles, iPhones, laptops, etc., at a significantly lower cost compared to what they would be priced at in the U.S. This reduction in costs is subsequently passed on to consumers. For instance, if a Surface laptop or an Xbox console were manufactured in Europe or America, their prices could potentially increase by hundreds, even thousands of dollars. However, it’s important to note that the availability of the necessary expertise and logistics for such manufacturing may not always exist in these regions.

Some experts or optimists speculate that tariffs might be a strategic bargaining technique aimed at addressing certain trade imbalances with China. This could potentially lead to China adopting international standards for intellectual property and tech companies reinvesting in U.S. manufacturing. However, there are many reasons to question this strategy, particularly within the short to medium term.

As a tech-savvy individual, I’m bracing myself for the immediate ripple effects that global economic volatility will bring. Unforeseen and anticipated impacts are on the horizon, affecting everything from my retirement savings tied to the stock market to general investments, as money managers scramble to secure safer assets. The increased costs in global supply chains might trickle down to everyday items like laptops and household cleaning products, making them more expensive.

We’d love to hear from our valued readers, have the trade wars affected you in any way up till now? Have they altered your shopping plans for this year? Are you frustrated about the delay in Nintendo Switch 2 preorders? Share your thoughts below and let’s talk about it!

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

2025-04-13 15:39