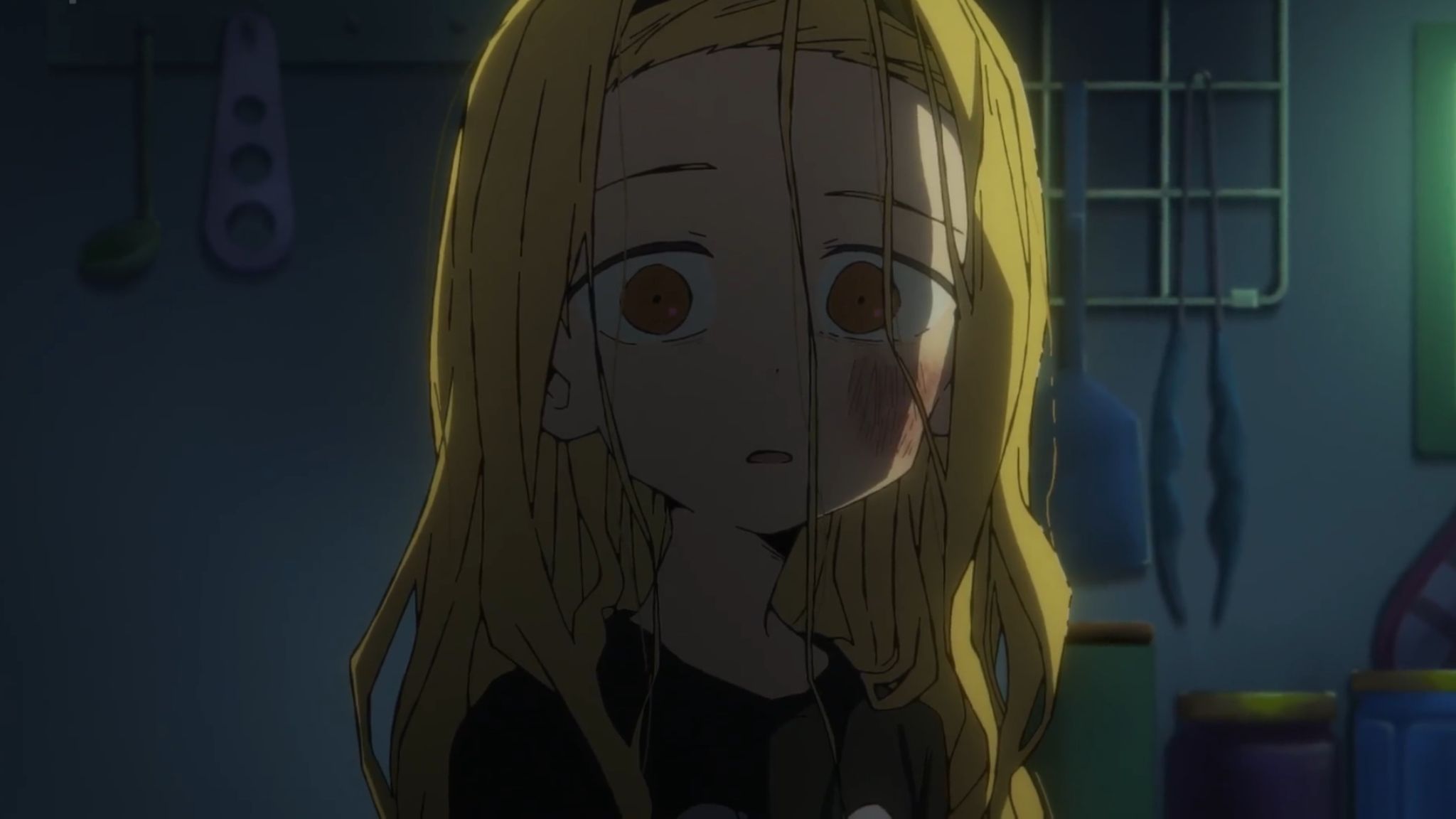

Free Steam Game Now Available for Horror Fans

The game titled Hellkind, developed single-handedly by Motamot and launched on June 30th, remains permanently free. Unlike other offers where games are initially free but later monetized, this one doesn’t follow that model. Instead, it’s a regular game, offered without charge. We can’t say why it’s free, but its length might be the reason – approximately an hour long. It may not boast fancy features, but apparently, it’s quite enjoyable.