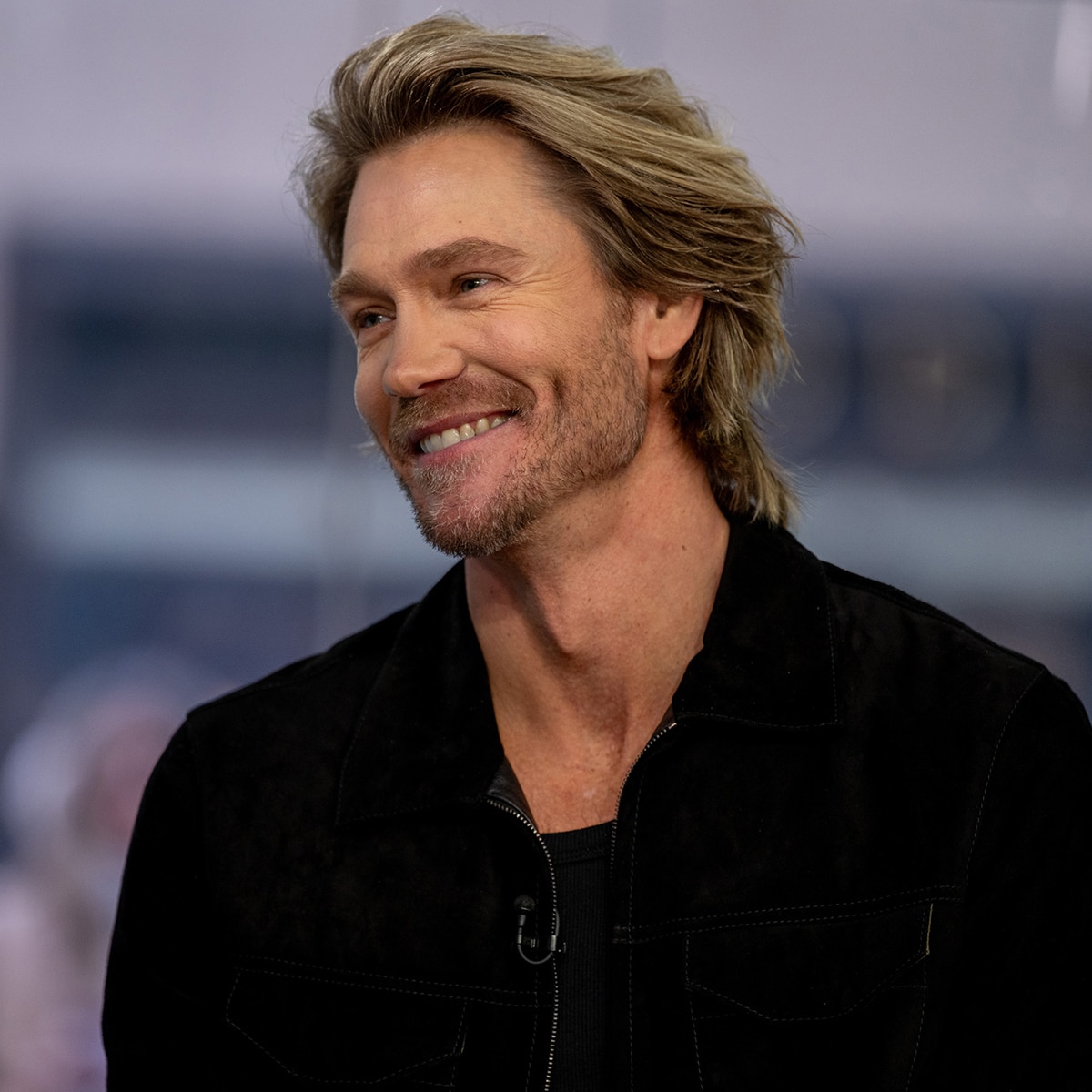

Chad Michael Murray’s Kids Make Public Debut on Red Carpet

At the Los Angeles premiere of “Freakier Friday” on July 22, Chad Michael Murray’s children made an unexpected appearance, marking their first significant red carpet event. For this special occasion, Chad’s son and daughter—whose names have yet to be disclosed—dressed in pastel clothes that harmonized with the attire of the “One Tree Hill” alum and his wife, Sarah Roemer.