What you need to know

- Despite recent bankruptcy claims, investors are betting on OpenAI to become the world’s most valuable company worth trillions of dollars ahead of Microsoft, NVIDIA, and Apple.

- Investors say the ChatGPT maker is in a unique position because of its unusual scale and structure and could scale greater heights because of its dominant enterprise and consumer position.

- OpenAI’s latest round of funding from investors could propel its market cap well beyond $150 billion to facilitate its sophisticated AI advances.

As a seasoned tech investor with over two decades of experience, I have witnessed the rise and fall of numerous tech giants. The story of OpenAI is one that has piqued my interest more than most. The company’s unique position, its ambitious goals, and its potential to reshape the world as we know it make it an intriguing investment opportunity.

In July, it was disclosed that OpenAI might face bankruptcy within the next year due to excessive expenses related to their AI projects. The forecast suggested a potential loss of $5 billion for the company best known for creating ChatGPT. This financial strain is reportedly caused by over-investment in AI development, such as spending approximately $7 billion on training AI models and an extra $1.5 billion on staffing costs, even though they benefit from reduced pricing on Microsoft’s Azure services.

The tech company earning from ChatGPT and LLM access fees accumulates approximately $2 billion and $1 billion respectively each year, yet these earnings barely cover their projected operational expenses ranging from $3.5 billion to $4.5 billion. To put this in perspective, OpenAI has successfully secured funding in seven rounds, resulting in a market capitalization exceeding $80 billion. It appears that the company behind ChatGPT may require another round of investment to maintain its operations.

It appears that Microsoft, NVIDIA, and Apple might be some of the investors who will contribute in OpenAI’s upcoming funding round, which could prolong its existence and significantly increase its market value to surpass $150 billion. Furthermore, there are indications that additional investors are entering the competition and wagering on OpenAI to become the global leader in AI technology with a valuation of trillions of dollars, possibly even surpassing Microsoft, NVIDIA, and Apple (according to Financial Times).

Based on reports from individuals familiar with the matter, it appears that Thrive Capital has already gathered a billion dollars for OpenAI’s project. The organization aims to collect an additional $6.5 billion through further funding rounds from investors such as Microsoft, Apple, NVIDIA, and Thrive Capital, as well as securing $5 billion in debt from various banks.

Besides Microsoft, NVIDIA, and Apple, other tech companies such as Tiger Global from New York and MGX, funded by the United Arab Emirates, are considering investing in OpenAI for a long-term perspective. It’s anticipated that these investments will be finalized shortly. Insiders familiar with the deal mention that the interest in participating in OpenAI’s funding round stems from its unique size and organizational setup.

As a researcher studying venture capital investments, I’ve noticed that typically, investors such as Thrive Capital would invest less capital in companies close to bankruptcy to minimize risk. Yet, OpenAI appears to be an exception to this rule. A partner from an investment firm supporting OpenAI suggests there might be something distinct about this company that sets it apart.

Discussing the journey towards creating a trillion-dollar enterprise – I believe it’s not an overly ambitious goal. The emergence of Generative Artificial Intelligence presents the most significant opportunity for development since the rise of cloud computing or the internet.

As a tech enthusiast, I’m deeply invested in the incredible strides OpenAI is making in the field of artificial intelligence. However, to continue scaling these heights, it’s crucial that we provide them with substantial capital investment. The reasons are twofold: first, addressing the power-related concerns that come with such advanced AI development; second, countering the potential threat posed by the staggering statistic that 30% of AI projects might be abandoned by 2025 after the proof of concept stage. This investment isn’t just about fueling innovation—it’s about ensuring that promising projects don’t fall by the wayside and that we can continue to reap the benefits of cutting-edge AI technology.

Other investors are choosing to steer clear of OpenAI and instead invest in competing companies, such as Elon Musk’s xAI, which claims it will lead in every AI metric by the end of 2024. These investors express worries about OpenAI’s ability to manage its business growth effectively given ongoing management disputes that led to Sam Altman stepping down from his CEO role unexpectedly.

Investors believe OpenAI will weather the storm

After the OpenAI controversy, several high-ranking employees have chosen to resign due to issues related to safety and what appears to be a focus on aesthetically appealing products over safety measures. Some have gone as far as launching new ventures dedicated to creating safe AI technology, successfully securing $1 billion in funding from investors to back their initiatives.

OpenAI, needing additional funding to continue operations, has been sued by Elon Musk, a previous co-founder, due to perceived breaches of their original mission and alleged involvement in racketeering activities, as stated in the lawsuit against ChatGPT’s maker and Sam Altman.

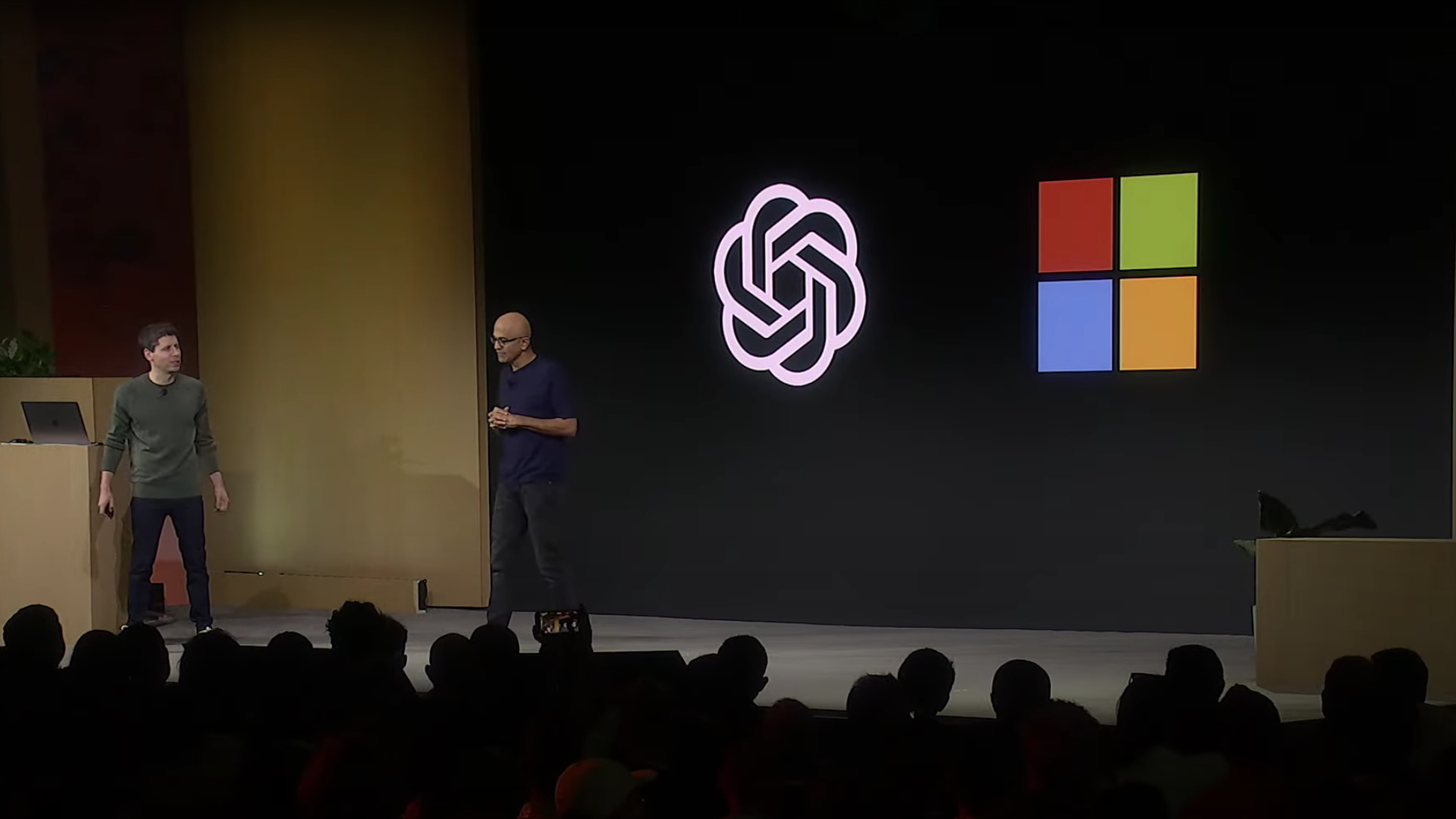

The collaboration between OpenAI and Microsoft is growing more intricate daily, according to Microsoft insiders, who suggest that Microsoft is functioning increasingly like a high-profile IT service provider for the fast-rising tech start-up. Yet, Microsoft’s CEO, Satya Nadella, asserts otherwise.

We were extremely self-assured about our own competence. We possess all the intellectual property rights and the capacity to back it up. In essence, if OpenAI were to vanish tomorrow, I wouldn’t want any of our clients to be concerned, truthfully, as we have the legal rights to carry on the innovation, not just to offer the products. However, we could continue with what we had been doing in collaboration, independently, and so we have the team, the computing resources, the data, and everything necessary.

Lately, Microsoft has identified OpenAI as a rival in artificial intelligence and search technology. Despite the numerous hurdles that OpenAI faces, this hasn’t stopped investors from focusing on the broader prospects. As one of OpenAI’s backers put it:

The situation is significant, as no company has ever achieved a leading role in both the enterprise and consumer sectors at an early stage. Such businesses often become ‘the one that gets the most’: it’s unlikely that you’d find two similar services like ChatGPT on your device.

They consider these hurdles as a normal part of the growth process that startups typically face on their path to achieving stability.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- 7 Chilling Horror Films Born from The Twilight Zone’s Dark Legacy

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

2024-09-20 19:09