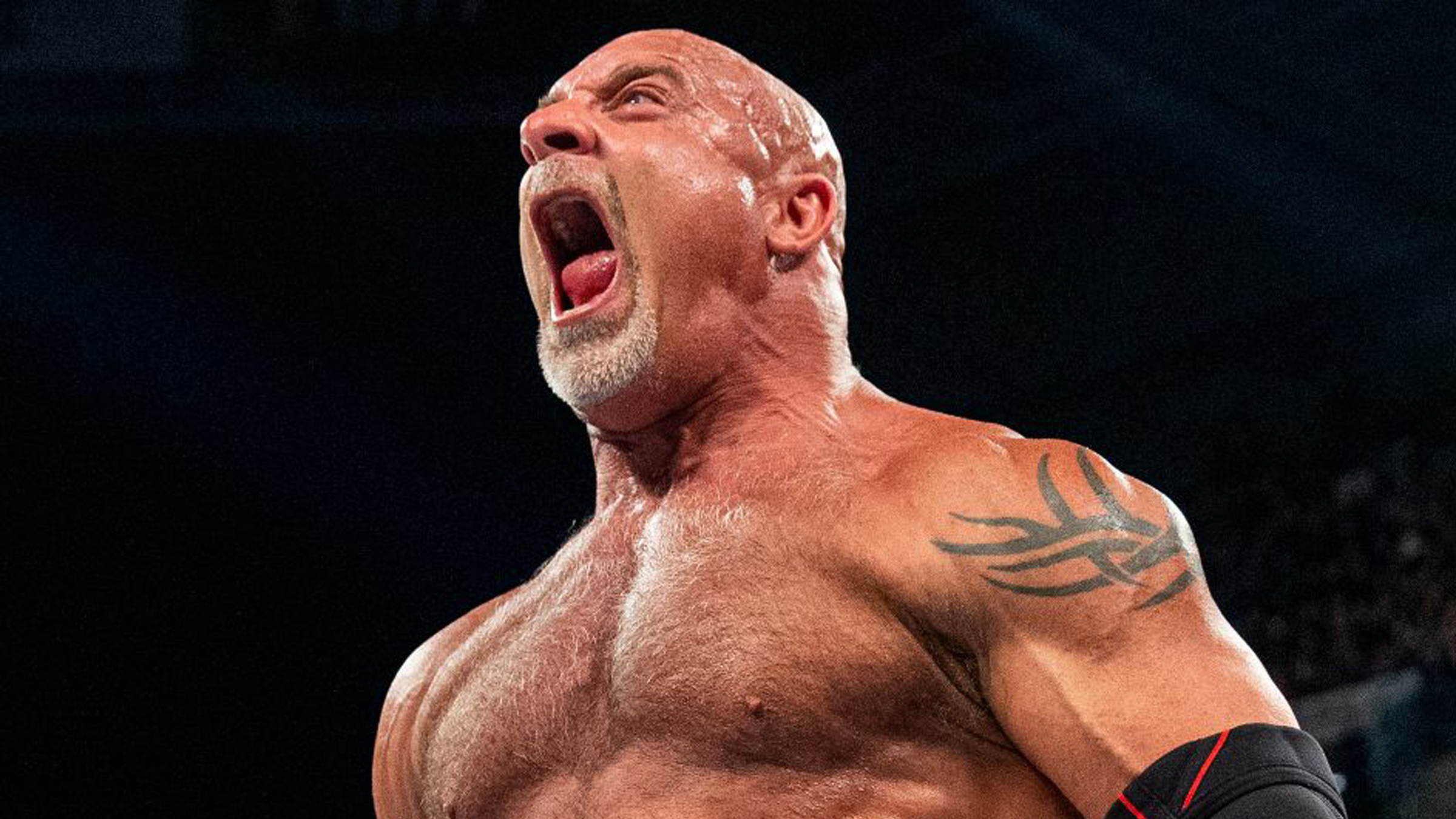

Goldberg’s Final WWE Match Was Not What We Expected (Or Was It?)

Initially, Goldberg overpowered Gunther in their skirmish, pushing him roughly to the ground. In retaliation, Gunther retaliated with a kick to Goldberg’s abdomen, but Goldberg countered by forcing him towards the ropes using a forceful shoulder block. Next, Goldberg endured several aggressive chops from the Champion and responded with laughter. Finally, he delivered a clothesline that left Gunther staggering.