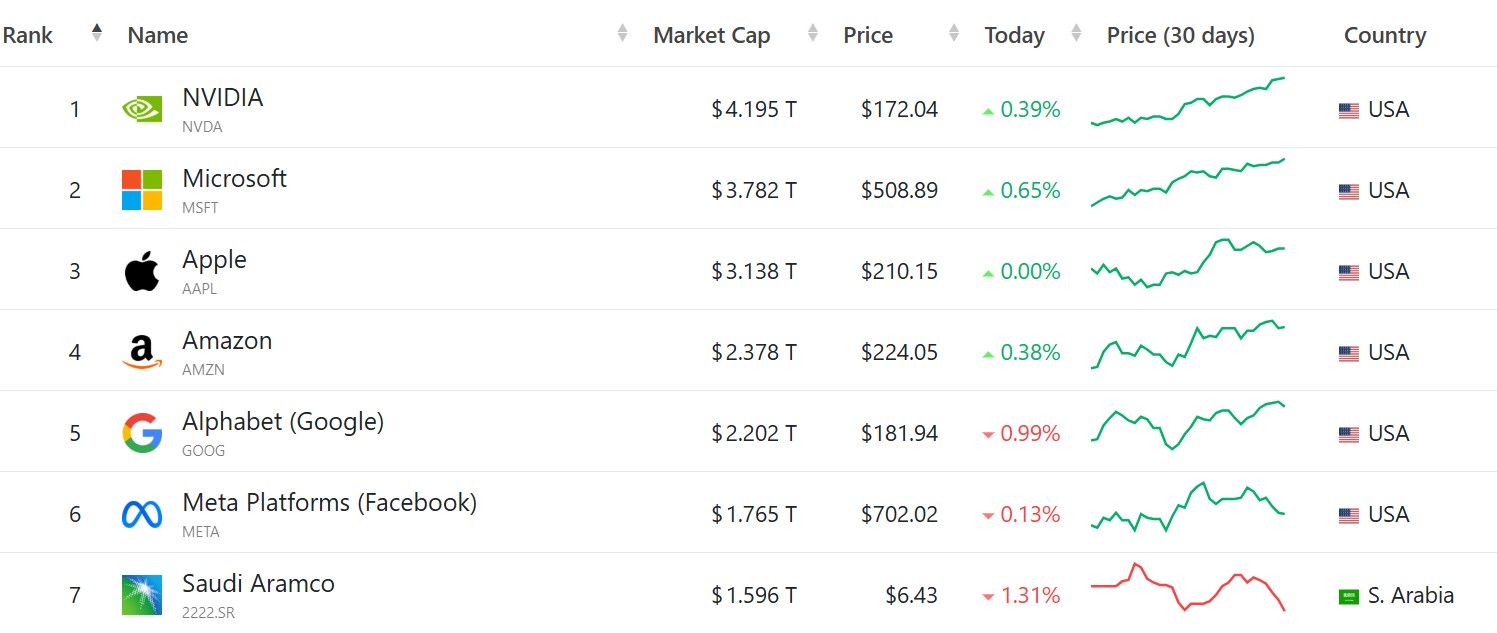

It’s possible that NVIDIA has secured the title of the first company to reach a valuation of $4 trillion, but Microsoft could be quickly catching up.

Under the leadership of CEO Satya Nadella, Microsoft has emerged as a standout performer in the stock market, whether positively or negatively. Currently, Microsoft boasts a market capitalization of approximately $3.758 trillion, trailing NVIDIA’s $4.179 trillion slightly. In recent times, Microsoft has surpassed Apple, with a market cap of $3.1 trillion, as investors grow uneasy about Apple’s standing in an AI-centric world.

In recent times, both NVIDIA and Microsoft have significantly expanded their market presence due to their focus on cloud services. NVIDIA contributes with their advanced server technology that is fueling the global AI boom, while Microsoft operates its Azure data centers and partners with OpenAI to manage the backend for hundreds of thousands of Azure customers, as well as millions more indirectly. Interestingly, Apple is said to be utilizing Azure and OpenAI’s models to enhance some of its platform features, demonstrating the effectiveness of Satya Nadella’s cloud investment approach.

Microsoft’s stock price has surged more than 15% so far this year, outperforming the S&P 500 index significantly.

Microsoft’s shares have gained significant popularity lately due to substantial dividend distributions and share repurchase initiatives. People who invested at the beginning of the cloud rush have reaped massive returns from Microsoft stock, a trend that appears likely to persist as cloud technology serves as the foundation for nearly every new technological advancement. In essence, without cloud computing, there would be no AI, no streaming services like Netflix, no e-commerce giants like Amazon, no web services, apps, online games, and more – all of which have propelled Microsoft to market capitalization leadership in recent years.

Microsoft has significantly increased its investments in subscription services like Microsoft 365, Azure, and Xbox Game Pass. This move not only ensures them a consistent income stream that surpasses the norms set by retail trends but also offers them resilience against fluctuations in consumer confidence to some extent.

However, it’s important to note that there are potential risks associated with the situation. Some financial experts consider Microsoft’s stock to be on the pricey side at the moment, which may partly explain the company’s recent round of layoffs over the past year.

Improving profit margins and earnings per worker can temporarily elevate a company’s valuation, but as I mentioned previously, the demoralizing impact of layoffs on employee morale and product quality could cause long-term damage. To put it simply, Microsoft’s popular consumer products like Windows, Xbox, Surface, and others have shown signs of stagnation in varying degrees, making the company’s business diversification more susceptible to risks.

It’s worth pondering if Microsoft’s current business approach is heavily geared towards raising their share prices, considering that executive compensation frequently depends on stock performance instead of consistently delivering superior products. One might anticipate a strong correlation between high-quality products and a rising stock price, but unfortunately, many of Microsoft’s existing consumer-oriented solutions are lacking in quality.

The fact that Amazon Web Services (AWS) maintains a strong second position in the cloud market isn’t set in stone; Google and other competitors are rapidly pouring resources into closing the gap. Moreover, Google doesn’t necessarily depend on OpenAI for its AI models, which could provide it with an edge when introducing novel products. There’s also apprehension that advanced AI, capable of completely replacing humans (referred to as agentic AI), might ironically harm some of Microsoft’s enterprise software businesses.

Microsoft consistently demonstrates its ability to adapt and thrive in changing technological landscapes; however, some viewers perceive this swift reallocation of resources as unpredictable and unreliable for consumers. Despite these perceptions, Microsoft’s business-to-business operations continue to be its primary strength, which is expected to propel its market capitalization beyond $4 trillion within the upcoming weeks or months.

But things can change rapidly in tech, even for big players like Microsoft.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Gold Rate Forecast

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 10 Movies That Were Secretly Sequels

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Controller Settings for ARC Raiders

- Goat 2 Release Date Estimate, News & Updates

- Best Werewolf Movies (October 2025)

2025-07-17 17:09