What you need to know

- Microsoft is slated to report its first fiscal quarter earnings on Wednesday.

- Despite overall growth revenue, projections suggest the firm’s AI department could report dismal Copilot Pro sales.

- Investors have already sparked concern about the company’s spending on AI projects with little profit returns.

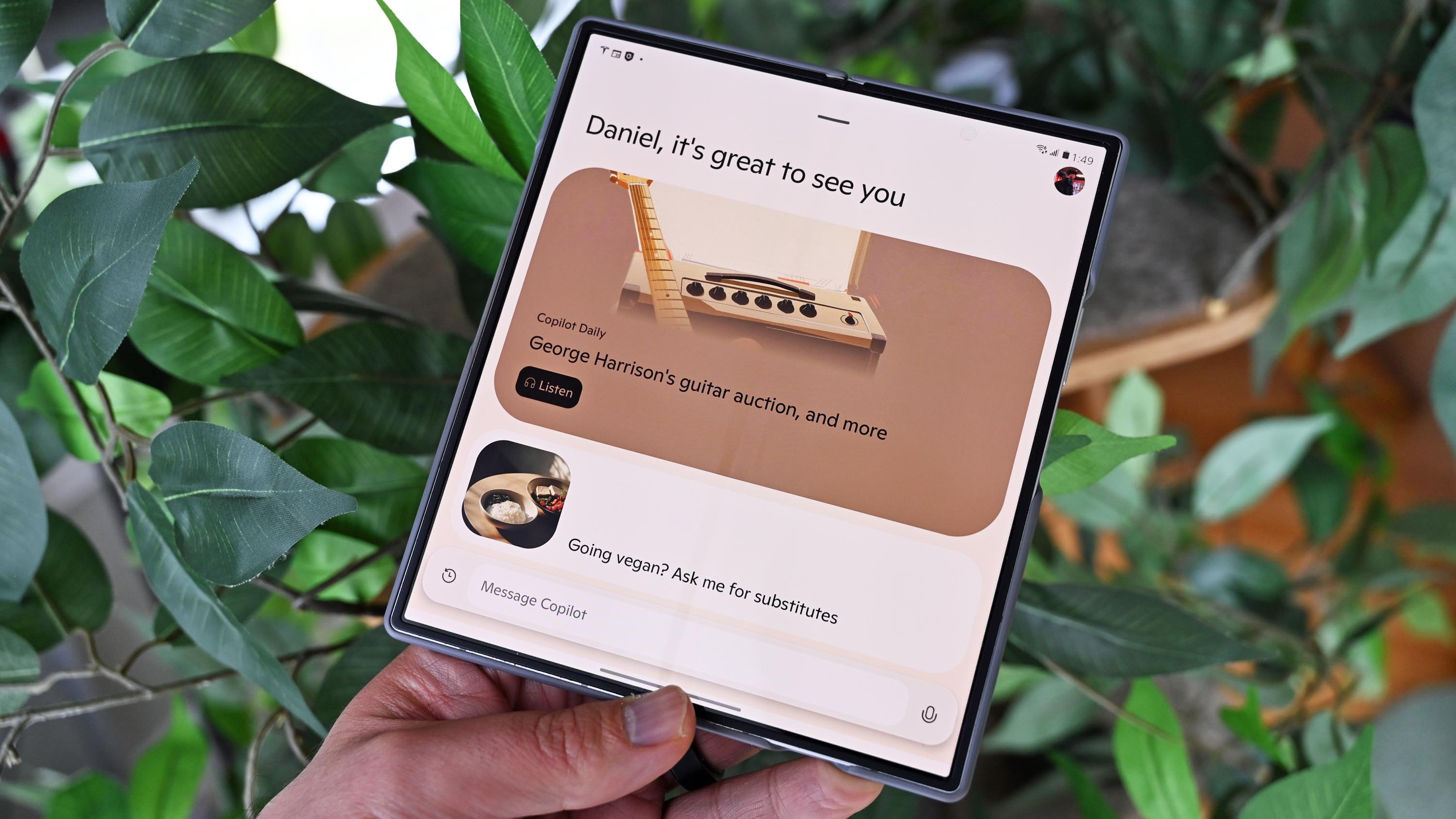

As a tech enthusiast with over two decades of experience in the industry, I must say that the current state of AI is both exhilarating and concerning. Microsoft, a tech giant and a trailblazer in the AI landscape, has been struggling to establish growth in its Copilot Pro sales, which is alarming given its substantial investment in this area.

This week, Microsoft is set to unveil their financial report for the initial quarter of their fiscal year. Similar to the previous earnings conference, predictions suggest that the revenue generated from artificial intelligence may fall short, even though there has been a lot of excitement and significant investments in this area. (Source: Reuters)

It’s troubling because some investors have expressed worries over Microsoft’s significant investments in AI initiatives. As one of the foremost corporations in the AI sector, Microsoft has benefited from its partnership with OpenAI, which gave it an early advantage in this field. This has led to extensive adoption of advanced technology throughout its system.

Despite indications suggesting that Microsoft is finding it challenging to foster growth in the category, there appears to be minimal enthusiasm among consumers for its Copilot AI monthly subscription service, specifically Copilit Pro. Remarkably, a survey on Windows Central revealed that over half of the respondents do not utilize this service at all.

Similarly, a different study found that the main criticism against Microsoft’s Copilot team is that it doesn’t perform as effectively as ChatGPT. However, Microsoft clarified that this isn’t accurate, suggesting that users might not be utilizing the tool optimally and are instead blaming inadequate prompt design skills. To address this issue, Microsoft has introduced Copilot Academy to educate users on how best to use the tool.

Based on the analysis by Morgan Stanley, it seems that Microsoft is facing a “barrier of concerns” regarding its profits due to factors such as escalating capital investments, shrinking margins, insufficient proof about the benefits of artificial intelligence, and organizational complexities following a financial restructuring.

According to FactSet’s analysis, Microsoft might announce revenues of approximately $64.57 billion for the first quarter of 2025, marking a 14.1% increase compared to its last reported quarter. The Productivity and Business Processes segment is projected to generate around $23.6 billion, while the Intelligent Cloud segment could bring in about $14.1 billion.

Microsoft’s Azure cloud computing division is projected to show substantial growth exceeding 33%, consistent with their forecasts, but this growth rate is notably lower compared to the previously reported growth for the fourth quarter. This discrepancy might suggest a potential slowdown in that specific department, perhaps due to escalating and costly demands related to AI development.

The AI landscape is shaky at best

At a crucial juncture, when OpenAI faced the possibility of bankruptcy and projected losses amounting to $5 billion over the next year, a turnaround occurred. The creators of ChatGPT managed to escape their dire financial situation by securing $6.6 billion from investors in a funding round. This infusion of capital significantly boosted their market value, valuing the company at an impressive $157 billion.

As a researcher delving into the realm of artificial intelligence, it’s increasingly clear that substantial financial investments and an abundance of resources such as electricity, data storage, and cooling water are essential for advancements in this field. The experts foresee a potential scenario where Microsoft might acquire OpenAI, a move possibly driven by dwindling investor interest in AI. This could lead them to redirect their resources elsewhere in pursuit of continued progress.

A report suggests OpenAI could burn up to $44 billion chasing sophisticated AI advances before naming profit in 2029. There’s also the issue of OpenAI being on a strict clock to turn into a profit venture within the next 2 years or run the risk of refunding the money raised by investors during its latest round of funding. The move has already faced a significant bottleneck following former OpenAI co-founder Elon Musk filing a lawsuit against the ChatGPT maker over “a stark betrayal of its founding mission.”

Experts caution that there may be various obstacles on the path to this move, including potential resistance from regulators, government officials, OpenAI employees, and other influential parties. Yet, investors are optimistic about OpenAI’s current challenges being common for startups and foresee it eventually rising as the leading AI company worldwide, with an estimated value in the trillions of dollars.

Read More

2024-10-29 02:11