Top gainers and losers

Most profitable crypto: Banana For Scale (BANANAS31), HashKey Platform Token (HSK), FUNToken (FUN), Tutorial (TUT), Gains Network (GNS), Sei (SEI), tokenbot (CLANKER), Liquity (LQTY), GoPlus Security (GPS), Movement (MOVE).

Most profitable crypto: Banana For Scale (BANANAS31), HashKey Platform Token (HSK), FUNToken (FUN), Tutorial (TUT), Gains Network (GNS), Sei (SEI), tokenbot (CLANKER), Liquity (LQTY), GoPlus Security (GPS), Movement (MOVE).

Cryptocurrencies that are trading close to all time high values Fasttoken (FTN/USDT) Fasttoken rate has changed by 0.41% in the last 7 days. The difference for the last day was -0.21%. Cryptocurrency Fasttoken ranks the 57 place in the rating by capitalization. The price of FTN/USD has declined by 0.68% from the peak value on … Read more

Sorry, PNG/USD forecast is not available at the moment. Please try again later. Forecasts that will be relevant tomorrow:

Sorry, GRS/USD forecast is not available at the moment. Please try again later. Forecasts that will be relevant tomorrow:

After the surprising departure of Jeremiah Brown from Love Island USA on June 22, some spectators have suggested that his fellow islander Nic Vansteenberghe might have orchestrated a plan to vote him out, in order to pursue Andreina Santos without competition from Jeremiah.

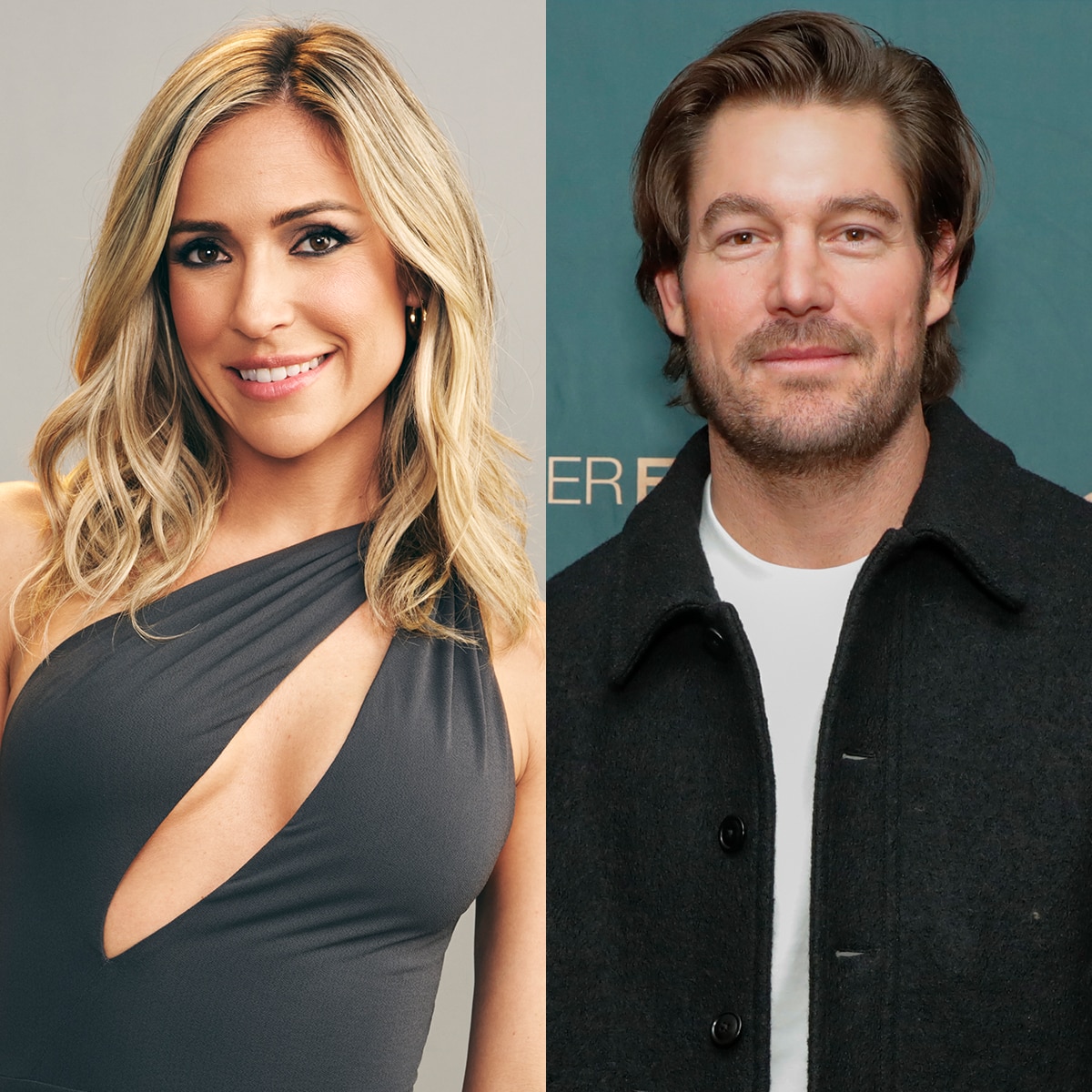

The former Hills star openly admitted to having a short-lived relationship with the Southern Charm actor, contrary to rumors involving his co-star Austen Kroll.

Typically, audiences find the 27-year-old actress from Euphoria presenting herself as a classic Hollywood platinum blonde.

On Wednesday, Graham (age 55) posed alongside Seymour (age 77), who had recently offered a life advice, in a swimsuit photograph, enjoying a refreshing dip in the pool together.

Speaking on the “Bussin’ With the Boys” podcast on June 24th, the San Francisco 49ers tight end, who is 31 years old, estimated that he spends between $150,000 and $200,000 per season on his health and fitness routine. He added that this figure, when combined with additional expenses, amounts to an extra $200,000.

As a movie reviewer, I’d put it this way: “In my latest review, we delve into issue #2 of ‘The Vision & The Scarlet Witch’. Penned by Steve Orlando, Lorenzo Tammetta, Ruth Redmond, and lettered by Travis Lanham, this comic continues from the moment when Scarlet Witch used her powers to resurrect Vision. However, the Vision is now in a fragile state, leading Scarlet Witch to escort him to the Clutch Dimension for some relaxation. Here, we discover that not only are Vision’s abilities at their peak, but also his emotions, which adds an intriguing layer to his character. With a shared mission, they embark on a joint investigation into Grim Reaper and his Death’s Doors – enigmatic portals that entice people with the prospect of reuniting with deceased loved ones, only to lead them towards untimely demise.