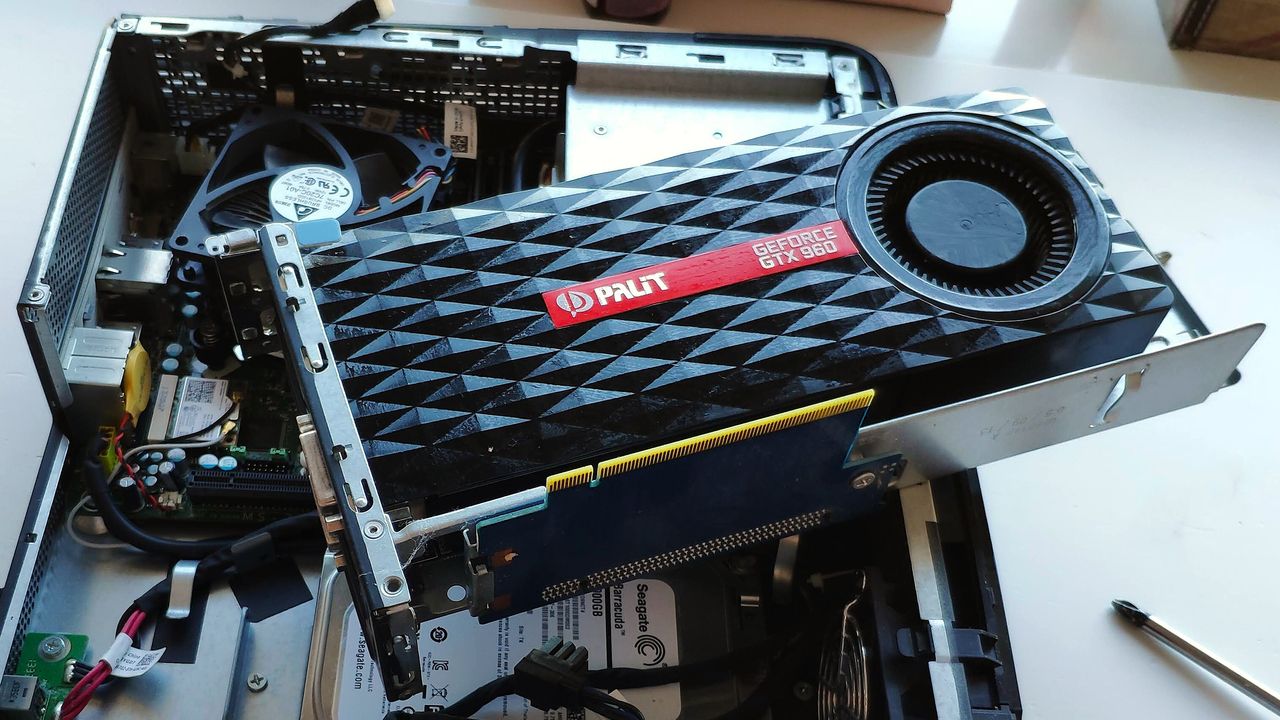

NVIDIA announces end-of-life support for many of its GTX cards — but it’s not all bad news

In October 2025, NVIDIA intends to release another significant driver update for these architectures, following which they will switch to quarterly security updates only. Notably, this timeline aligns with the end-of-life date for Windows 10, set for October 14, 2025.