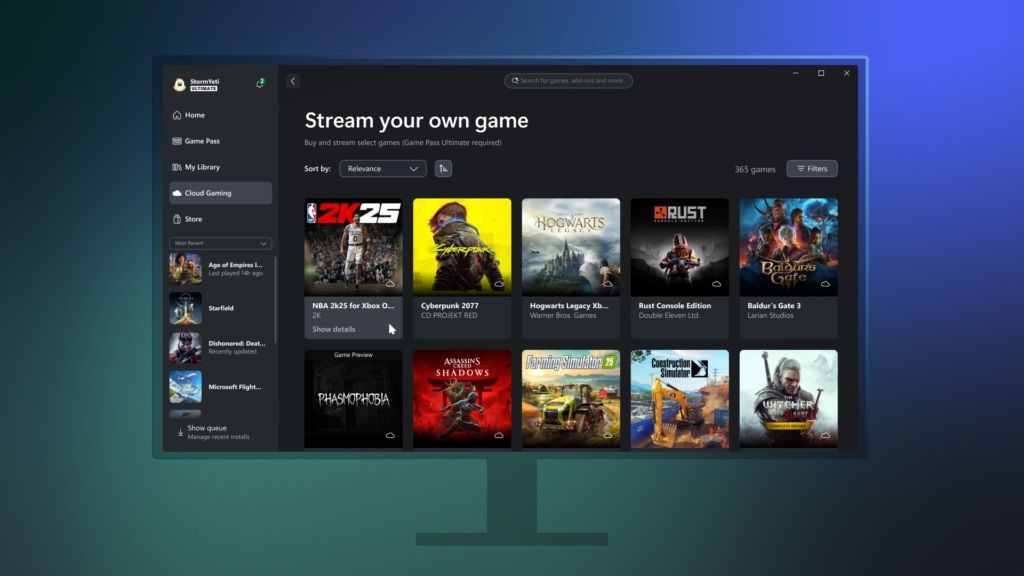

After a long wait, the “Play Your Own Game” feature started becoming available last autumn, initially offering around 50 games that could be streamed through Xbox.com/play, including hits like Baldur’s Gate 3 from Larian Studios.

Since then, the list of playable games has expanded regularly, with titles such as Assassin’s Creed Shadows, Final Fantasy 16, and Subnautica now available for streaming.

The feature is no longer exclusive to Xbox; it’s also accessible on devices like the Xbox Series X|S and Xbox One consoles, LG and Samsung Smart TVs, and Meta Quest headsets.

To stream your own game, you must first buy a copy of the game and have an active subscription to Xbox Game Pass Ultimate, which grants access not only to “Play Your Own Game” but also to a multitude of other titles in the Game Pass library.

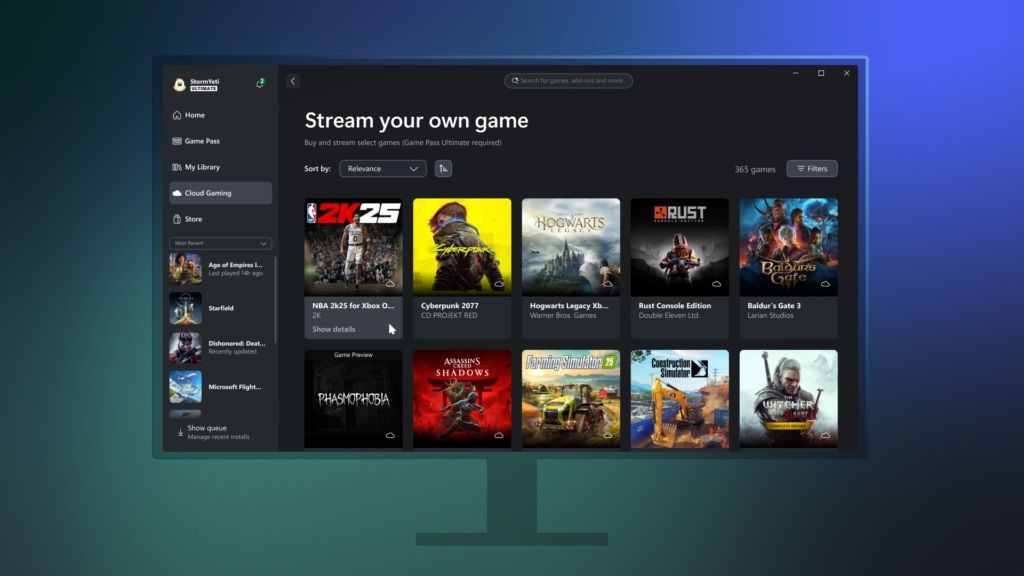

If you’re not already part of the Xbox Insider Program, you can join to test out advanced features before they roll out more widely across Xbox consoles and the Xbox PC app.

The full launch of the “Play Your Own Game” update for the Xbox PC app is yet to be announced.