Ubisoft, known for pioneering innovation and creativity within the gaming industry, is experiencing a steep downfall, as evident by their recent decisions to close multiple studios and let go of many employees. Their hardships, characterized by unsuccessful game releases, internal disputes, and strategic blunders, have led to a sequence of events that suggest they’re fighting to preserve what little is left of their once-vibrant domain.

Today, it was announced that Ubisoft is closing down Ubisoft Leamington, a UK studio that has been with Ubisoft since 2017 when it was acquired from Activision. Originally named FreeStyleGames, this studio housed approximately 50 skilled workers who have contributed to popular games like Star Wars Outlaws, Skull and Bones, Avatar: Frontiers of Pandora, Tom Clancy’s The Division 2, and Far Cry 5. This closure signifies the end of a chapter for the employees and highlights the difficulties Ubisoft encounters in managing its wide variety of video games.

Closing Ubisoft Leamington is one aspect of a broader reorganization strategy, which also involves changes at Ubisoft’s offices in Düsseldorf, Stockholm, and Newcastle-upon-Tyne, where Ubisoft Reflections is based.

As a dedicated fan, I’m sharing some unfortunate news that has come from Ubisoft. In an effort to streamline operations, trim costs, and focus on projects with lasting potential, the company will be letting go of 185 employees across various locations. In a heartfelt statement to Eurogamer, Ubisoft expressed their deep regret over this impact on their workforce. They want to acknowledge the significant contributions these individuals have made and are committed to offering support during this transition period.

In a continued focus on streamlining our projects and cutting expenses for long-term sustainability at Ubisoft, we’ve announced targeted reorganizations at Ubisoft Düsseldorf, Ubisoft Stockholm, Ubisoft Reflections, and regrettably closed the Ubisoft Leamington site. This decision is expected to affect 185 employees in total. We greatly appreciate their work and are dedicated to helping them navigate this change.

– It’s clear that Ubisoft is facing significant financial difficulties, as evidenced by the recent wave of layoffs. The company’s value has dropped dramatically since early 2021, falling from about $12.17 billion to just $1.78 billion in January 2025, a decrease of approximately 85%. This steep decline suggests that investors have lost confidence in Ubisoft and are concerned about its financial stability. The company’s mounting debt, shrinking cash reserves, and underperforming games have created a perfect storm, putting Ubisoft at risk of bankruptcy.

Joost van Dreunen, founder of SuperData, has been open about Ubisoft’s potentially vulnerable situation. He predicts that Ubisoft may transition to private ownership and dispose of its high-value assets gradually. He also speculates that individual franchises, notably Rainbow Six Siege and Assassin’s Creed, could potentially be worth more independently than as components of the struggling corporation.

The complex blunders contributing to Ubisoft’s decline involve several factors. For instance, some recent game launches, such as “Star Wars: Outlaws,” have fallen short of audience anticipation, with preorders substantially lower than projected and sales figures remaining confidential—a common indicator of subpar performance. Furthermore, the choice to debut “Outlaws” on Steam rather than the exclusive Ubisoft Connect platform used for hits like “Assassin’s Creed Valhalla” at launch suggests a lack of faith in distribution networks and an inconsistency in strategic decision-making.

The financial situation of Ubisoft appears to be growing more challenging, as indicated by their latest reports. The company’s non-IFRS net debt has significantly increased to around €1.1 billion, while IFRS net debt reached approximately €1.4 billion – a substantial rise from the previous year’s €880.8 million. Their cash reserves have also decreased, leaving them with only €932 million, which makes it harder for Ubisoft to control their borrowing expenses. Moreover, the annual cost of maintaining their workforce, currently at 18,666 employees, is estimated to be €746.6 million. This heavy expenditure becomes problematic in the face of falling revenues and mounting debt.

Poor management and organizational issues have compounded problems for the company. The closure of XDefiant and the expensive production of Skull & Bones, estimated to have cost between $650 and $850 million over a ten-year period, underscores ineffective leadership and misuse of resources. These projects have depleted Ubisoft’s financial reserves without generating the anticipated profits, placing the company in a precarious position and forcing it to fight for survival.

As a movie buff putting things into perspective, I’ve noticed that Ubisoft, in its zealous pursuit for diversity, equity, and inclusion (DEI), seems to have stirred up some unease among their core gaming community. While cultivating an inclusive environment is paramount, it appears they’ve placed too much emphasis on this aspect without giving equal attention to other strategic concerns.

The result? A growing sense of discontent among dedicated gamers and investors alike, which has undeniably affected Ubisoft’s market standing. This misstep adds another layer of complexity to their journey towards regaining the trust and confidence that they once enjoyed.

In addition to these issues, there are whispers that Tencent, along with Ubisoft’s founding Guillemot family, might be contemplating the division of Ubisoft and using its resources to establish an entirely new business venture. This proposed reorganization would entail assessing which assets to retain and determining their worth. However, due to Ubisoft’s current condition as a shadow of its past glory, this move may not be the salvation the company urgently requires. Alternatively, Tencent could discover greater value in acquiring Ubisoft’s intellectual properties during a bankruptcy auction, allowing Ubisoft to file for bankruptcy without a viable future plan.

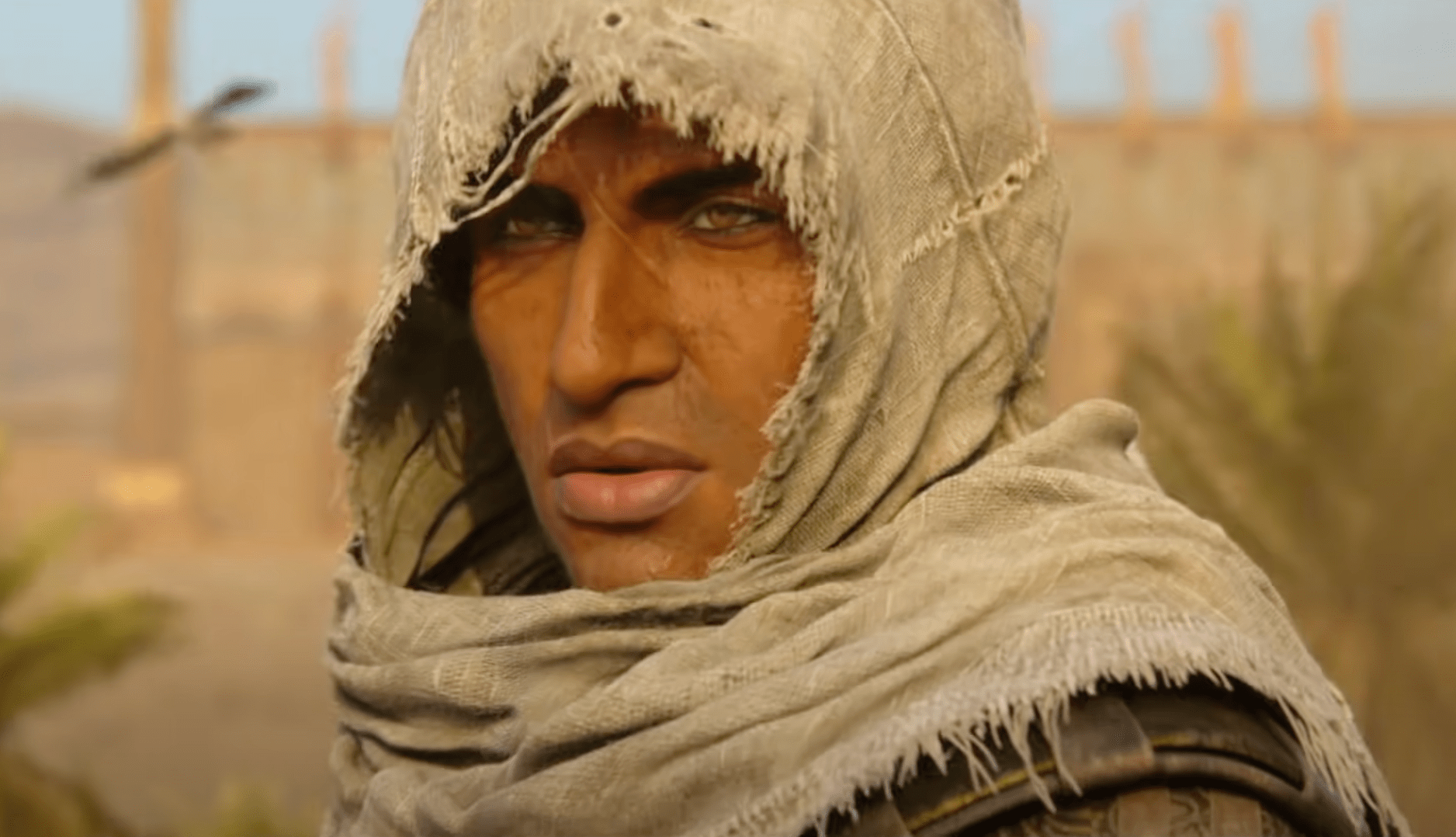

The upcoming launch of “Assassin’s Creed: Shadows,” which has been pushed back to March 20th at a significant expense to the company, represents a pivotal moment for Ubisoft. Should this game underperform, it may be the last straw for Ubisoft. Such an outcome might lead to more job cuts and worsen the company’s already precarious financial situation, potentially pushing it closer to bankruptcy.

To summarize, Ubisoft’s recent events – closing studios, dismissing numerous staff members, and encountering unsuccessful game launches – are indicative of a company grappling with a severe crisis. The steep drop in market value, along with rising debts and internal inefficiencies, has exposed Ubisoft to the risk of acquisition or even bankruptcy.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2025-01-27 21:55