Ubisoft has recently partnered with Tencent to establish a gaming offshoot specifically for their flagship titles such as Assassin’s Creed, Rainbow Six, and Far Cry.

It’s evident that Ubisoft has been experiencing significant financial losses, and this trend became apparent following the release of their Q3 FY25 financial report which depicted a company in dire straits. In just Q3, net bookings plummeted by 51.8% compared to the previous year. Digital bookings dropped by 33.8%. A crucial aspect for live-service games, player recurring investment, saw a decrease of 33.7%. Moreover, Ubisoft’s current debt-to-EBITDA ratio stands at an alarming -21.1x, indicating that the company is losing money at a rate that renders its financial model unsustainable even before taking into account taxes, interest, or amortization costs.

When Ubisoft unexpectedly declared the establishment of a new gaming affiliate this week, receiving a €1.16 billion ($1.25 billion) investment from the Chinese tech titan Tencent, it left investors perplexed. One might wonder, given the company’s seemingly precarious situation, why they would embark on such daring new endeavors?

The answer is simple: it’s not a bold strategy. It’s a bailout disguised as expansion.

Tencent’s “Investment” Is a Lifeline in Disguise

Ubisoft described this action as a strategic step to establish game environments that can remain fresh and adaptable across multiple platforms over time. This newly created division will be home to Ubisoft’s most prized intellectual properties, such as Assassin’s Creed, Far Cry, and Rainbow Six. The company underlined its ambition for enhanced creative capabilities, higher narrative standards, and groundbreaking multiplayer features. However, the true significance of this move seems to be hidden beneath the promotional jargon.

This isn’t about innovation. It’s about liquidity.

Ubisoft, struggling financially, has opted for an unusual approach instead of outright selling or openly discussing its troubles. They’ve separated their most valuable assets into a new corporation and sold a stake to Tencent. This move is reminiscent of corporate survival strategies, aimed at quickly raising funds by utilizing the remaining value. Ubisoft has estimated the worth of this new subsidiary at €4 billion, using a generous 4 times sales multiple from fiscal years 2023-2025, even though fiscal year 2025 appears to be one of the company’s poorest in recent history.

Hiding Collapse Behind a PR Curtain

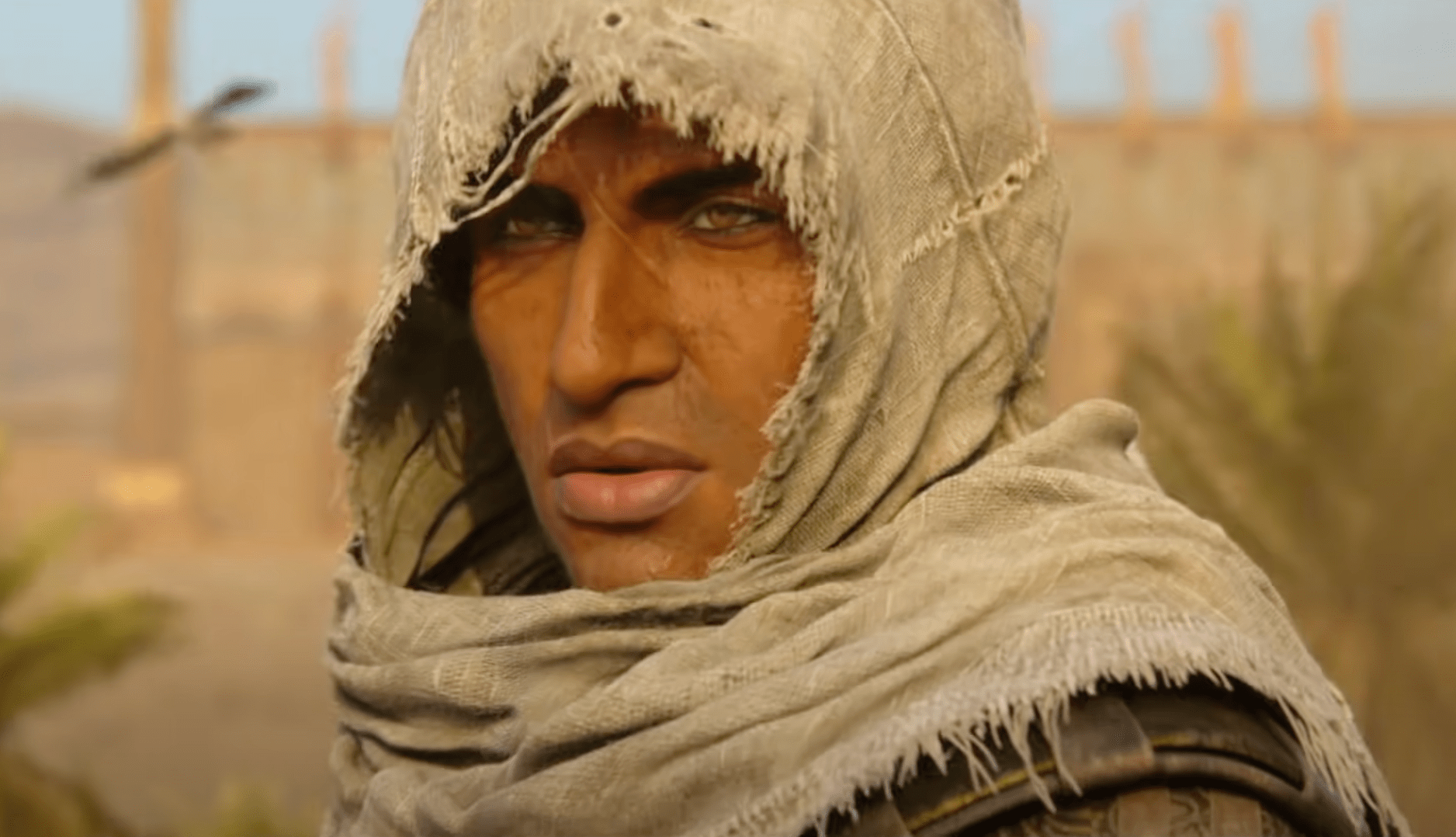

This announcement coincidentally came up shortly following the release of “Assassin’s Creed Shadows,” a game that Ubisoft has hinted could be their turnaround point. However, in spite of Ubisoft trying to portray the game as a hit, the data suggests a different narrative.

Ubisoft reports that 2 million individuals are playing Shadows, although they didn’t specify how many copies were sold. Some people suspect this total includes subscribers of Ubisoft’s subscription service, which has over 1.5 million members. Since these subscribers can access Shadows as part of their monthly fee, there’s a chance the reported “2 million players” figure might include those who didn’t actively purchase the game but have passive access instead.

On Steam, the game “Shadows” reached a maximum of 64,825 simultaneous players, and currently hovers around 30,000. This is lower than BioWare’s controversial title, “Dragon Age: The Veilguard,” which has faced widespread criticism. For Ubisoft, this is a clear warning sign. A top-tier “Assassin’s Creed” game not attracting significant PC players suggests more than just waning interest; it also points towards a dwindling brand influence.

A Surrender in Stages

Instead of focusing on artistic liberty or advancements driven by players, the Tencent deal serves as a means for Ubisoft’s survival in the current market. In essence, Ubisoft is pledging its future to ensure it remains viable today. The Guillemot family, who have historically been resistant to a complete takeover, are now gradually surrendering control – bit by bit.

For Tencent, the deal brings several key advantages: it gains more extensive access to Western game intellectual properties, enhances its presence in live-service environments, and secures long-term earnings prospects – all this by helping a company that can no longer sustain itself independently.

Ubisoft refers to this as a “transformational strategic shift,” but in essence, it’s merely the next step in a gradual decline. A company once known for its prestige now bears an uncanny resemblance to a zombie, kept functioning by foreign investment, shuffling towards a future that seems more likely to involve consolidation or liquidation rather than transformation.

If “Assassin’s Creed Shadows” aimed to signal a resurgence, the figures—and the underlying sense of urgency—undoubtedly convey one truth in an excruciatingly obvious manner.

This isn’t a comeback. It’s a cover-up.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-03-27 22:55