- 😲 Dormant ETH whale resurfaces, transferring 7,000 ETH ($13.8M) to Kraken as ETH plummets to $1,760.

- 🌊 Given the turbulence in risk assets, ETH traders should closely monitor exchange inflows.

Ethereum [ETH] has plunged below the $2,000 mark, erasing $46 billion in market value within a week. This drop brings ETH back to the $1,900 range for the first time in two years.

With a 10.64% weekly decline, ETH stands as the weakest performer among high-caps. But with RSI in oversold territory and trading volume surging 47%, could this be the perfect “dip-buying” opportunity?

🐳 Dormant ETH Whale Awakens 💤

Ethereum’s market just saw a significant on-chain event. An ETH whale, dormant since the initial coin offering (ICO), has resurfaced, transferring 7,000 ETH ($13.8M) to Kraken.

This move coincided with ETH plummeting to $1,760 – its lowest level since October 2023.

Despite ETH rebounding to $1,900, the whale still holds 30,070 ETH ($50M). If more selling follows, ETH could face deeper corrections, which looks increasingly likely in the near-term.

Why? While declining exchange reserves confirm accumulation, the broader market downturn and rising liquidations could put ETH’s recovery at risk.

Over $110 million in ETH long positions were liquidated in the past 24 hours and ETH funding rates turning negative on three out of six top exchanges suggest short-sellers are tightening their grip.

Adding to the bearish pressure, 180-day dormant circulation spiked as ETH broke below $2,100, indicating a surge in long-term holder sell-offs.

In a risk-off environment, this aligns with a distribution phase, further weighing on ETH’s short-term price action.

🔎 Identifying Key Support Zone 📉

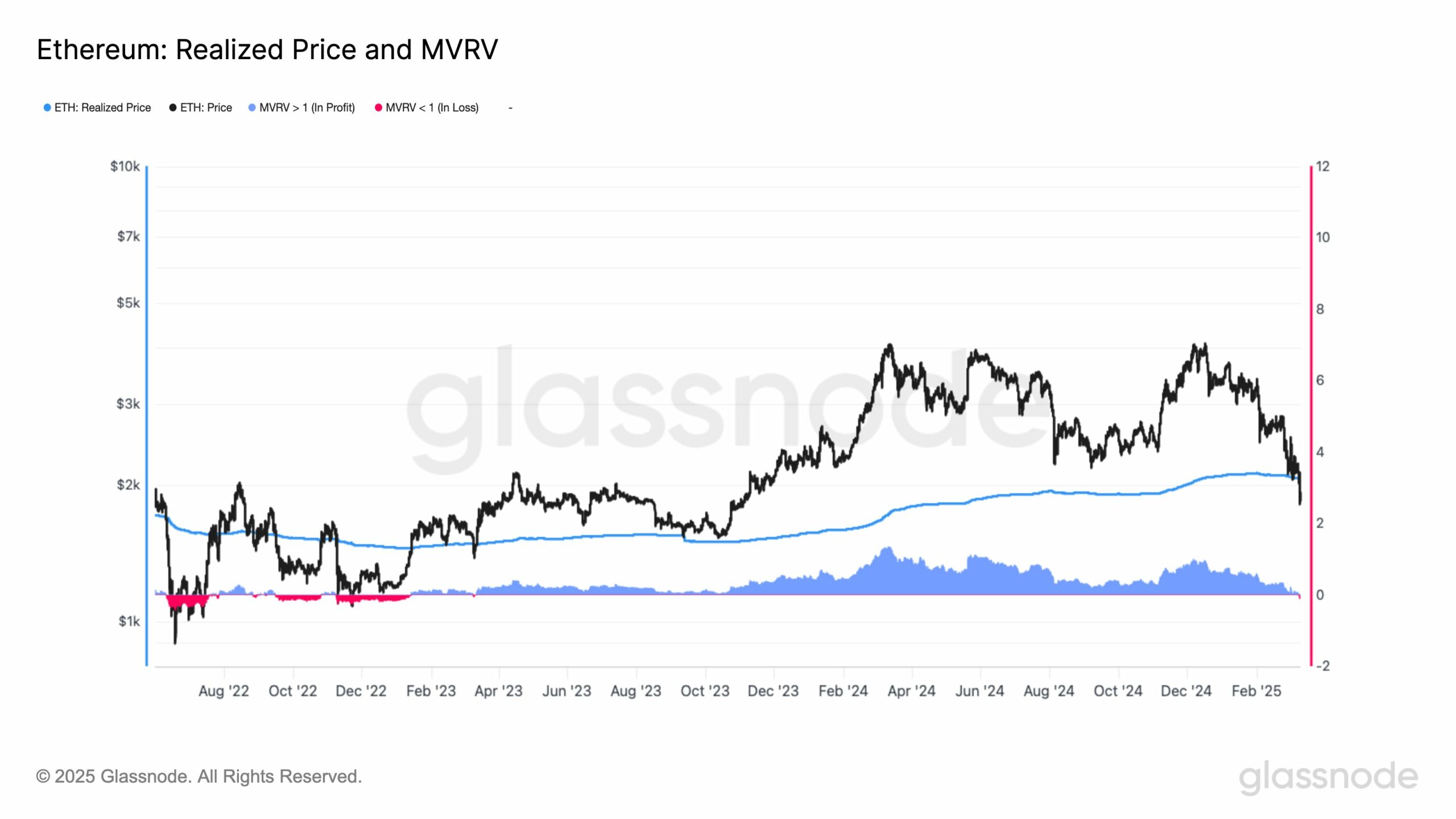

Ethereum has fallen below its realized price for the first time in two years, meaning the average holder is now at an unrealized loss.

Currently trading at $1,917, ETH sits below the realized price of $2,058, pushing its MVRV ratio to 0.93, reflecting a 7% network-wide unrealized loss.

Historically, dips below realized price have signaled capitulation zones. With dormant ETH whales selling off, this trend seems to be in place.

Immediate support rests at $1,592 – a break below this level could push 4.80 million ETH into loss. If breached, it could open the door for further downside.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-03-12 04:11