- Oh, do gather ’round, dear friends! Ethereum‘s stablecoin supply has hit a rather smashing $132B, hasn’t it? Such growth, one might almost call it fashionable!

- In the grand protocols of Ethereum, an additional $5 billion has been sprinkled about like confetti, as the little coins scurry to new heights of transactional glee.

After a rather unseemly 26% dive last month, Ethereum [ETH] has picked itself up, dusted off its digital trousers, and rallied a sprightly 8.44% in just a day. This upward march is likely to continue, as the activity increases and the market’s interest is piqued beyond measure.

Presently, the key metrics are showing growth that would make a duchess blush, suggesting that market participants are hoarding ETH like it’s going out of style. AMBCrypto has peered through its monocle and analyzed the contributing factors to ETH’s potential rally. Most intriguing!

The Stablecoin Supply on Ethereum: A New High Society

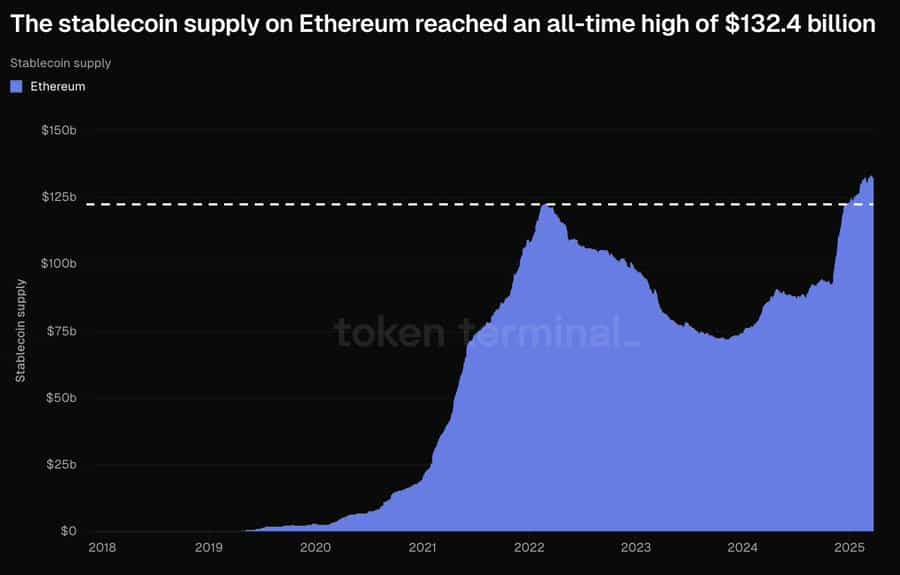

Ethereum, the ever-so-friendly host to innovation, continues to draw stablecoins like bees to a picnic. Its total stablecoin supply has hit an all-time high of $132.4 billion; a figure that would make even the most jaded of investors swoon.

Stablecoins, those clever chaps designed to maintain a 1:1 peg with the likes of the U.S. dollar, are all the rage for traders and investors seeking refuge from the market’s tempestuous moods. They’ve become the darlings of asset storage and crypto transaction facilitation.

An increase in stablecoin supply on a blockchain is often a sign of things to come, as traders position themselves for a buying spree. AMBCrypto has delved into the matter, exploring factors that could impact these assets. One never knows what one might find!

Liquidity Inflows to Ethereum: A Flood of Fortune

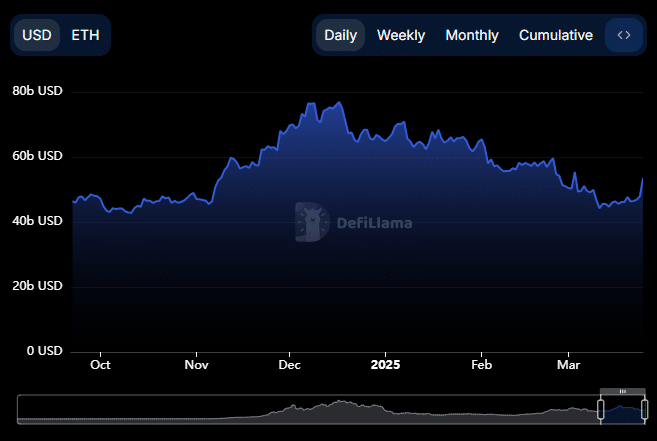

Ethereum has seen a veritable surge in liquidity inflows, rather like the tide coming in after the stablecoin supply hit its record high.

DeFiLlama’s Total Value Locked (TVL), which is the measure of all the bling in the ecosystem, has shown Ethereum’s TVL rising to $53.448 billion in a day, up from $47.92 billion. A $5.5 billion increase? My, my, how the blockchain doth grow!

This growth suggests that Ethereum is being stockpiled, with assets locked across protocols like so many jewels in a treasure chest, reflecting a rather keen interest from investors.

AMBCrypto has also noted a rise in Ethereum’s netflow, placing it as the runner-up in liquidity inflows, just behind Berachain. Second place, you say? How very dashing!

Data from Artemis reveals that $22.2 million was added to the Ethereum network, reinforcing the notion that good things come to those who wait (and trade).

Long-term ETH Holding: A Trend Most Grand

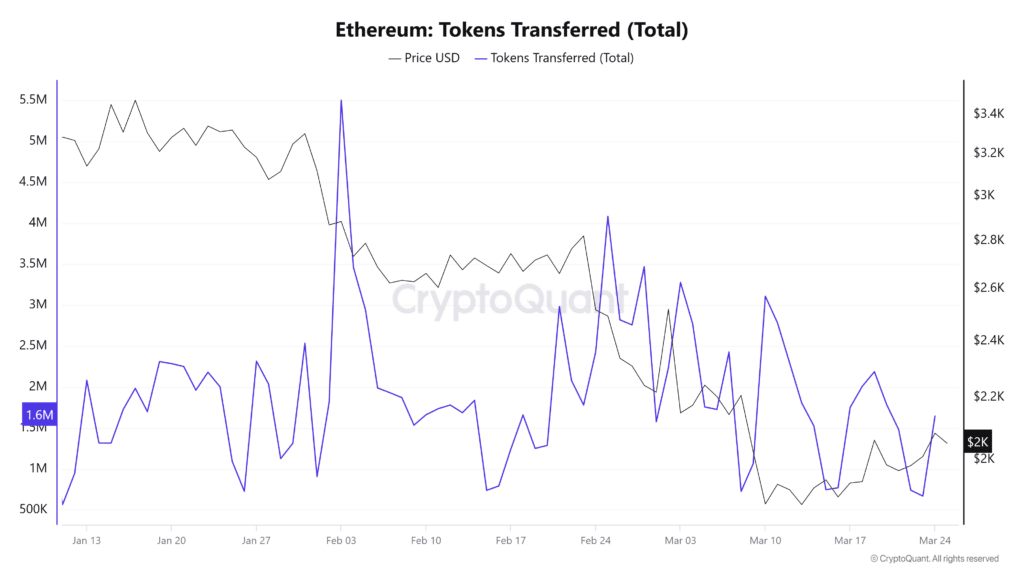

Ethereum’s total token transfers have surged by approximately 9.33% in the past 24 hours, pointing to a market that’s as lively as a cocktail party.

AMBCrypto has taken a gander at Ethereum’s exchange reserves and concluded that recent transfers are painting a rather rosy picture for ETH’s future.

Exchange reserves, you see, are like the amount of ETH available for a grand ball. Higher reserves suggest a rather rowdy party, whereas lower reserves hint at a more intimate gathering for long-term enjoyment.

The recent dip in ETH reserves implies that traders are whisking their assets away to private wallets for a long-term soiree, which could indeed be beneficial for ETH’s price in the grand scheme of things.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- BLUR PREDICTION. BLUR cryptocurrency

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- How to Get to Frostcrag Spire in Oblivion Remastered

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2025-03-25 16:44