- Derivative exchanges just got a chill -400,000 ETH in netflows. Brrr!

- CME ETH Futures Open Interest chart did a little “oopsie” from $3,216.66M to $3,251.98M. #PlotTwist

So, Ethereum‘s derivatives netflows took a dive below -400,000 ETH, like a crypto cliffhanger. Pair that with Bitcoin miners’ cash flow problems, and you’ve got yourself a market stress smoothie. Historically, this is when the market’s like, “Let’s chill on selling and go bullish, folks!”

Chart Party: Recovery or Just a Drill?

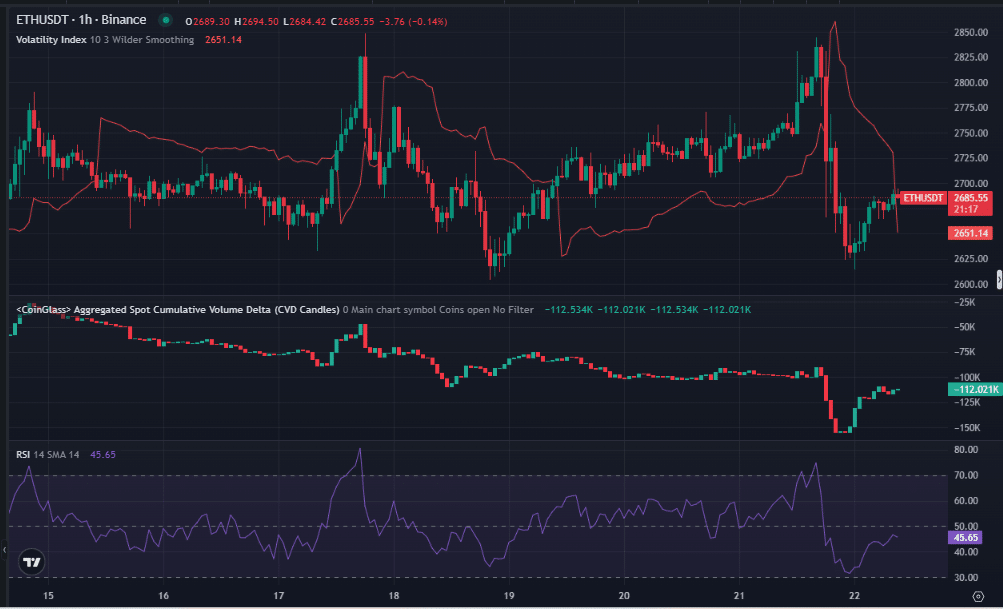

Peeking at the 1-hour ETH/USD chart on Binance, ETH was like, “I’m cool at $2,685.55,” after a three-day bender. But don’t forget, the Bybit hack might still be lurking in the shadows, ready to throw shade on altcoins.

The RSI was like, “I’m Switzerland here,” hinting at a market that’s either neutral or just got dumped. Historically, this is when the market’s like, “Let’s buy the dip, y’all!”

Meanwhile, the Aggregated Cumulative Volume Delta (CVD) was at -112.02k, like a big “NOPE” from sellers. But lo and behold, as prices tanked, some sneaky traders were like, “Let’s grab that ETH on sale!” Setting the stage for a potential $2,800+ party.

Bullish Accumulation: The ETH Hide and Seek Game

Ethereum’s three-month exchange netflows chart was like, “Negative outflows? -191.96K ETH? Must be Tuesday.”

Big outflows usually mean less selling pressure, as investors tuck their ETH into a cold storage blanket. The market consolidation phase was like, “Drop to $2,529? Expected. Now, let’s get ready for the rebound.”

Miner underpayment? More like miner underspending. Supply-side cuts are the new black, setting the stage for a rebound as selling goes out of style.

Market Positioning: The Setup for the Next Big Move

The CME ETH Futures Open Interest did a little dip from $3,216.66M to $3,251.98M. Market’s like, “Less speculation, more action!”

At press time, ETH was chilling at $2,736.79, with Open Interest suggesting traders are playing it cool. History says this could be the calm before the crypto storm.

Lower Open Interest = fewer bets on the table. Could this be the calm before the ETH surge?

Volatility Spike: The Calm After the Crypto Storm?

The 1-hour ETH/USD Volatility Index was like, “26.61? That’s all you got?” After a sell-off to $2,618.17, volatility settled down like a toddler after a tantrum.

This is the market’s way of saying, “I’m confused, but I’m chill.” Reduced volatility = post-outflow consolidation, and we’ve seen this movie before.

Holder Confidence: Stronger Than a Crypto Bear Market

The Global In/Out of the Money showed 107.13M ETH in the money (75.06%), 24.24M ETH out of the money (16.98%), and 11.35M ETH at the money (7.95%). ETH was like, “I’m cool at $2,686.24.”

With most ETH in the money, holders are like, “We got this

Read More

2025-02-22 21:17