- In the curious case of Bitcoin, it seems that STHs may find selling less fashionable, thus boosting BTC‘s allure.

- As stablecoins flood the market like debutantes at a ball, BTC may find itself the belle of the crypto sphere once more.

Bitcoin, the digital darling, briefly flirted with the $100,000 mark on the 7th of February, only to retreat like a shy suitor, currently hovering at $95,811.80—a modest decline of 2.65% in just a day.

But fear not, for as profit margins for short-term holders shrink, they may find the allure of selling less appealing, thereby providing a rather elegant lift to BTC’s price.

The Market’s Grand Reset: A Glimpse of Elegance

According to Glassnode’s rather insightful Bitcoin Short-Term Holders Profit/Loss Ratio, the market has undergone a reset as chic as a Parisian fashion show, with the ratio now at 1.08.

These short-term holders, akin to dashing gentlemen at a soiree, hold BTC for less than 155 days before parting ways. A ratio of 1.08 suggests a slim profit, as modest as a whisper above parity.

For every $1.08 gained, a mere $1 is lost—a delicate balance indeed.

This ratio has dipped below its 90-day average, much like a society matron’s hat at a garden party, indicating the market’s pivot towards a more neutral stance as realized profits wane.

AMBCrypto, ever the keen observer, noted that with BTC at $95,000 and the market in such a reset, a grand exit from this level could be imminent.

The Decline of Profits: A Supply Squeeze in the Making

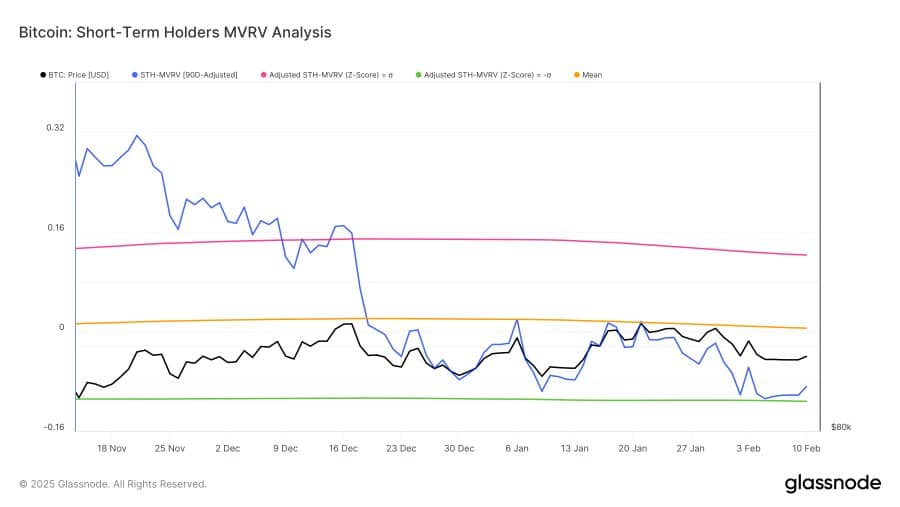

The Market Value to Realized Value (MVRV) ratio for these short-term BTC holders has also taken a dive below its 90-day average, in a most dramatic fashion.

This aligns rather neatly with the broader market’s mood.

At the quill’s stroke, the STH-MVRV stands at 1.05, meaning BTC’s current price is but a whisper above the average purchase price of these fickle holders.

AMBCrypto has observed that such declines typically reduce the urge to sell, as holders await a more opulent exit.

Glassnode’s data on realized profit-taking echoes this trend, showing a decline in BTC distribution among these flighty holders. This shift in behavior is as much about taste as it is about decreasing profitability.

As fewer short-term holders cash in their chips, the circulating BTC supply tightens, which could send prices soaring due to the reduced temptation to sell.

AMBCrypto has also identified other market factors that could set the stage for a rally as grand as a Viennese waltz.

Stablecoin Inflows: A Flood of Buying Power

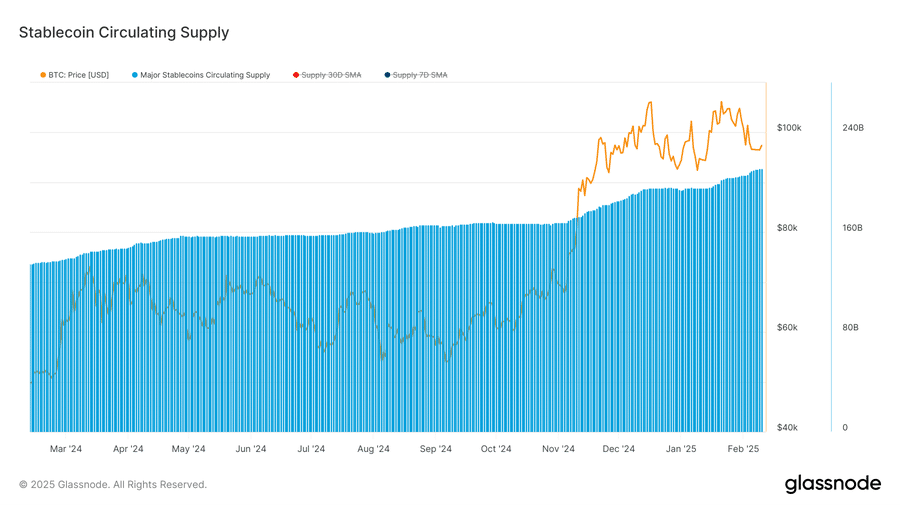

Stablecoin supply has surged like a tide at midnight, indicating a veritable flood of capital into the crypto market. In 2025 alone, the total stablecoin supply has increased by a staggering $16.97 billion.

It has risen from $194.2 billion to $211.2 billion, with the largest inflows occurring in the month of love, February.

A rising stablecoin supply suggests liquidity as abundant as a river in spring, which often heralds a surge in crypto purchases.

Given Bitcoin’s growing popularity—both as a strategic reserve asset for the crowned heads and among the institutional elite—it is poised to benefit from this most fashionable trend.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2025-02-12 20:13