In the vast and tumultuous sea of the crypto markets, where fortunes rise and fall with the capricious whims of the digital gods, a voice of singular authority has spoken. John Bollinger, the sage of technical analysis and inventor of the eponymous Bollinger Bands, has cast his discerning eye upon the charts. With the gravity of a prophet and the precision of a surgeon, he declares: Ethereum and Solana trace the contours of a “W” bottom, while Bitcoin, alas, remains mired in its own indecision. On the 18th of October, in the year 2025, he proclaimed via the platform X:

“Potential ‘W’ bottoms in Bollinger Band terms in ETHUSD and SOLUSD, but not in BTCUSD. Gonna be time to pay attention soon I think.”

– John Bollinger (@bbands) October 18, 2025

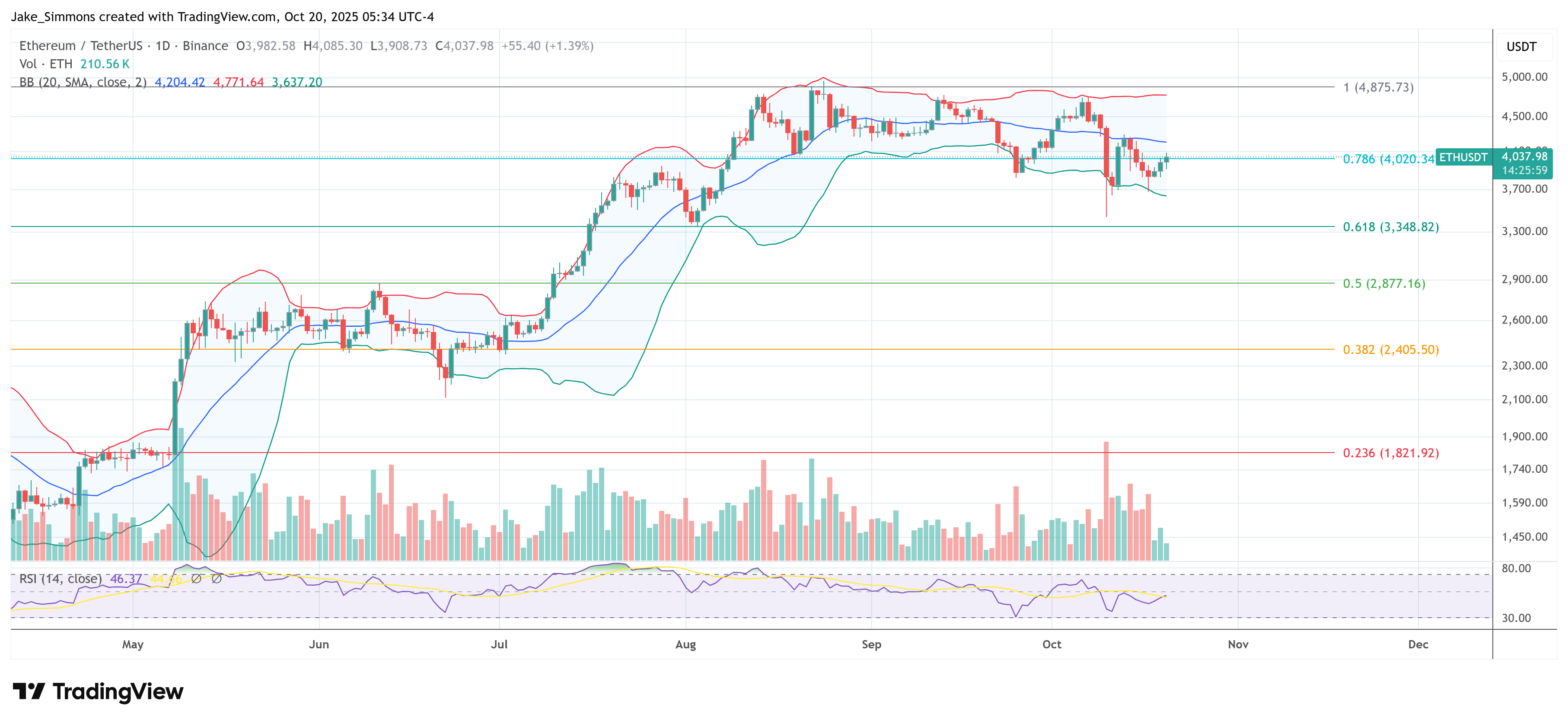

Ah, the “W” bottom-a pattern as rare and elusive as a white stag in the forest of financial charts. In Bollinger’s lexicon, it is a two-trough reversal, the second low holding steadfast above the first, accompanied by a volatility signature that whispers of prior expansion, subsequent contraction, and a refusal to succumb to the depths of a lower low. The more robust manifestations see the second low cradled within the bands, a positive divergence against the lower band, followed by a band “pinch” and a graceful ascent through the middle band, transitioning into an upper-band walk. Bollinger’s choice of words-“potential” and “time to pay attention”-betrays his method: pattern recognition precedes confirmation, and the true validation lies not in the raw shape of the lows, but in the subsequent dance of price with the middle and upper bands.

Bollinger’s crypto pronouncements are as rare as a sincere apology from a politician, and thus, his words carry the weight of an oracle. As the crypto trader Satoshi Flipper (@SatoshiFlipper) aptly observed, “John Bollinger, creator of Bollinger Bands, makes barely one crypto call per year and hasn’t graced ETH with his wisdom in three long years-until now. And each call he makes goes on to mark generational bottoms. He hath declared SOL + ETH have bottomed. To fade this legend would be folly of the highest order.”

History, that implacable judge, lends credence to Flipper’s reverence. Bollinger’s last notable Ethereum call, on September 9, 2022, saw ETH ascend from $1,290 to $4,000-a rally that etched itself into the annals of crypto lore. Such is the market psychology: Bollinger’s infrequent, technically disciplined alerts are seen as cycle-defining, beacons in the chaos.

Context from earlier this year adds further nuance. On April 10, Bollinger flagged a similar structure in Bitcoin, noting, “Classic Bollinger Band W bottom setting up in BTCUSD. Still needs confirmation.” In the same week, BTC carved out a bottom at $74,508 and proceeded to log seven straight green weekly candles, advancing roughly 55%. From Bollinger’s call into the first week of October, BTC rallied more than 70%. A testament, perhaps, to the power of his insight-or merely the capriciousness of the markets? One can only speculate.

The market nuance in Bollinger’s latest readout lies in the explicit exclusion of Bitcoin. If ETHUSD and SOLUSD are printing W-like structures in Bollinger terms while BTCUSD is not, it implies a temporary decoupling in volatility structure and relative strength. In practical terms, a non-confirming Bitcoin may lag into a later confirmation, remain range-bound in a mid-band churn, or fail its own setup if lower-band interactions persist without recapture of the middle band. Bitcoin, it seems, is the wallflower at this crypto ball.

For Ethereum and Solana, confirmation would typically manifest as sustained closes above the 20-period moving average (the Bollinger middle band), followed by a disciplined advance that transforms the upper band from resistance into a guide. A healthy W bottom sequence does not produce immediate, vertical band overthrows; rather, it builds a stair-step profile with periodic mid-band checks that hold. Failure, on the other hand, would involve another lower-band excursion that undercuts the second trough or a volatility bloom that widens the bands without directional follow-through-signatures of an incomplete base.

At press time, ETH traded at $4,037, a number that, in the grand scheme of things, is but a fleeting moment in the eternal dance of the markets.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Best Thanos Comics (September 2025)

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Goat 2 Release Date Estimate, News & Updates

2025-10-20 13:00