As the sun sets on the digital horizon, bitcoin (BTC) teeters at $81,678, a mere shadow of its former glory, having touched the abyss at $81,551. The week’s losses, a sobering4.27%, paint a picture less reminiscent of a victory parade and more of a somber funeral march for the holders’ spirits. 😢

The Great Crypto Meltdown: From $81,551 to the Ash Heap of History

This weekend, the cryptocurrency market is not so much navigating stormy seas as it is sinking in a quagmire of its own making. Bitcoin, the once-mighty titan, now resembles a weary warrior inching ever closer to the $80,000 precipice. By8 p.m. Eastern Time, the collective market value has shriveled by0.41%, a paltry $2.66 trillion standing as a monument to what once was. 📉

Bitcoin’s retreat of4.27% against the dollar this week is but a prelude to the greater tragedy unfolding. Ethereum (ETH) has suffered a9.7% contraction, and XRP, in a twist of fate worthy of a Greek tragedy, has hemorrhaged over12% of its value. Trading on Sunday was as lively as a wake, with volume down17% from the previous day. BTC’s nadir at $81,551 was reached at the fateful hour of6:10 p.m. Eastern Time, a moment that will live in infamy. ⏳

Data from cryptoquant.com paints a picture of apathy among U.S. investors, with the Coinbase Premium Index as lifeless as a museum exhibit. Meanwhile, South Korean retail traders, in a display of either bravery or folly, continue their accumulation spree. Bitcoin’s global average price hovers around $82,239, but Upbit’s South Korean platform boasts an $83,676 premium, a curious anomaly in these trying times. 🌏💰

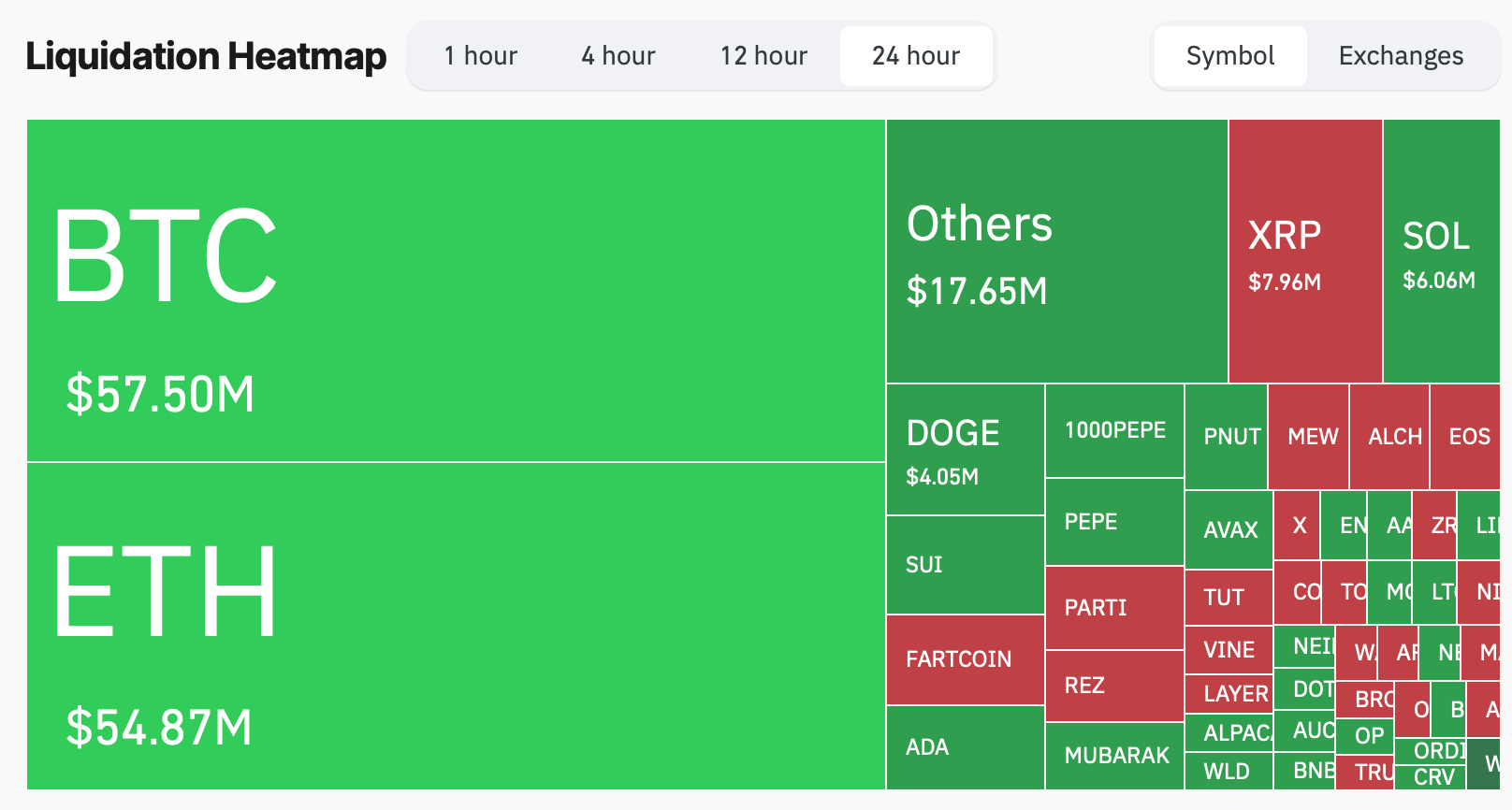

The market’s relentless descent has culminated in $192.64 million worth of derivatives liquidations in the past day. Bitcoin longs were not spared, contributing $44.08 million to the pyre, with ethereum positions adding $45.09 million. Binance was the stage for the grand finale – a $13.31 million ETH/USDT position meeting its fiery end. In all,69,760 traders watched their leveraged dreams evaporate into the digital ether. 🚒💔

Read More

- WCT PREDICTION. WCT cryptocurrency

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2025-03-31 04:01