Ah, the capricious winds of fortune! Dogecoin (DOGE), that whimsical creature of the crypto menagerie, traded at a modest $0.14 on Friday, a mere 0.25% ascent in the fleeting span of 24 hours. Yet, the week’s ledger tells a tale of woe, with a 7.40% decline, as if the coin had stumbled upon a quagmire of indecision. Trading, once a bustling bazaar, has waned, with volumes halved-a silence that speaks volumes, if you will pardon the pun. 🌪️

The Arcane Whispers of Momentum and Averages

In the labyrinth of market data, the DOGE RSI lingers at 52.70, its signal line a breath away at 52, painting a portrait of equilibrium, a coin suspended in mid-air, neither ascending nor descending. The Exponential Moving Averages, those oracles of trend, align thus: EMA 20 at $0.13, EMA 50 at $0.14, EMA 100 at $0.15, and EMA 200 at $0.17. A downward curve, you say? Indeed, a slope as gentle as a sigh, with the EMA 50 watched with the intensity of a lover awaiting a letter. The coin’s market capitalization, a mere $23.60 billion, stands as a testament to its humble aspirations. 📉

The Prophets and Their Ladders of Hope

Ah, the analysts! Those modern-day soothsayers, with their ladders of targets: $0.15, $0.18, $0.20, $0.24, and the vaunted $0.28. Jonathan Carter, a name now etched in the annals of crypto lore, declares these levels as echoes of past glories. Above the 50-day average, he proclaims, lies the promise of renewed vigor. Yet, one cannot help but smirk at the irony-a coin’s fate hinging on such arbitrary thresholds. 🧙♂️

#DOGE Descending Channel Breakout Imminent

Dogecoin, that mischievous pup, teeters on the brink of breaking free from its descending channel, a daily chart drama worthy of a Russian novel. Price action above the MA 50, a harbinger of reversal, or so they say. Upside targets, you ask? $0.153, $0.182, and beyond-a ladder to the moon, perhaps? 🌕

– Jonathan Carter (@JohncyCrypto) January 11, 2026

Higher lows, they say, a positive structure if it holds. Yet, the all-time high of $0.73 looms like a distant star, a reminder of what once was. A fourfold growth, they whisper, a dream as fleeting as a summer breeze. 🌬️

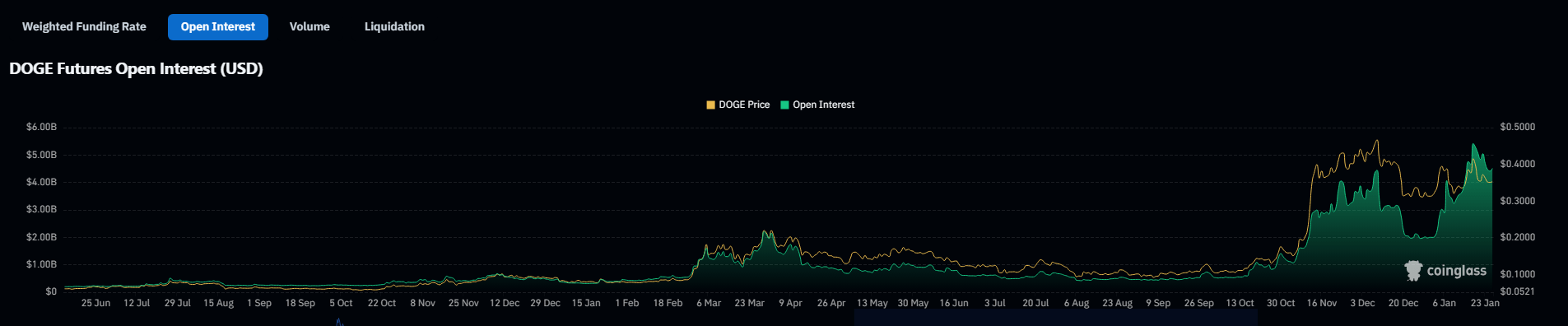

Open Interest Climbs, Volume Withers

CoinGlass, that arbiter of market sentiment, reports a 43% drop in trading volume to $1.30 billion, even as Open Interest swells by 1.70% to $1.80 billion. Liquidations, a mere $596K, with longs outpacing shorts-$431K to $165K. A tale of leveraged optimism, perhaps, or merely the last gasp of a dying trend? 🧮

Traders, those eternal gamblers, eye the EMA 50 at $0.14 with bated breath. A sustained breach, they say, could summon the bulls from their slumber. Yet, should the EMA 20 at $0.13 falter, doubts will creep in like shadows at dusk. Momentum, neutral as a Swiss diplomat, awaits a decisive break-a break that promises sharper swings, given the anemic volume. 🦉

The current tableau is a study in contradictions: whispers of regained momentum alongside dwindling volume and a downward slope in longer EMAs. Open Interest rises, yet participants hesitate, awaiting confirmation. Should buying pressure return and volume revive, those analyst targets may yet shimmer on the horizon. If not, the chart may languish in its tight range, a prisoner of indecision. 🕰️

Read More

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- Dan Da Dan Chapter 226 Release Date & Where to Read

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Wreckreation Review – Burnout Lite

- 2D ‘Star Wars: Clone Wars’ Series Isn’t Canon, but It Is Great

- Good Luck, Have Fun, Don’t Die review: Clever, infectious and wildly original – AI be damned

2026-01-12 12:07