Ah, Ethereum, that mischievous scamp of the crypto world, has been tiptoeing just below its recent high, like a naughty child sneaking up on a cake. The price action, my dear reader, is tightening its belt, preparing for a grand performance-or perhaps a spectacular tumble. Short-term traders, those nervous nellies, are wringing their hands over potential exhaustion, but the broader trend, like a stubborn mule, remains intact. 🧐

Some clever chaps have been poking around in the on-chain metrics, and lo and behold, they’ve found strong holding behavior. This, my friends, adds a dash of confidence to the ongoing trend, like a sprinkle of sugar on a rather dull porridge. 🥄

Technical Analysis

By Shayan, the wizard of charts

The Daily Chart

On the daily timeframe, ETH has been prancing about in a steep ascending channel, like a circus pony on a tightrope. Higher highs, higher lows-it’s all very impressive, isn’t it? The 100-day moving average, that sly fox, has crossed above the 200-day MA, a move that historically signals a mid-term uptrend. Despite minor pullbacks, the asset has been finding support near the midline of the channel, like a weary traveler resting on a soft pillow. 🛌

But oh, the bullish momentum is fading, like a deflating balloon at a child’s party. The price has been consolidating below a key resistance area at $4,850, tested multiple times without a breakout. This tightening range, my dear Watson, could lead to an explosive move-either a glorious rally or a disastrous plunge. If ETH breaks above $4,850 with volume, the rally might extend toward the channel’s upper boundary. But beware! A breakdown could send ETH tumbling to the $4,000 zone, where fresh buyers await like vultures circling a carcass. 🦅

The 4-Hour Chart

Now, let’s zoom in, shall we? The 4H chart reveals a clean consolidation range, with ETH bouncing between $4,300 and $4,800 like a ping-pong ball in a wind tunnel. This sideways structure is forming just beneath a key resistance zone, indicating that buyers are not exactly leaping with joy. They’re waiting, like patient spiders, for a deeper pullback or a confirmed breakout. 🕷️

If this range breaks to the downside, the next area of interest is the highlighted purple demand zone just below the $4,000 key level. This zone, my friends, has confluence with the ascending trendline and could attract long-term buyers like honey attracts bees. But for now, the RSI has dipped below 50, suggesting the bulls are losing their grip. A pullback, alas, might be the more probable scenario in the short term. 🍯

Onchain Analysis

Exchange Reserve

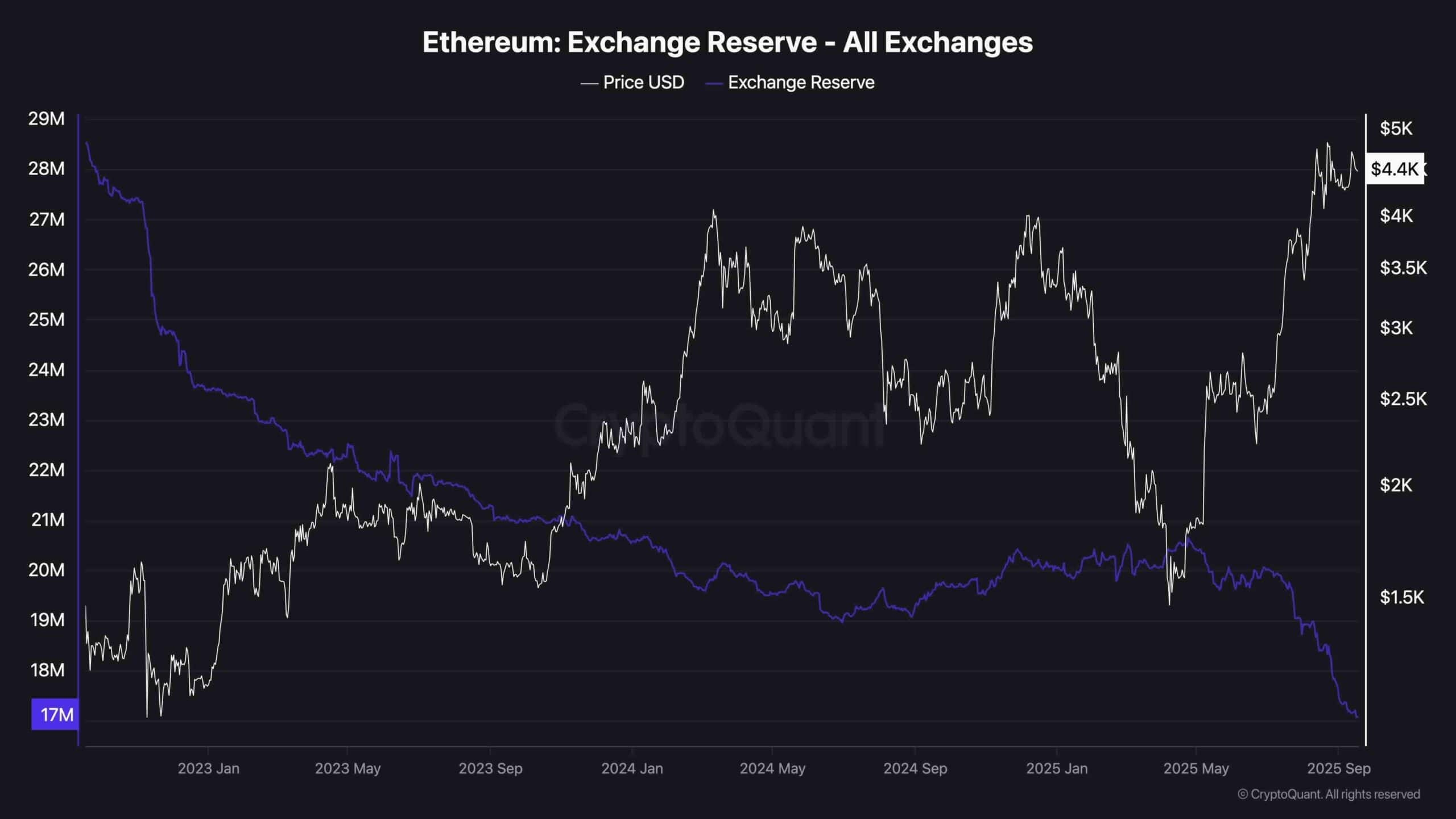

Ah, the on-chain data from CryptoQuant-a treasure trove of insights! It shows a clear trend of declining ETH exchange reserves, a bullish signal as strong as a giant’s handshake. Since 2022, ETH held on exchanges has plummeted from over 28 million to under 17 million, a multi-year low. This consistent outflow indicates that large holders and long-term investors are withdrawing their ETH from centralized platforms, likely for staking, DeFi use, or cold storage. Brrr, it’s chilly in here! ❄️

The relationship between exchange reserves and price is often inverse, like a seesaw in a playground. When reserves fall, there’s less ETH available to sell, leading to supply-side pressure and eventual price appreciation. The recent acceleration in outflows during the price rally to $4.4K adds another layer of conviction. Holders are not rushing to take profit, a healthy sign of confidence in ETH’s longer-term potential. Bravo, Ethereum, bravo! 👏

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Best Controller Settings for ARC Raiders

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Best Thanos Comics (September 2025)

- Goat 2 Release Date Estimate, News & Updates

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

2025-09-17 18:41