- U.S. SEC finally admits Bitcoin miners aren’t selling lemonade stands, but are actually doing something legit. 🎉💻

- Ethereum‘s PoS makeover gets more side-eye than a mullet at a fashion show. 🤔👀

Hold onto your hats, folks, because the SEC has issued a decree so revolutionary, it might just make blockchain sound as exciting as watching paint dry. Bitcoin miners and their proof-of-work (PoW) gang aren’t securities after all. Shocking, I know. It’s like finding out your goldfish can sing opera.

While the Bitcoin brigade breathes a sigh of relief, Ethereum’s [ETH] proof-of-stake (PoS) transition has critics coming out of the woodwork faster than you can say “sell in May and go away.” It’s a tale as old as time: one side loves the stability of a well-trodden path, the other chases the thrill of innovation. But now, for PoW enthusiasts, the fog of uncertainty has lifted just a tad.

SEC Decrees: PoW Miners Aren’t Peddling Securities

In a plot twist no one saw coming (except everyone), the SEC’s Division of Corporation Finance has cleared the air: PoW mining is as much an investment contract as a rock is a fruit. It’s all about the grunt work, no “efforts of others” shenanigans here. This news is like a breath of fresh air for PoW miners, who can now mine in peace without the SEC breathing down their necks.

“Mining Activities”… basically, don’t involve the offer and sale of securities. Mind. Blown. 🤯

This decision is the equivalent of the SEC saying, “Carry on, folks, nothing to see here,” and everyone’s just relieved they can stop holding their breath.

Ethereum’s PoS: The Controversy Continues

Just when you thought the drama had peaked, critics of Ethereum’s PoS transition are back with a vengeance. Meltem Demirors, a voice louder than a foghorn in a library, claims Ethereum’s shift to PoS was a plot twist no one asked for. It’s like turning a classic novel into a musical – sure, it’s flashy, but is it really necessary?

“Proof of Stake was a mistake. Ethereum could’ve been the belle of the ball, but instead, it’s doing the Macarena at a rave.” 🕺💃

Demirors argues that PoS turned Ethereum into a fragmented mess, missing out on becoming the next big thing powered by a compute-to-energy economy. It’s like choosing a unicycle over a sports car.

And then there’s Red Panda Mining dropping truth bombs on X like they’re going out of style.

With PoW basking in the glow of regulatory clarity, the Ethereum debate is hotter than a jalapeño in July.

Ethereum: Eyeing $2,000 with Hopeful Eyes

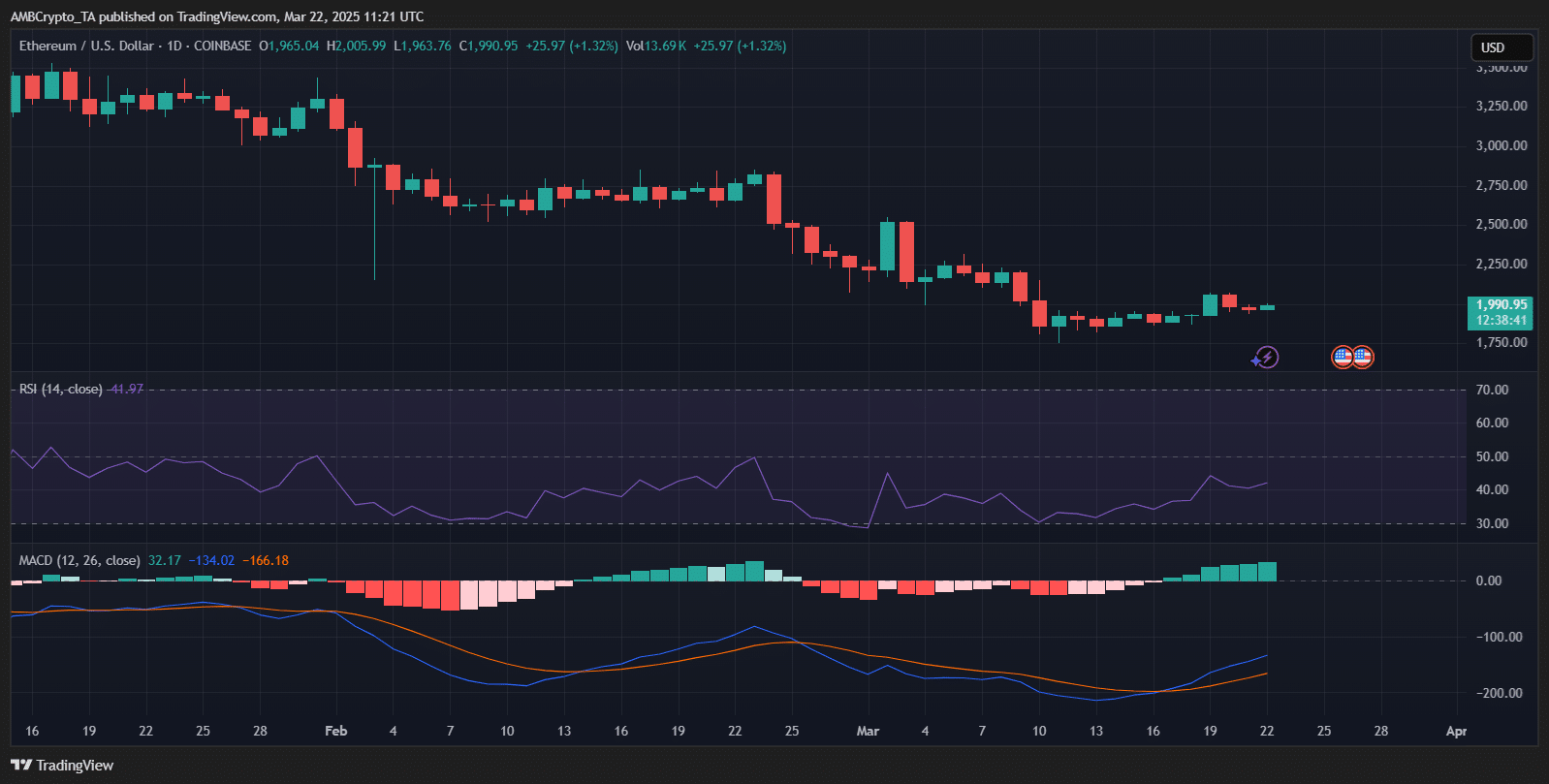

Ethereum is flirting with the $2,000 mark, inching closer with the subtlety of a bull in a china shop. After a modest1.32% gain, it’s like watching your favorite team score a last-minute goal – thrilling, yet nerve-wracking.

While ETH’s price chart looks like a rollercoaster designed by a sadist, technical indicators are flashing green lights. The MACD’s bullish crossover is like a thumbs-up from a friendly neighbor, suggesting brighter days ahead. Yet, the RSI’s neutral stance is the equivalent of your mom saying, “We’ll see,” when you ask for a puppy.

For now, Ethereum’s rebound seems as cautious as a cat on a hot tin roof. But hey, in the world of crypto, a little caution never hurt anyone… much.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2025-03-23 01:48