In the grand theater of finance, Bitcoin (BTC) clings desperately to the $110,000 mark, its fate swaying like a drunken ballerina on a tightrope. A week of macroeconomic chaos, punctuated by the October 10 liquidation carnage, has left traders clutching their pearls. The US Federal Reserve, in a magnanimous mood, has gifted the world a 25-basis-point rate cut and a promise to end quantitative tightening by December 1. One might call it a “soft landing,” though the term “landing” feels optimistic when markets still resemble a toddler’s art project.

Bitcoin, ever the resilient aristocrat, has stabilized above a key price zone, much like a peacock preening after a hurricane. Traders now watch with bated breath, hoping for signs of momentum-or at least a coherent strategy.

Sentiment, that fickle muse, remains cautiously constructive. The October crash, a cataclysmic event that left leveraged investors weeping into their espresso cups, has forced a recalibration. Leverage? Reduced. Spot markets? Gradually regaining their sparkle. Price structure? Whispering faintly of rebirth. It’s a tale as old as time: chaos, collapse, and the faint hope of a phoenix.

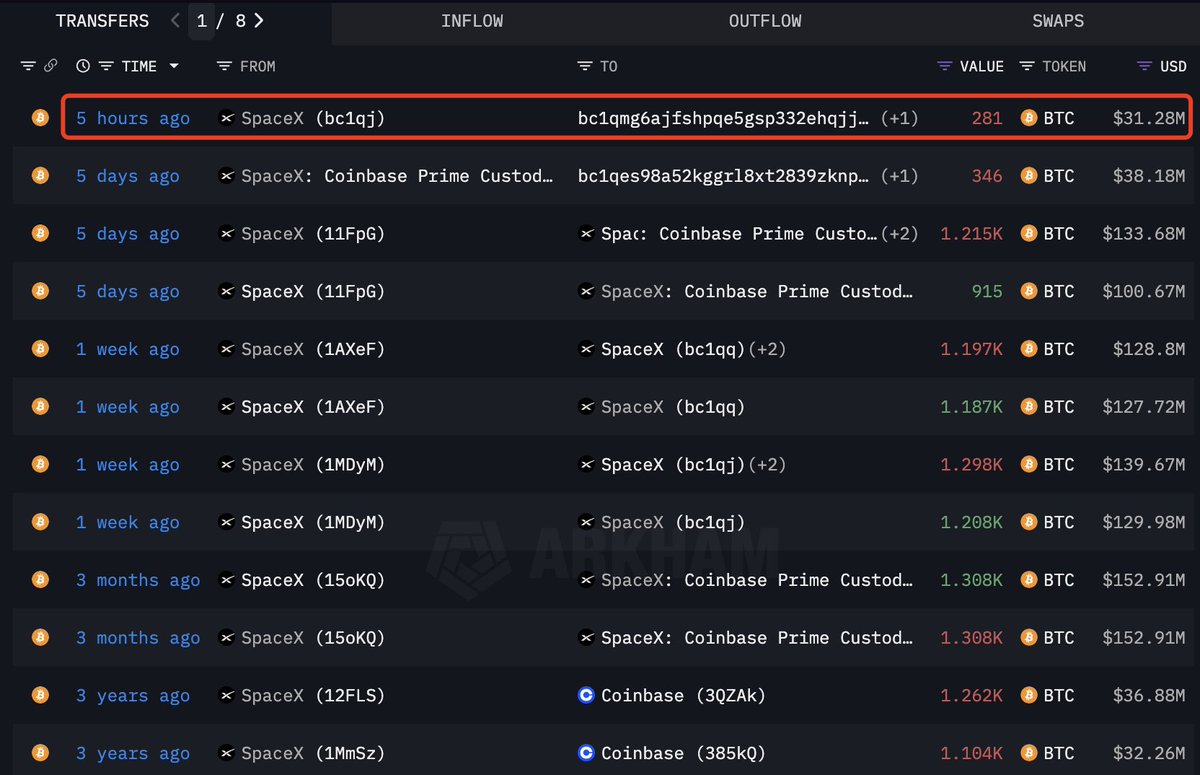

Meanwhile, SpaceX, the silver-spoon tech prodigy, has been busy transferring 281 BTC ($31.28M) to a new wallet-a third move in 10 days. One might suspect a midlife crisis, but more likely, it’s corporate treasury management. Or perhaps Elon’s trying to outwit his ex. Either way, the market speculates wildly, like a gossip columnist with a calculator.

With macro conditions shifting and on-chain players repositioning, investors sip their lattes, wondering if Bitcoin can hold its ground-or if it’ll be the next victim of a liquidity-driven market expansion. Spoiler: it’s probably both.

SpaceX’s BTC Ballet: Institutional Whispers & Bullish Daydreams

According to Lookonchain, SpaceX has moved its Bitcoin holdings three times in 10 days, including 281 BTC. While some mutter about custody restructuring, others see it as a prelude to a liquidity-driven bull run. Ah, the power of imagination! Could it be a subtle nod to institutional repositioning? Or merely a cosmic joke? The market, ever the drama queen, is all ears.

Traders parse the data like monks deciphering ancient scrolls. Some say it’s internal wallet housekeeping; others insist it’s a sign of the apocalypse. Or, more likely, a very expensive game of musical chairs with billions at stake.

These maneuvers arrive as the Fed’s dovish pivot ushers in a new era of liquidity. Capital conditions, once as dry as a Turgenev novel’s protagonist, now hint at accommodation. Analysts, emboldened by this turn, argue BTC is in its most favorable macro environment since 2020. One might call it a “bullish thesis,” though the term “thesis” feels quaint when the market is still healing from a $100,000 haircut.

Long-term holders distribute supply like a miserly uncle at a family reunion. Spot markets, meanwhile, hum with robust participation, as if the October crash never happened. Or perhaps it did, and we’re all just pretending to forget.

The October 10 crash, that harrowing liquidation event, reset the board. Now, the market balances on a knife’s edge: cleaner structure, improving liquidity, and institutional activity that whispers of a grander plot. Will it all culminate in a bull run? Or will it collapse into a heap of meme coins and existential dread? Only time-and a few more rate cuts-will tell.

Bitcoin’s Waltz with the 200-Day MA: A Dance of Hope & Despair

Bitcoin (BTC) trades near $110,200, defending a support zone like a knight guarding a damsel in distress. The daily chart reveals BTC’s struggle to outpace the 50- and 100-day moving averages, as short-term sellers lurk like wolves in the mid-$110,000 shadows. Yet, the 200-day MA (red) remains a steadfast ally, a long-term trend indicator that whispers, “There, there. It’ll be okay.”

Since the October 10 liquidation event carved a sharp wick into the $104,000-$106,000 range, Bitcoin has waltzed into a higher-low structure. Bulls now dream of reclaiming the $113,500-$115,000 area, where moving averages converge like lovers at a masquerade ball. Clearing this zone could set the stage for a retest of $117,500-a breakout level that smells of $120,000-$123,000 glory.

But beware, dear reader! A daily close below the 200-day MA and $108,000 support could send Bitcoin spiraling toward $104,000. For now, it’s a delicate dance of consolidation, holding key supports while awaiting the next twist in this financial soap opera.

And so, the market waits-for a catalyst, for clarity, for a moment when Bitcoin’s next move won’t feel like a roll of the dice. Until then, we sip our coffee, check our charts, and wonder if this is the beginning of a bull run… or just another chapter in the saga of our collective madness. 🚀💸

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Best Controller Settings for ARC Raiders

- The Best Members of the Flash Family

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Ultimate Spider-Man: Incursion #2 Is the Most Basic Crossover Chapter Imaginable

- Gigi Hadid Twins With Her “Lil Bestie” Daughter Khai in Rare Update

2025-10-30 23:16