- Strategy plots a $500M heist of stock sales to chase BTC‘s shadow.

- The crypto world snickers and gasps at Strategy’s bold dance with debt.

On the whimsical day of March 18th, the alchemist Michael Saylor, maestro of Strategy (once upon a time MicroStrategy), conjured a scheme to peddle $500M worth of ‘perpetual preferred stock’ (STRF) in the quest for Bitcoin‘s [BTC] elusive heart.

In a tale as old as time, the firm had previously spun another preferred stock ‘STRK‘ from the same Bitcoin-threaded cloth.

This was but a chapter in their grand saga to amass $42B through the alchemy of stock and the sorcery of debt (convertible notes) for the noble pursuit of BTC.

Strategy’s Plans: A Circus of Opinions

In a bid to demystify Strategy’s latest stock sorcery, Jeff Park, the Head of Alpha at Bitwise, elucidated,

“Choose your destiny: STRK for a 9.4% yield and a chance to swap for MSTR, or STRF for a 10% yield and a dance with the devil’s own redemption clause.”

In layman’s terms, STRK is the sheep in wolf’s clothing, while STRF is the wolf—no clothing required, and twice the bite.

But lo, the crypto community is a fickle court, and some decried Strategy’s ‘high leverage’ as the architect of BTC’s potential downfall. Wazz Crypto, a shadowy soothsayer of the markets, decreed,

“This wizard is turning Bitcoin into a leviathan of risk. Is it still digital gold if it drowns with a single ship?”

Simon Dixon, another voice in the crypto chorus, sang of ‘next-level risk’ that might require a royal rescue.

“Strategy’s promise of a perpetual 10% dividend, paid in dollars—while their coffers hold but Bitcoin and air—is a leap of faith into the unknown.”

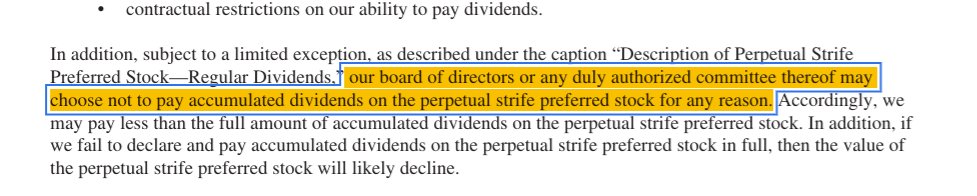

Bitmex Research, however, threw a wet blanket on the dividend dreams, stating,

“It appears $MSTR can sidestep these 10% to 18% dividends with a mere shrug. The future is clear: class A $MSTR shareholders will wait for dividends like the British wait for summer.”

As for the perennial BTC skeptic, Peter Schiff, he dubbed the new stock issuance ‘absurdity’ and quipped,

“Bitcoin’s buoyancy is owed to the Trump administration’s tender mercies. Without them, it’s sink or swim for both Bitcoin and $MSTR.”

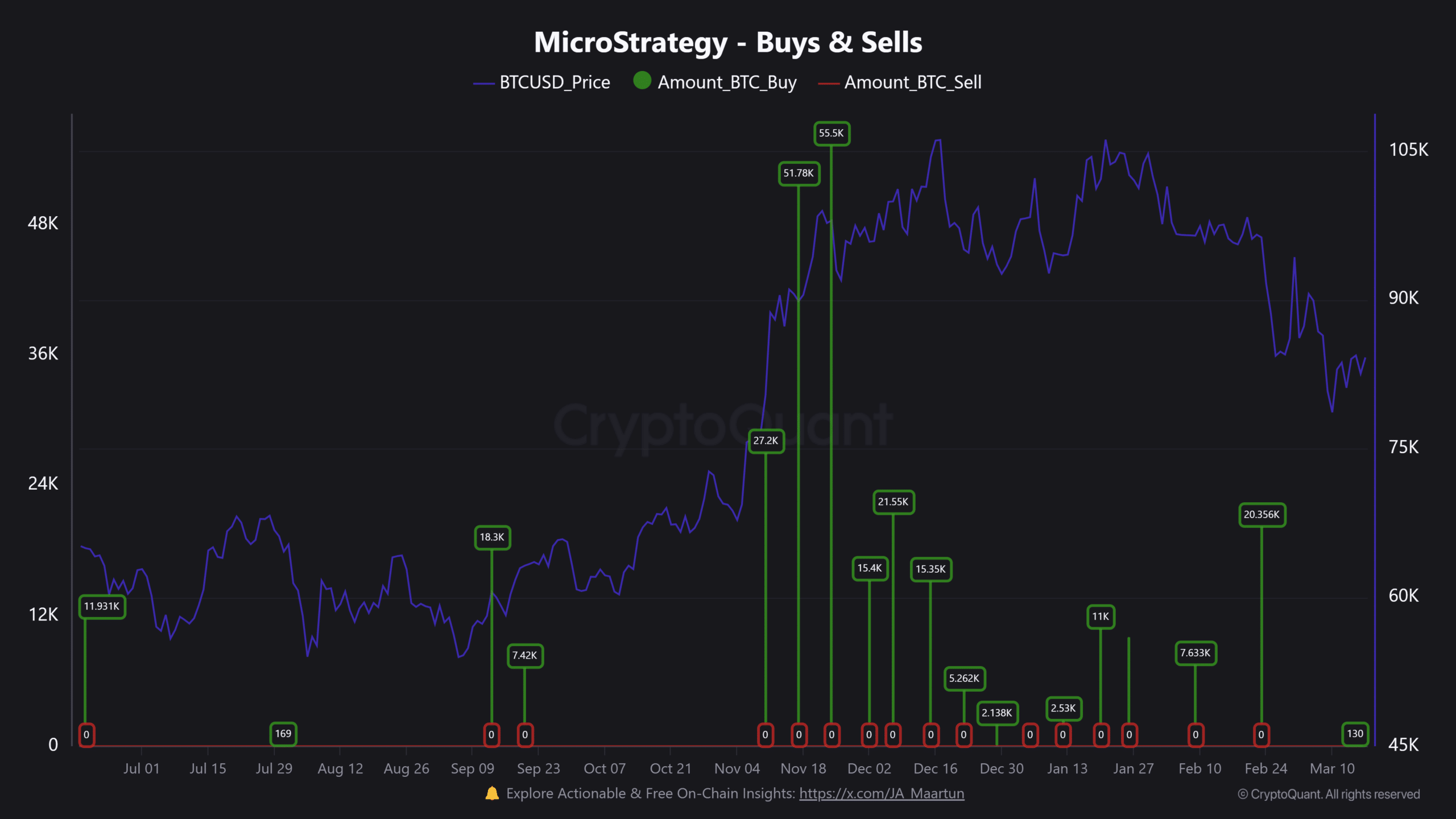

Compared to the feverish pace of BTC buying last quarter, Strategy’s hoarding has slowed in 2025. On the 16th of March, they added a mere 130 BTC to their trove, now boasting 499,226 coins—commanding a 2.3% slice of the BTC pie.

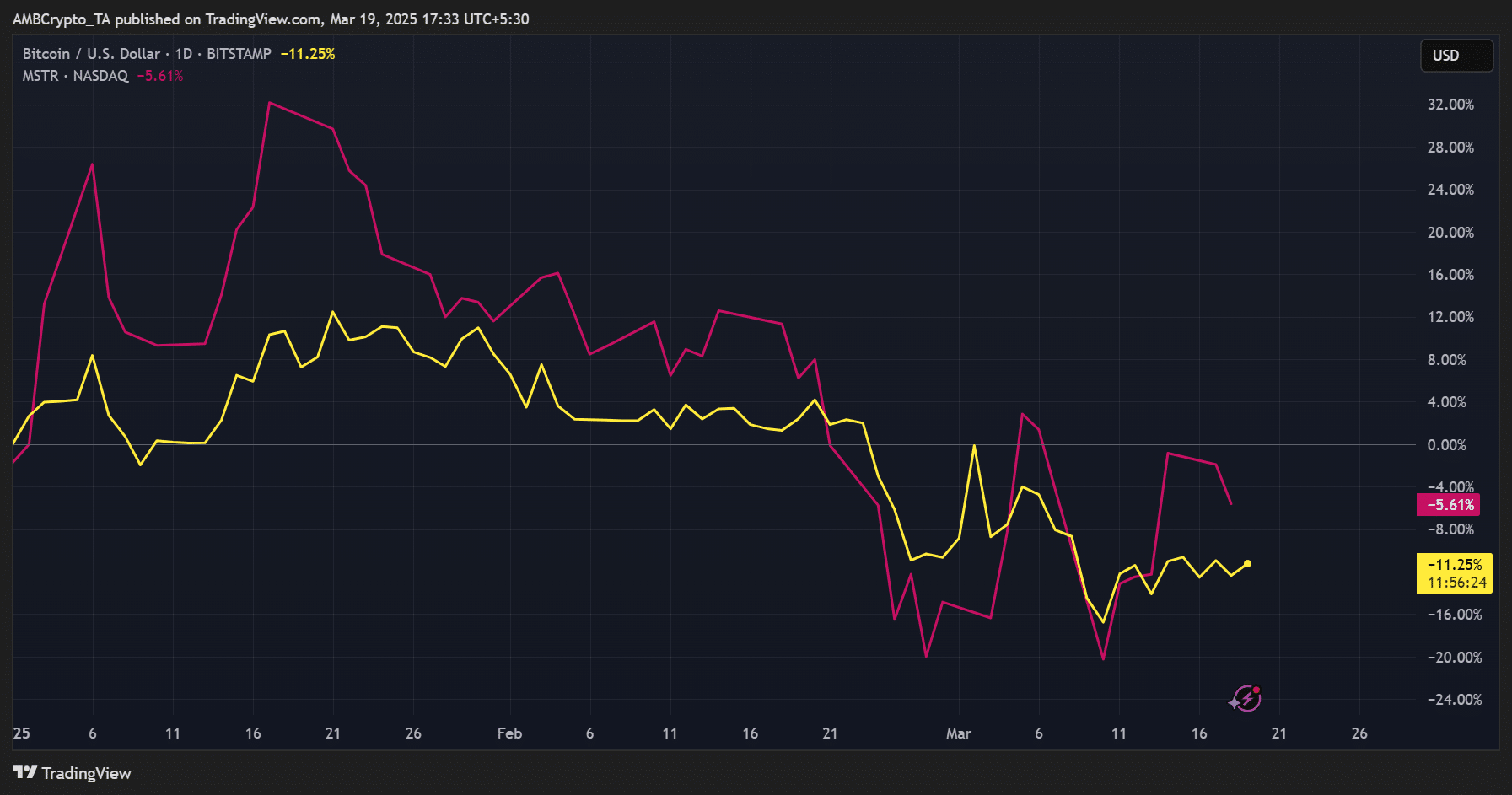

As the ink dries on this missive, MSTR’s value has tumbled to $282, a far cry from its recent zenith of $543, mirroring BTC’s own misfortunes. In the past fortnight, it has seesawed between $230 and $300, while BTC struggled to breach the $90K barrier.

In the grand tapestry of 2025, MSTR has weathered the storm better than BTC, down only 5% compared to BTC’s 11% plunge.

Last week, MSTR staged a 26% rebound as BTC flirted with $85K, hinting that the stock may yet rise from the ashes if the cryptocurrency finds its lost luster.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

2025-03-20 01:17