Well, well, well. After 41 days of the U.S. government playing hard-to-get, it looks like the lights are finally back on. 🎉 And what’s this? Trump’s throwing a $2,000 party for every American? 🥳 Someone call the fiscal stimulus hotline, because things are about to get interesting. 💸

Naturally, the internet’s favorite chaos asset, Bitcoin, is sitting in the corner, sipping its metaphorical martini, wondering if it’s time to break out the confetti cannons. 🎊 Are investors about to send BTC to the moon, or is this just another episode of “Will It Crash?”? 🌕💥

US Government Shutdown Ends: Liquidity Set to Return to the Market? 🌊💰

According to Nick Sortor (yes, the one from X, not your ex), the Senate finally got its act together with a 60:40 vote. 🎯 This means the longest government shutdown since someone forgot to pay the electric bill is this close to ending. But hold your horses-the House and Trump still need to sign off. 📜✍️

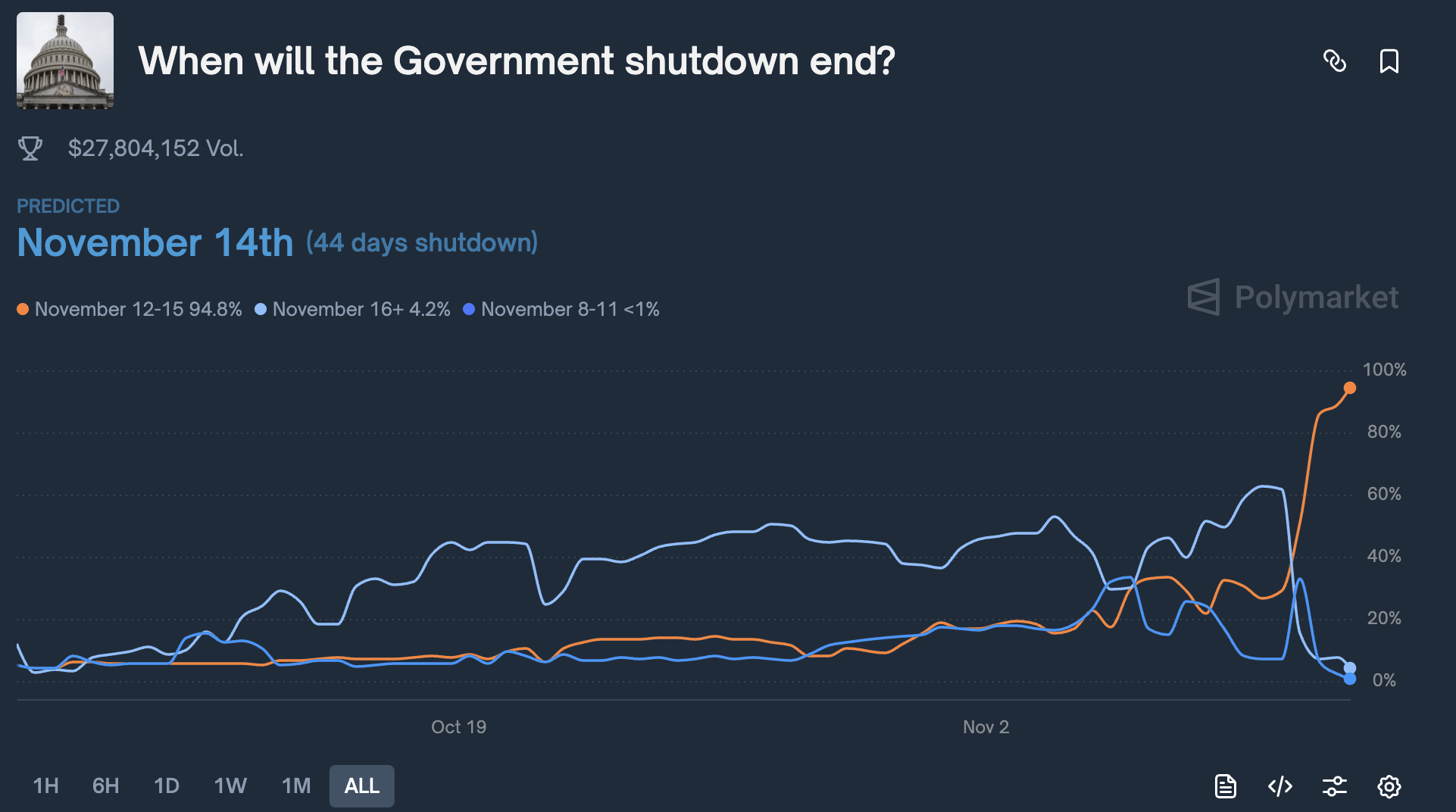

Polymarket says 90% of investors are betting on a resolution this week. Because, let’s be honest, who doesn’t love a good cliffhanger? 🎬 Meanwhile, Bitcoin, gold, and silver are already doing the happy dance. 💃🕺

“Government’s back, baby! Deficits? Up. Inflation? Up. Dollar? Down. Bitcoin? Shrugs dramatically.” – Peter Schiff, probably. 🤷♂️

Apparently, Bitcoin loves a good shutdown resolution. In 2018 and 2019, it surged 96% and 157%, respectively. 🚀 But let’s not get ahead of ourselves-correlation doesn’t always mean causation. Unless you’re a crypto bro, then it’s basically science. 🔬

Sure, Bitcoin might rally, but let’s not forget the broader market is also doing its thing. It’s like showing up to a party and taking credit for the music. 🎶 And even if history repeats, it’s not exactly a sprint-more like a marathon with a few pit stops for existential crises. 🏃♀️💭

Still, the Senate’s nod has everyone feeling like it’s 2020 all over again. Risk-on assets? Check. Bitcoin? Double check. Now if only someone could explain what “risk-on” actually means. 🤔

“Tariff Dividend”: Trump’s New Fiscal Stimulus and Its Impact on Bitcoin 🎁💵

Just when you thought the plot couldn’t thicken, Trump drops the “tariff dividend” bomb. $2,000 for every American? Sure, why not? 🤑 Oh, and 50-year mortgages? Because who doesn’t want to be paying off their house when they’re 90? 🏠👵

If this goes through, it’s like pouring rocket fuel into the economy. 🚀 But Ian Miles Cheong (and his buddy Scott Bessent) are here to remind us it might not be cold, hard cash. Tax relief? No tax on tips? Sounds like a choose-your-own-adventure fiscal policy. 📖

Either way, more liquidity means more money sloshing around. And where there’s money, there’s Bitcoin, waiting like a cat in front of a laser pointer. 🐱✨

Bitcoin: A Turning Point or a Bull Trap Before the Next Wave? 🎢🐂

So, is this Bitcoin’s moment to shine, or is it just another episode of “Will It Rug Pull?”? 🌟💔 Right now, BTC’s chilling around $105,300, acting all cool under pressure. But with selling pressure up 1,300%, it’s like everyone’s panicking except Bitcoin-it’s just vibing. 😎

The 65-month liquidity cycle is peaking in 2026, which means a 15-20% correction could be on the horizon. But timing? As clear as a foggy London morning. 🌫️ So, buckle up, buttercup-this ride’s just getting started. 🎢

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Best Controller Settings for ARC Raiders

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- The Best Members of the Flash Family

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Dan Da Dan Chapter 226 Release Date & Where to Read

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

2025-11-11 13:37