- Oh, les messieurs de la finance! 🤑 Bitcoin as a treasury asset, a daring feat indeed, forcing companies to choose between prudent risk management and blindly chasing the coattails of MicroStrategy’s success 🏃♂️

- Today, a whopping 90 publicly traded companies hold BTC on their balance sheets, because who needs stability, n’est-ce pas? 😏

Bitcoin [BTC], that most mercurial of creatures, as a treasury reserve asset? Mon dieu, the very idea is both bold and unproven, yet companies are leaping onto this bandwagon with all the finesse of a court jester 🤡. The rationale, you ask? Why, to hedge against inflation, of course, and to add a dash of diversification to those staid corporate balance sheets 📊.

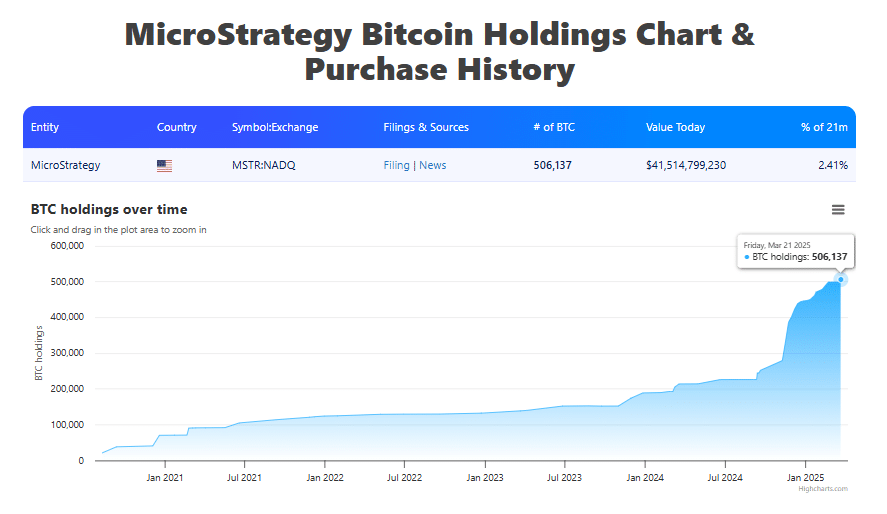

MicroStrategy, that pioneering spirit, kicked off this trend in 2020, reaping gains that would make even the most seasoned gambler green with envy 🤑. And now, newcomers like GameStop are joining the fray, because what could possibly go wrong, right? 🤷♂️

With 90 companies already in the Bitcoin fold, the question on everyone’s lips is – Will this become the new norm? Some sages predict that by 2030, a full quarter of the S&P 500 will be holding BTC, because who needs traditional assets, anyway? 🙅♂️

Market in Mayhem – Is Bitcoin the New Savior? 🌪️

2025, the year of macro trends gone wild, and stocks are feeling the pinch 🤕. The S&P 500 closed Q1 down a whopping $2 trillion in market value, inflation ticked up to a dizzying 2.8%, and a 25% auto industry tariff is sending shivers down the spines of even the most hardened investors 😬.

Even the almighty Tesla couldn’t escape the carnage, with a Q1 performance as lackluster as a debutant’s first ball 🎭. Amidst all this uncertainty, it’s little wonder Bitcoin’s growing role in corporate balance sheets is making headlines, because what’s a little more risk in a chaotic world, eh? 📰

And then, of course, there’s the MicroStrategy (MSTR) effect – a bet on BTC as its primary treasury asset that’s paid off in spades since 2020 🤑. With over 500,000 BTC in its treasury, S&P 500 companies are now scratching their heads, wondering if they can replicate this magic trick 🎩.

Since then, while the S&P 500 has seen a respectable gain of 64.81% and BTC has surged a whopping 781.13%, MSTR’s valuation has skyrocketed by a mind-boggling 2,074.85% 🚀. But, as our image so eloquently depicts…

MSTR’s stock, once the darling of the market, now tells a different tale – down 45% to $277, a reminder that what goes up, can indeed come crashing down 🌀.

With Bitcoin swinging to the tune of macro volatility and gold hitting record highs, the question remains – Is adding BTC to the S&P 500 balance sheet a stroke of genius or a reckless gamble? 🤔

BTC on Corporate Balance Sheets – Genius or Folly? 🤷♂️

//ambcrypto.com/wp-content/uploads/2025/03/XAUUSD_2025-03-31_19-43-22.png”/>

Yet, with 90 S&P 500 companies already in the Bitcoin camp, some envision this as merely the beginning of a grand adventure 🌟. Tech executives prophesize that by 2030, a full quarter of S&P 500 companies will proudly hold BTC on their balance sheets, because why not, indeed? 🤷♂️

But with Bitcoin’s swings as unpredictable as a French farce, it’s a high-stakes game – one that could either yield a bounty fit for kings or turn into a career-ending gamble 🎲.

Read More

2025-04-01 08:11